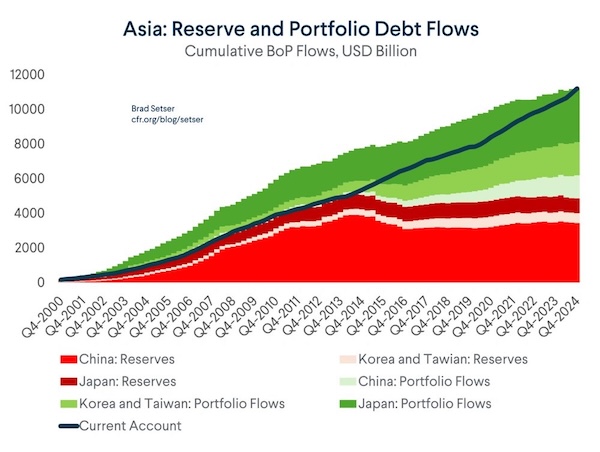

In recent times, a key factor propelling the surge in stock prices has been the substantial inflow of foreign capital into the market. Brad Setser, an expert in the field, notes that the financing of the US current account deficit in past years hasn’t been significantly influenced by reserve accumulation. Instead, a strong belief in the exceptional nature of the US economy, coupled with an unwavering confidence in the continual rise of U.S. technology stocks, has played a pivotal role, albeit one that has not received the acknowledgment it deserves.

Such confidence in U.S. markets isn’t confined to international investors alone. Domestically, there has been a notable embrace of equities, unprecedented in its scale. This trend is driven by the same narratives that have captivated foreign investors. Reports from The Daily Shot highlight that in 2024, U.S. household equity holdings hit an all-time high, accounting for 30% of total financial assets. This milestone surpassed previous peaks witnessed in 1968 and 2000, indicating a significant shift towards equity investment among Americans.

However, this enthusiastic crowding into the U.S. stock market, by both American and foreign investors, has led to the market becoming substantially overpriced by historical standards. Simon White, another commentator in the financial sphere, has pointed out that using a comprehensive measure – which takes into account multiple indicators of long-term equity valuation – the valuation levels at the beginning of the year soared to an all-time high, remaining in the 84th percentile compared to data spanning over a century.

This inflated valuation of stocks has profound implications for future returns. John Hussman, a respected figure in the investment community, has pointed out that the current price/forward earnings ratio of the S&P 500 suggests that its likely total returns over the next decade could hover around zero, with a more optimistic scenario predicting low single-digit returns.

Such a prognosis would understandably alarm the stewards of America’s corporate giants, compelling them to offload shares in their own companies at an unprecedented rate. According to Irene Tunkel of Bloomberg, the message from these corporate executives is unambiguous – many of them perceive their companies’ stocks to be overvalued, seeing the present moment as an opportune time to sell. This sentiment starkly contrasts with the popular investor belief that stock prices are on a perpetual upward trajectory.

Amid these developments, the narrative of U.S. economic and stock market exceptionalism stands at a curious juncture. Historically, the U.S. stock market has been a beacon of potential high returns for investors worldwide, driven by the country’s innovative tech sector, robust financial system, and the attractiveness of its equity market. From the post-World War II era to the dot-com bubble of the late 1990s, and through the recovery that followed the 2008 financial crisis, the market has showcased its resilience and capacity for growth, often outpacing its global counterparts.

However, the narrative of unending growth is being challenged by current market conditions and expert analyses. The implications of inflated valuations are not negligible, suggesting a reevaluation of investment strategies might be in order for both domestic and international investors. The perspective offered by corporate executives further amplifies concerns around current valuation levels, providing a cautionary tale for those who believe in the invincibility of the stock market.

As we navigate through these interesting times, the ultimate question remains: How will these factors – foreign inflow, domestic investment trends, and the apparent overvaluation of the stock market – play out in the longer term for the U.S. economy and its stock market? The future remains uncertain, and careful consideration and analysis will be crucial for investors seeking to make informed decisions in this complex financial landscape.

One of the major drivers of the strength in stock prices lately has been foreign inflows into the . As Brad Setser writes, “Reserve accumulation hasn’t driven the financing of the US current account deficit in recent years… Belief in U.S. exceptionalism,” and the idea that, “U.S. tech stocks only go up,” has played an under-appreciated role.

In addition to foreigners, domestic investors have also embraced equities in recent years like never before, likely driven by the very same investment narratives behind foreign accumulation. “US household equity holdings reached a record 30% of total financial assets in 2024, surpassing prior peaks in 1968 and 2000,” reports The Daily Shot.

All of this crowding by both foreign and domestic investors into the U.S. stock market has made it historically very expensive. As Simon White notes, “A holistic measure of multiple measures of long-term equity valuation, which reached an all-time high at the start of the year, still sits at its 84th percentile in data going back over a century.”

And this has important implications for returns going forward. As my friend John Hussman reports, “Presently, the S&P 500 price/forward earnings ratio is consistent with likely 10-year S&P 500 total returns of about zero, with low single digit returns being the optimistic case.”

It is not surprising then to see the captains of U.S. industry sell shares in their own companies at a historic pace. As Irene Tunkel tells Bloomberg, “The message from executives is loud and clear: many believe their companies are overvalued, making now an opportune time to sell.” Clearly, they don’t buy the popular thesis that ‘stocks only go up.’