On Tuesday, stock markets experienced a notable upswing, as the broader index notched a 0.55% increase. This boost came against a backdrop of optimism surrounding the prospective trade accord between the United States and China. Additionally, the market responded to the latest Consumer Price Index (CPI) data, which showed a modest month-over-month increase of 0.1%, slightly beneath the anticipated figure.

The mood among investors exhibits a blend of optimism and caution. This sentiment was encapsulated in the most recent AAII Investor Sentiment Survey, conducted the previous Wednesday. According to the survey, bullish sentiment among individual investors stood at 32.7%, while those harboring bearish outlooks represented a larger share, at 41.4%.

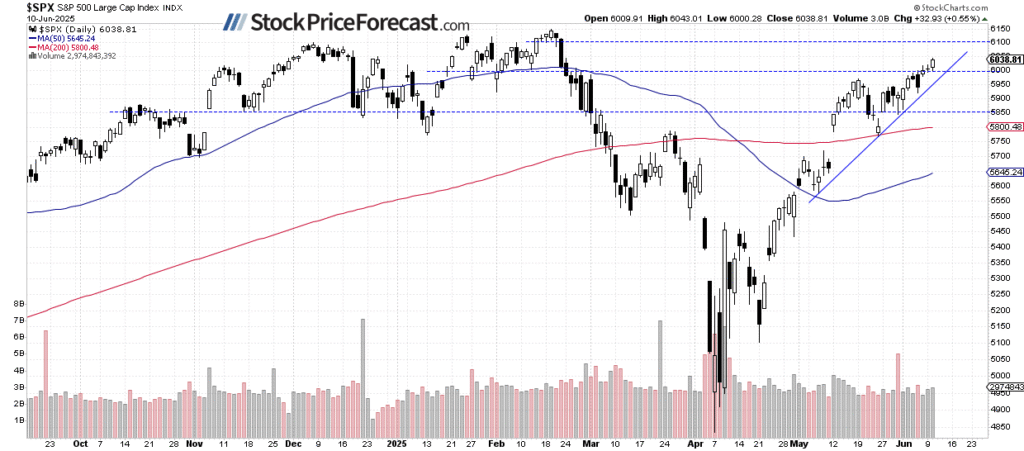

The S&P 500, a key barometer of the U.S. stock market’s performance, surged past the 6,000 mark, now probing the borders of its trading range from the early months of the year. This milestone is significant, demonstrating the market’s resilience and the positive impact of investor sentiment on stock prices.

Turning our attention to the Nasdaq 100, this index too registered notable progress, closing 0.66% higher on Tuesday. It effortlessly scaled above its recent trading band, inching closer to the 22,000 level. Predictions for the trading day forecasted a 0.5% uptick at the opening, with the index potentially eyeing its all-time peak of 22,222.61, recorded on February 19. The current support and resistance levels for the Nasdaq 100 are identified around 21,700 and between 22,000 to 22,200, respectively.

In the realm of market volatility, the Volatility Index (VIX) dropped to a local minimum of 16.65 last Friday, highlighting diminished investor apprehension. Staying relatively stable since then, the VIX trends offer insights into market sentiment, traditionally falling amid reduced fear and climbing alongside market downturns. It’s generally understood that a lower VIX suggests a potential for market reversal downwards, whereas a higher VIX indicates a potential upward market shift.

Focusing on future contracts, the S&P 500 futures demonstrated commendable momentum, breaching the 6,050 threshold post-CPI data release. With no immediate signals of a reversal, the market nonetheless appears to be inching towards a point where a correction could be imminent.

In conclusion, the stock market is poised to open higher, buoyed by the recent consumer inflation data that came in lower than expected, along with positive developments in U.S.-China trade negotiations. The market’s current trajectory hints at a sustained short-term uptrend, though we find ourselves nearing a pivotal resistance zone characterized by record highs reached in February. The anticipation of a potential market correction looms, albeit amidst a generally upward trend.

This scenario underscores two critical insights:

– The S&P 500’s recent ascension to new local highs, nearly touching the record established in February, underscores the advantages accruing to those who leveraged the Volatility Breakout System.

– While presently no overt bearish signals are present, the prospect of a future market adjustment remains on the cards.

To encapsulate, the stock market’s recent performance is a testament to the complex interplay between investor sentiment, economic indicators, and geopolitical developments. As it navigates through these variables, the resilience and adaptability of the market continue to be tested. The optimism spurred by low inflation figures and trade deal prospects has fueled stock market gains, illustrating the intricate relationship between policy, economics, and investment decisions. As we move forward, the ability of investors to interpret these signals and adjust their strategies accordingly will be crucial in navigating the uncertainties that lie ahead.

Stock prices advanced on Tuesday, with the closing 0.55% higher as investors were hopeful about the U.S.-China trade deal and today’s Consumer Price Index release. The came in slightly lower than expected at 0.1% month-over-month.

Investor sentiment remained mixed, as reflected in the last Wednesday’s AAII Investor Sentiment Survey, which reported that 32.7% of individual investors are bullish, while 41.4% are bearish.

The S&P 500 broke above the 6,000 level and is currently testing its January-February trading range.

Nasdaq 100 Nears 22,000

The closed 0.66% higher yesterday, as it broke above its recent trading range, nearing the 22,000 level. Today, it’s likely to open 0.5% higher, and it may see an attempt at reaching its February 19 all-time high of 22,222.61.

Support is now around 21,700, while resistance remains at 22,000-22,200.

VIX Remains Relatively Low

The (VIX) fell to a local low of 16.65 last Friday, indicating reduced investor fear. It has been essentially moving sideways since.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 Futures: Extending Advances Above 6,000

This morning, the contract is extending its short-term uptrend, breaking above the 6,050 level after the CPI data. No negative signals are evident right now; however, the market may be nearing a downward correction.

Conclusion

The S&P 500 is expected to open 0.5% higher this morning, extending its short-term uptrend on lower-than-expected consumer inflation data. The market is also reacting to the U.S.-China trade deal news. We are approaching a key resistance zone, marked by record highs from February. Therefore, I think that a downward correction is likely at some point.

Here’s the breakdown:

- The S&P 500 reached yet another local high, nearing its record high from February and extending gains for those who bought based on my Volatility Breakout System.

- There are no clear bearish signals, but a downward correction is not out of the question at some point.