In the complex world of global finance, the dance between market optimism and geopolitical tensions continues to dictate the rhythm of stock prices and investment decisions. This past week has exemplified this delicate balance, with ongoing political dialogues providing a semblance of support to the markets, albeit with the lurking shadow of uncertainty if critical deals between the US and major geopolitical counterparts like China and Iran fail to come to fruition.

The S&P 500 and NASDAQ indexes have been scaling heights, flirting with record-breaking numbers as they ride on a wave of steady growth. This upward momentum, a harbinger of investor confidence, stands in stark contrast to the European markets, where Germany’s DAX index witnessed a retreat, and Poland’s WIG20 seemed to tread water, seeking a clear direction amidst market indecision.

At this juncture of market volatility and speculative forecasting, many investors turn to platforms like InvestingPro for grounded trade ideas and insights that parse through the noise. Their AI-selected stock recommendations aim to offer a clearer path through the murky waters of financial investing, especially in times when the predictable becomes unpredictable.

The backdrop to this current market scenario is a series of political developments that have injected both hope and hesitancy into the markets. Dialogues between the US and China have progressed, edging closer to a trade agreement that could potentially ease tensions and foster a more conducive environment for international trade. However, this potential breakthrough is yet to receive the official nod from the leaders of both nations, leaving room for speculation and doubt.

Parallelly, the US, under the leadership of President Donald Trump, hinted at a nearing agreement with Iran regarding its nuclear ambitions. Such a deal could significantly lower the spectre of military conflict that looms large over the two nations. Nonetheless, with no deal set in stone, the threat of escalatory actions remains, exacerbated by Israel’s recent military engagements with Iranian bases. This precarious situation underscores the high stakes involved, where the absence of diplomatic resolutions could plunge stock markets into turmoil.

Economic indicators have also played their part in shaping market sentiment, with recent data slightly undershooting expectations. This has led to speculation around the Federal Reserve potentially cutting interest rates sooner, providing a temporary buoy to market optimism.

Focusing on individual indexes, the S&P 500 continues its ascent, supported by favourable market conditions and investor sentiments. It has recently surpassed the significant 6000 level and is making strides towards achieving new highs. This optimism is tempered by the knowledge that any sharp downturn could see the index retract to lower support zones, highlighting the volatility and uncertainty that defines stock market investments.

The NASDAQ, mirroring the S&P 500’s trajectory, is also on a path of sustained growth, with ambitions of reaching new record highs in sight. However, like any market index, it is not immune to corrections, and a slide below key support levels could prompt a reconsideration of market optimism.

Contrastingly, the DAX index is experiencing a downward correction, edging closer to critical support levels. This presents a potential opportunity for investors awaiting a bounce back, signifying the cyclical nature of stock markets where every downturn potentially harbours the seeds of a future upward swing.

Given the prevailing market conditions, rife with volatility and influenced by a complex web of geopolitical, economic, and corporate factors, resources like InvestingPro offer invaluable insights. Through AI-powered stock picks, fair value assessments, and comprehensive stock screening tools, investors are better equipped to navigate the uncertainties of the market. This becomes particularly pertinent when investing giants like Warren Buffett, Michael Burry, and George Soros make strategic moves, often signalling broader market trends.

In the flux of global finance, where each day brings new developments, understanding the intricacies of the market, and leveraging advanced technological tools can be the difference between navigating successfully through storms or being adrift in a sea of uncertainty. However, it’s crucial to remember that all investments come with inherent risks and that decision-making responsibility lies with individual investors, underscoring the importance of due diligence and informed investing.

While this article aims to shed light on current market dynamics and the utility of platforms like InvestingPro, it’s essential to approach all investment decisions with caution and a thorough understanding of the associated risks and rewards.

- Political talks support markets but risks remain if US-China and US-Iran deals stall.

- S&P 500 and NASDAQ approach record highs with steady upward momentum holding for now.

- DAX corrects lower while WIG20 remains stuck in consolidation awaiting breakout direction.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

This week, stock markets moved mostly because of political and trade developments. New talks between Beijing and Washington brought both sides closer to a deal, though it still needs final approval from both Presidents.

At the same time, President Donald Trump also said today that the US may soon reach a deal with Iran on its nuclear program. If no deal is made, the risk of military action will grow, which could lead to sharp drops in stock markets. Therefore, uncertainty remains high, especially after Israel attacked Iran’s military bases.

On the economic side, the main data this week was , which came in slightly lower than expected. This raised hopes that the may cut interest rates a bit sooner.

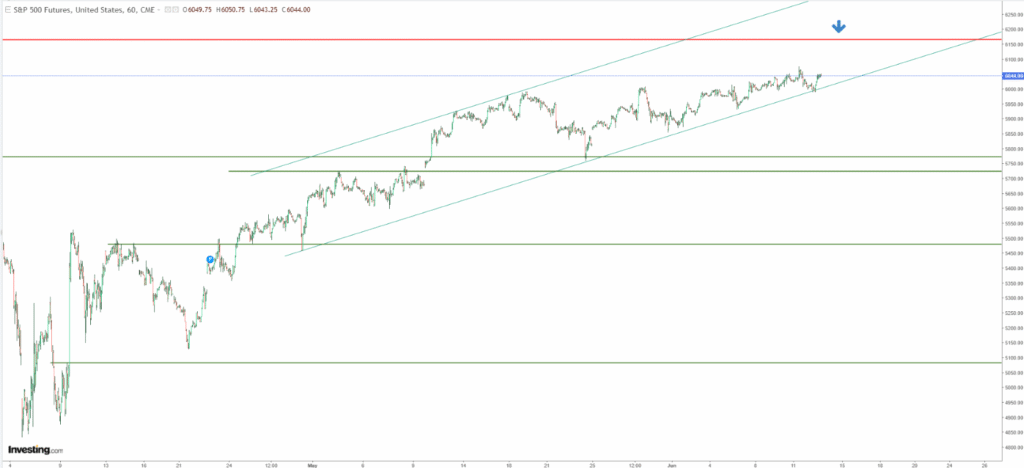

S&P 500 Maintains Upward Momentum

The continues to move steadily higher, supported by the lower boundary of its rising price channel. Right now, it has broken above the key 6000 level and is trying to hold above it, which remains the most likely scenario for now.

The main target for buyers is the all-time high just below 6200, which now looks within reach. However, if the price breaks sharply below the lower band, the risk of a correction will increase, possibly bringing the index down toward the support zone between 5800 and 5700.

NASDAQ is not leaving the upward path

prices are also moving steadily higher, like the S&P 500, with buyers now approaching the record highs near 22300 points. A breakout to new highs currently looks like the most likely scenario.

A drop below the support level of 21500 points would be a warning for buyers and could lead to a deeper correction toward 20500 points.

DAX Develops Downward Correction

Unlike the US indices, the is seeing a stronger downward correction and is moving closer to a key support level at 23500 points. If this level breaks, it could open the way for further declines, with the next support around 21500 points.

However, the market is still in an uptrend. If there is a strong rebound from the support level, it could offer a good opportunity to take a long position.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.