In a marked downturn, United States equities took a significant hit last Friday, culminating in a sharp decrease across major stock indices. This decline was primarily fuelled by an escalation in geopolitical tensions after Iran fired missiles towards Israel. This aggressive action was in retaliation to Israel’s robust military operations, which were aimed at significantly undermining Tehran’s nuclear armament capabilities. Such geopolitical instabilities tend to unsettle financial markets globally, as investors weigh the potential impacts on international trade and oil prices, the latter of which saw a noteworthy increase following the missile launch.

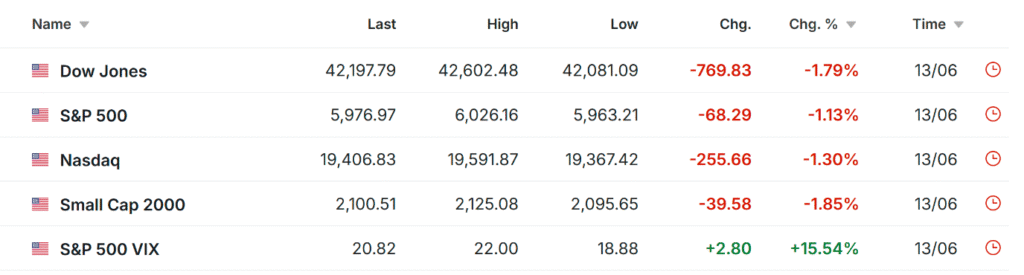

The reverberations of these tensions were clearly observable in the U.S. stock market’s performance. Over the week, the S&P 500 index experienced a modest retreat, falling by 0.4%. Similarly, the technology-centric NASDAQ Composite was not spared, dropping by 0.6%, while the Dow Jones Industrial Average saw a more pronounced decrease of 1.3%. These movements underscore the sensitivity of financial markets to geopolitical developments and the swift reaction of investors to such uncertainties.

In the coming week, market participants are poised to navigate a landscape marked by continued geopolitical tension, particularly between Israel and Iran. This period also coincides with a shorter trading week in the U.S., owing to the observance of the Juneteenth federal holiday. Amidst this, key economic data points, most notably the U.S. retail sales report scheduled for Tuesday, will offer fresh insights into the economic health and consumer confidence within the United States. Additionally, the Federal Reserve’s forthcoming meeting, where interest rates are anticipated to remain unchanged, will be closely monitored. Market observers will be particularly attentive to any indications from Fed Chair Jerome Powell on the potential trajectory of interest rate adjustments, alongside the Fed’s updated economic projections.

Despite the conclusion of the earnings season, a handful of companies, spanning various industries from construction to information technology, are set to announce their quarterly financial results. Among them are homebuilder Lennar, consulting giant Accenture, supermarket chain Kroger, and electronics manufacturer Jabil. These reports will provide further clarity on the corporate landscape and potentially guide investor sentiment in the near term.

In light of these developments, Amazon emerges as a company of interest for investors, primarily due to its upcoming AWS re:Inforce conference in Philadelphia. This event is expected to be a significant driver for Amazon’s stock, offering the company an opportunity to showcase its advancements in cloud computing, particularly in security solutions. Amazon’s history of positive market performance in the wake of its AWS conferences, coupled with its strong financial fundamentals, paints a promising picture for its stock in the immediate future.

Conversely, Lennar presents a different narrative, with expectations of a challenging week ahead. The company is anticipated to announce earnings that might not live up to investor expectations, attributed to a downturn in the housing market exacerbated by high mortgage rates and economic uncertainties. Such conditions have led to a bearish sentiment among analysts regarding Lennar’s performance, which could result in a post-earnings sell-off should the company’s financial results confirm these apprehensions.

As we observe these contrasting fortunes, the week ahead promises to be a litmus test for market resilience amidst geopolitical strife and economic data releases. For investors, staying informed and agile will be crucial as they navigate these turbulent waters.

Investors and market spectators alike are encouraged to keep a keen eye on developments, leveraging comprehensive market analysis and tools such as those offered by InvestingPro. In a complex and ever-evolving market environment, access to detailed insights and analytics can significantly enhance decision-making, allowing investors to position themselves strategically for both present and future market shifts.

Disclosures highlight the author’s existing financial positions, emphasizing the importance of transparency in financial commentary. However, it is crucial to acknowledge that these views represent personal opinions and should not be interpreted as financial advice. Prospective investors should conduct their due diligence or consult with a financial advisor to ensure that any investment decisions align with their financial goals and risk tolerance.

Such comprehensive market analyses not only arm investors with critical information but also shed light on the intricate interplay between geopolitical events and financial markets. As tensions mount and economic indicators point to a period of significant scrutiny, the ability to discern and react to market signals becomes paramount in navigating the uncertainties that lie ahead.

U.S. stocks closed sharply lower on Friday, and oil prices surged after Iran launched missiles at Israel in response to intensive Israeli strikes aimed at crippling Tehran’s ability to build nuclear weapons.

Source: Investing.com

Friday’s sell-off dragged the major averages into negative territory on the week. The benchmark declined 0.4%, while the tech-heavy shed 0.6%, and the fell 1.3%.

The holiday-shortened week ahead – which will see U.S. stock markets closed on Thursday in observance of the Juneteenth federal holiday – is expected to be another busy one as investors monitor escalating tensions between Israel and Iran.

On the economic calendar, most important will be Tuesday’s U.S. retail sales report, which will shed further light on the health of the economy.

Source: Investing.com

Meanwhile, the Federal Reserve is widely expected to leave interest rates unchanged on Wednesday, but Fed Chair Jerome Powell could offer hints about when rate cuts might start when he speaks in the post-meeting press conference. Along with its policy update, the Fed will release new dot-plot quarterly projections for interest rates, unemployment and inflation.

And while the earnings season is all but over, a few notable companies will report in the coming week, including homebuilder Lennar (NYSE:), IT and consulting services firm Accenture (NYSE:), supermarket chain Kroger (NYSE:), and AI stock Jabil Circuit (NYSE:).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, June 16 – Friday, June 20.

Stock to Buy: Amazon

Amazon (NASDAQ:) kicks off its AWS re:Inforce conference in Philadelphia this week, creating a potentially significant catalyst for the e-commerce and cloud computing giant. This annual event is a major catalyst for Amazon shares, with past conferences frequently sparking positive momentum for the stock.

AMZN closed Friday’s session at $212.10, roughly 12% below its record high of $242.52 reached on Feb. 4. With a valuation of $2.25 trillion, Amazon is the fourth most valuable company listed on the U.S. stock exchange.

Source: Investing.com

The three-day AWS re:Inforce event, starting Monday, provides a platform for Amazon to showcase advancements in its Amazon Web Services division, a critical growth driver for the company. It will focus specifically on security solutions for AWS, featuring a keynote address from Chief Information Security Officer Chris Betz.

Amazon’s ability to demonstrate advanced security capabilities integrated within its AWS ecosystem could accelerate enterprise adoption, particularly among larger organizations that have been slower to migrate mission-critical workloads to the cloud.

Historical trading patterns suggest positive momentum for Amazon shares surrounding AWS events. The tech giant has a history of attracting several analyst upgrades in the wake of its conference presentations.

Beyond the immediate catalyst of the re:Inforce event, Amazon continues to indicate strong fundamentals across its key business segments. The company’s recent quarterly results showed accelerating AWS growth, while the core e-commerce business demonstrated improved profitability.

Source: InvestingPro

Despite a modest year-to-date dip of 3.3%, financial health for Amazon flashes mostly green lights—its overall InvestingPro score is 3.11 (out of 5), with an ‘EXCELLENT’ growth label, ‘GREAT’ overall health, and ‘EXCELLENT’ profit.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now for 45% off and position your portfolio one step ahead of everyone else!

Stock to Sell: Lennar

Conversely, homebuilder Lennar faces a challenging week as it prepares to release earnings that are expected to disappoint. The outlook appears bleak, with expectations of a significant decline in performance, leaving shares vulnerable to a post-earnings sell-off.

The analyst community has grown increasingly pessimistic about Lennar’s near-term prospects, with sentiment decidedly bearish heading into the report. In the weeks preceding the earnings announcement, the company has received 10 downward estimate revisions without a single upward adjustment—a clear sign of deteriorating confidence in Lennar’s ability to navigate the current housing market challenges.

Source: InvestingPro

Lennar is scheduled to report fiscal Q2 numbers after the U.S. market closes on Monday at 5:00PM ET. According to the options market, traders are pricing in a swing of 4.9% in either direction for LEN stock following the print.

Wall Street expects a sharp year-on-year decline in Lennar’s performance, with consensus estimates calling for a 43.7% drop in earnings per share to $1.94 and a 6.7% annual decline in revenue to $8.18 billion.

Looking ahead, Lennar is likely to issue muted earnings and sales guidance for the full fiscal year, reflecting ongoing headwinds in the housing market. The outlook is clouded by a tough operating environment for homebuilders, marked by high mortgage rates, softening demand, and economic uncertainty.

Lennar shares have shown vulnerability to earnings disappointments in previous reporting periods, with significant downside volatility following results that missed expectations or included cautious forward guidance.

Source: Investing.com

The technical picture for LEN stock has deteriorated as well, with shares underperforming the broader market year-to-date. LEN stock ended at $108.61 on Friday, well below its 52-week high of $186.23.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for 45% off and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.