The Renaissance of Starbucks: Navigating Challenges under New Leadership

In the competitive landscape of global coffeehouses, Starbucks has long stood as a beacon of success, renowned for its iconic brand and loyal customer following. However, the company has navigated through choppy waters recently, experiencing a notable decline from its pinnacle in 2021. The company’s shares slumped by 30%, starkly contrasting the general market’s buoyant rise of about 35% during the same period. This discrepancy in performance has sparked conversations and raised questions about Starbucks’ future trajectory.

Strategic Leadership Revamp

At the heart of Starbucks’ strategy to rejuvenate its brand and operational success was an audacious move in September, when the company successfully courted Brian Niccol, the then-CEO of Chipotle, to take the helm. This decision did not come cheaply, nor was it made lightly. Niccol’s proven track record provided a beacon of hope for Starbucks’ stakeholders.

Niccol’s career, especially his transformative tenure at Chipotle, is well-documented and highly regarded. Under his leadership from March 2018 to August 2024, Chipotle witnessed a significant turnaround. The once-tarnished brand, grappling with the aftermath of food safety concerns, saw its revenue double, profits increase by sevenfold, and its stock price soar by over 800%. These accomplishments earmarked Niccol as a visionary leader capable of steering Starbucks back to its former glory.

Fiscal Outlook and Expansion Prospects

Facing Starbucks is a mixed bag of challenges and opportunities, as illuminated by the company’s current fiscal outlook. Analysts have forecasted a sharp 26% decline in earnings for this fiscal year, a sobering statistic that underscores the urgency for strategic interventions. However, there’s a silver lining as the fiscal year concludes in September, with robust growth anticipated in the subsequent years. Expectations are set for an impressive 20% earnings growth annually over the next three years, positioning Starbucks favorably if these targets are met under Niccol’s stewardship.

Market Valuation and Risk Considerations

In evaluating the investment landscape for Starbucks, one cannot overlook the risks associated with its current valuation. The metric of forward price-to-earnings ratio (fP/E) suggests that the company’s shares are not cheap by conventional standards. This prompts a bifurcation in investor sentiment where one must weigh the potential of Starbucks’ strategy against the backdrop of its valuation.

Investor’s Dilemma: Timing and Risk

The path forward for Starbucks and its stakeholders involves a delicate balancing act. On one hand, there’s a palpable excitement surrounding the company’s potential resurgence under proven leadership. This buoyancy is tempered by the reality that tangible results from the turnaround efforts are likely to unfold over an extended period. Investors are thus faced with a consequential choice: to invest early in anticipation of Starbucks’ recovery or adopt a more cautious wait-and-see approach, possibly foregoing initial gains for greater certainty.

As Starbucks embarks on this next chapter, its stock performance reflects the inherent challenges and optimism. Following the announcement of Niccol’s appointment, shares experienced a rally, highlighting investor enthusiasm. However, subsequent fluctuations underscore the nuanced and volatile nature of the market. Observers and investors alike remain keenly interested in whether Starbucks can cement its foothold in the $70s or ascend once more towards the $115 mark, reflective of the company’s historical zenith.

Conclusion: A Future Brewed with Potential and Prudence

Starbucks stands at a pivotal juncture, championed by leadership with a proven track record and facing a future ripe with both promise and peril. As the company ventures forward, the strategies implemented under Niccol’s guidance will be scrutinized for their efficacy in recalibrating Starbucks’ trajectory towards sustained growth and market leadership.

The narrative of Starbucks’ resurgence is far from simplistic, intertwined with fiscal intricacies, market expectations, and strategic gambles. Yet, it embodies a broader testament to the resilience of global brands and their capacity to evolve in response to internal and external pressures.

Ultimately, the unfolding saga of Starbucks will offer valuable insights into corporate revitalization, leadership, and strategic foresight in the dynamic global marketplace. Investors and market observers will be watching closely, eager to witness how this blend of challenges and strategies will shape the future of this beloved coffeehouse chain.

Disclaimer: It is important to acknowledge that market conditions are perpetually fluid, and investment decisions should be grounded in thorough research and consideration of individual risk tolerance. The content discussed herein is intended for educational purposes and does not constitute investment advice.

Starbucks (NASDAQ:) has been battered from its highs, down 30% from its 2021 peak. Overall, the has done quite well in that span, rising about 35%. So while shares of Starbucks could be doing a whole lot worse, they have clearly underperformed the overall market. Will that change going forward?

New Management

It was clear that Starbucks was struggling and that its leadership team was flailing, so in September, Starbucks lured away Chipotle (NYSE:) CEO Brian Niccol to run the company. Niccol cost a pretty penny to bring in — no pun intended — but shareholders were willing to take the risk.

That’s based on his resume, which includes a successful run at Taco Bell, then jumpstarting Chipotle after a string of food-related illnesses tarnished its brand. Under Niccol’s leadership from March 2018 to August 2024, Chipotle’s revenue doubled, profits increased sevenfold, and the stock climbed more than 800%.

The hope here is that Niccol can help turn around Starbucks. The reality is that it will take more than a quarter or two to fix.

Growth Expectations

When it comes to the fundamentals, there’s good news and bad news.

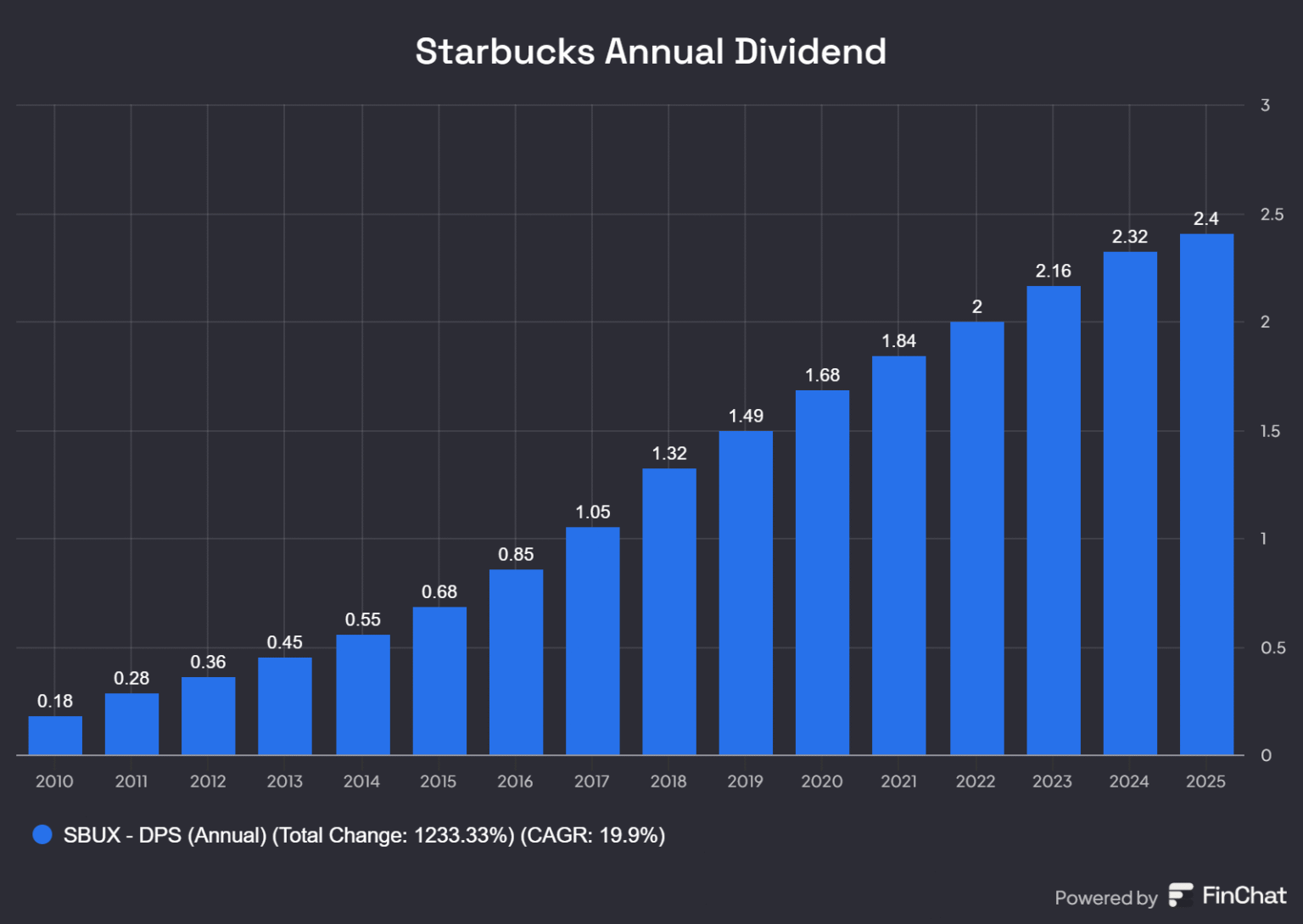

The bad news is, analysts expect earnings to fall 26% this fiscal year — ouch. The good news is, Starbucks’ fiscal year ends in September. The other good news is that consensus estimates call for 20% earnings growth in each of the next two years, and nearly 20% growth in the third year.

If Niccol & Co. achieve that feat, the stock may very well be undervalued at today’s prices.

Risks

Unfortunately, Starbucks isn’t exactly cheap at current levels. At least, that’s based on its forward price-to-earnings ratio (or the fP/E), which takes the stock price (P) and divides it by expected earnings (E).

Think of it like this: Even if SBUX stock price stays flat, a decline in earnings makes the stock more expensive from a valuation perspective.

This is where investors have to decide if the stock is right for them.

The Bottom Line

The risk/reward proposition is clear.

On the one hand, you have a major potential turnaround in the works under proven leadership. If it works, shares of Starbucks could have notable upside from current levels. However, if the turnaround takes longer than expected or doesn’t materialize to the degree that’s expected, then the stock’s returns may be disappointing.

It would be less risky to wait and see if the turnaround at Starbucks is taking hold. Investors who wait risk having the stock rise in anticipation of this development, then are forced to buy in at higher prices (albeit with more potential stability in the fundamentals). On the flip side, those who buy in early stand to benefit the most if the turnaround succeeds. But they also stand to risk more if the stock comes under pressure.

The Setup — Starbucks

Starbucks shares popped from the mid-$70s in August on news of Niccol’s hire and rallied all the way to $117.46 in March 2025 — less than 10% from all-time highs. However, the pullback has been swift, sending shares back down into the $70s before the latest bounce.

For several years now, shares have been stuck between approximately $75 and $115:

Chart as of the close on 6/5/2025. Source: eToro ProCharts, courtesy of TradingView.

Going forward, investors want to see SBUX find support in the $70s and eventually rebound higher. If support fails to hold, lower prices could be in store, potentially down into the mid-$60s. However, if the rebound gains steam, the $115 range — which SBUX hit a few months ago — could be back in play.

***

Disclaimer: Please note that due to market volatility, some of the prices may have already been reached and scenarios played out. Content, research, tools, and stock symbols displayed are for educational purposes only and do not imply a recommendation or solicitation to engage in any specific investment strategy. All investments involve risk, losses may exceed the amount of principal invested, and past performance does not guarantee future results.