In recent trading sessions, the global price of oil has experienced a notable ascent, reaching approximately $66.1 per barrel on Tuesday. This marks a continuation of gains for the second successive session. A core driver behind this upward trajectory is the ongoing geopolitical tensions that have heightened concerns surrounding a potential diminishment in the global supply of oil.

A significant focus of these geopolitical tensions is the situation involving Russia and Ukraine. Despite embarking on a second round of direct peace talks aimed at resolving their protracted conflict, which has spanned three years, the discussions did not yield any substantive progress towards a resolution. This ongoing conflict, with its lack of resolution, underscores the fragile state of geopolitical relations and their potential impact on global commodities.

Complicating matters further, a wildfire in Alberta, Canada, has led to a temporary cessation of oil and gas production in the region. Such environmental events underscore the vulnerability of oil supply to unforeseen disruptions, amplifying concerns regarding the stability of global supply chains.

Notably, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) have decided to maintain their July production increase at the same rate as the previous two months. This decision has played a role in assuaging fears related to a potential surge in oil supply, which could have otherwise exerted downward pressure on prices.

Adding to the complexity of the global oil landscape is the stance of Iran. An Iranian diplomat was quoted on Monday expressing Iran’s readiness to reject the US proposal aimed at resolving the decade-long nuclear dispute. The diplomat’s comments highlighted that the proposal did not align with Tehran’s interests nor did it signal a shift in Washington’s position on uranium enrichment. This development raises further questions about global diplomatic relations and their impact on the oil market.

Amidst these geopolitical and environmental developments, OPEC+ took a cautious step by deciding to increase its combined production by an additional 411,000 barrels per day last week. This move was contrary to the larger expected increase, thereby contributing to a more cautious approach to managing the global oil supply and stabilizing prices.

Investors and stakeholders in the oil sector remain vigilant, remembering the price wars of 2020 that led to a dramatic plunge in oil prices. The current market dynamics, however, suggest a scenario where a repeat of such drastic price wars is less likely. Particularly in the US, where an oil price drop below $50 is considered unsustainable for the sector—$50 being the break-even point.

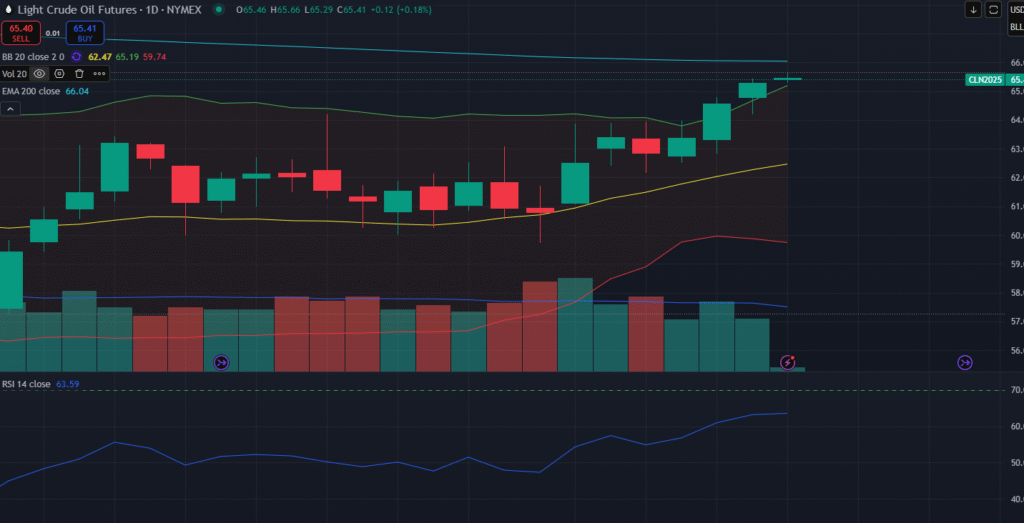

A closer analysis of the futures market provides further optimism regarding oil prices. The market is currently experiencing backwardation—a scenario where forward prices are lower than current spot prices. This market condition is typically a positive sign for commodities like oil, as it indicates expectations of tighter supply in the future.

Understanding the dynamics of the futures market is crucial in this context. In a normal market, often referred to as contango, supply and demand are balanced. However, weak demand and excess supply can lead to a greater contango, whereas excess demand can shift the market into backwardation. This shift is significant as it suggests a decreasing gap between spot and future prices, pointing towards a bullish outlook for oil prices.

Recent geopolitical events, including Iran’s increasing stockpiles of enriched uranium and the ongoing Russia-Ukraine conflict, further complicate the global landscape. Such developments not only cast doubt on the possibility of reaching diplomatic resolutions but also contribute to the anticipation of heightened oil prices, potentially reaching around $70 in the next quarter.

In conclusion, the global oil market stands at a critical juncture, influenced by a combination of geopolitical tensions, environmental disruptions, and strategic decisions by major oil-producing nations. As these factors interplay, the prospect of a tight global oil supply appears to be a central theme that could dictate the trajectory of oil prices in the near term. Understanding these dynamics, particularly in the context of futures market conditions, is essential for stakeholders aiming to navigate the complexities of the global oil market.