In the world of investments, the landscape is perpetually in flux, teasing with its unpredictability and the tantalizing allure of riches to those who dare to navigate its tempestuous waters. Among the myriad avenues explored by investors, gold stands as a venerable pillar, a testament to wealth and prosperity that has captivated human fascination for millennia. Yet, this journey is not without its tribulations, as evidenced by the ongoing weekly short trend that has enraptured the market’s attention, beginning on a seemingly ordinary Monday, the 12th of May. On this day, at precisely 07:23 GMT, the price of gold dipped through the 3243 mark, sparking the inception of what would unfold into a parsimonious tale of fluctuating fortunes.

By the week’s conclusion, on the 19th of May, the opening price of 3220 heralded the start of a remarkable trajectory for gold’s continuous contract, guided within the confines of its regression channel. Contrary to the normative expectations that accompany a short trend, which typically anticipates a descent in price, gold defied the odds by charting an upward course. This phenomenon, albeit an anomaly within the two-year backdrop marked predominantly by fleeting short trends, underscores the capricious essence of the market.

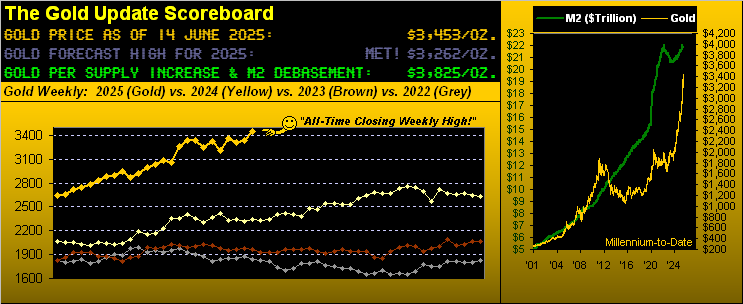

Over the span of 94 weeks leading up to the 1st of September, 2023—a period during which gold reached an impressive 1966—till the present, the yellow metal has luxuriated in long trends for a significant majority, specifically 70 weeks, as contrasted with a mere 24 weeks under the yoke of short trends. This brings us to a momentous occasion in gold’s odyssey as it clinched an all-time daily and weekly closing high by settling at 3453 in the past week, thus etching a +76% increment since that pivotal date 22 months prior. This remarkable evolution of gold’s valuation not only embellishes its allure but profoundly reinforces the adage that shorting gold might not be the most astute strategy.

Presently, standing on the cusp of a transition, the 2973-2844 support zone acknowledges the barely-there pulse of the short trend still coursing. However, the threshold to revert to a long trend, a scant 27 points above at the 3840 level, coupled with gold’s anticipated weekly trading range of 152 points, implies an imminent shift. And with global political tensions simmering, the possibility of an opening up gap come Monday is palpable.

Skeptics might argue, echoing the common sentiment that price spikes triggered by geopolitical unrest are fleeting. Nevertheless, the prospect of the trend reverting to long in the forthcoming week places an enticing target of a fresh all-time high above 3510 within reach.

Monitoring gold’s performance through the lens of the current year unveils a remarkable ascendancy, with a +31% uptick recorded over 24 trading weeks. The preceding week’s gain, notably third-highest both in percentage and points, serves as a testament to gold’s enduring luster.

Yet, amidst this financial tableau, the economic milieu, as gauged by the Economic Barometer, paints a less rosy picture, having descended to its nadir in nearly 16 years. Even as the economy grapples with a slowdown, inflation rates for May offer a silver lining. The Bureau of Labor Statistics reveals a deceleration in inflation, albeit the dread of stagflation lurks unconfirmed.

It is within this complex interplay of economic indicators and geopolitical tensions that gold’s value, alongside silver’s, continues to be reevaluated. Recent weeks have witnessed precious metals receiving a geopolitical bid, underscoring their status as safe havens amidst uncertainty.

As the narrative unfolds, the historical and contemporary dynamics of gold investment are imbued with lessons, strategy, and a hint of speculation. Amidst economic contractions and the specter of stagflation, gold remains a steadfast symbol of value. As investors and observers alike look towards the Federal Open Market Committee’s forthcoming policy statement amid these challenging times, the adage of keeping more gold (and silver) in the wallet resonates more profoundly than ever.

In summary, the journey of gold through the intricate dance of markets and economies is a narrative rich with history, strategy, and an ever-present promise of prosperity. As the world watches and waits, gold’s story continues to unfold, a gleaming testament to the enduring quest for wealth and security in an uncertain world. Cheers to the golden journey—may it be as enriching as it is enlightening.