On a recent Friday, the trading world saw gold reach an unprecedented peak price of $2,983 per troy ounce, setting a new benchmark for its market value. As the week concluded, this lustrous metal had achieved a notable increase of more than 2%, propelled by a diminishing appetite for risk among investors and a burgeoning anticipation of forthcoming interest rate reductions.

### The Forces Fuelling Gold’s Ascent

This recent surge in gold prices can be traced back to a number of key factors, each playing a distinct role in this financial phenomenon. The intensification of trade disagreements on the global stage has provided significant momentum. A striking instance of this was US President Donald Trump’s announcement of a potential 200% tariff on European wines and other alcoholic imports, a direct countermeasure to the EU’s imposing 50% levy on US whiskey exports. Such developments have injected a degree of volatility and unpredictability into the markets, compelling investors to gravitate towards ‘safe-haven’ assets such as gold.

Moreover, the recent unveiling of economic data from the United States, which indicates a relaxation of inflationary pressures as observed in February, has bolstered the argument for prospective interest rate cuts by the Federal Reserve. This prospective monetary policy adjustment renders gold—an asset that yields no interest—more attractive to investors.

The appeal of gold is further amplified by the sustained demand for gold-backed exchange-traded funds (ETFs) and the consistent acquisition of gold reserves by central banks worldwide. Notably, reports from February confirmed that China, in its bid to diversify its reserve assets, has incremented its gold reserves for the fourth consecutive month. Such robust demand from institutional buyers has eclipsed the potential impact of the US dollar’s fluctuations on gold prices, which currently appears to have a minimal influence on the metal’s market trajectory.

### Technical Examination of XAU/USD

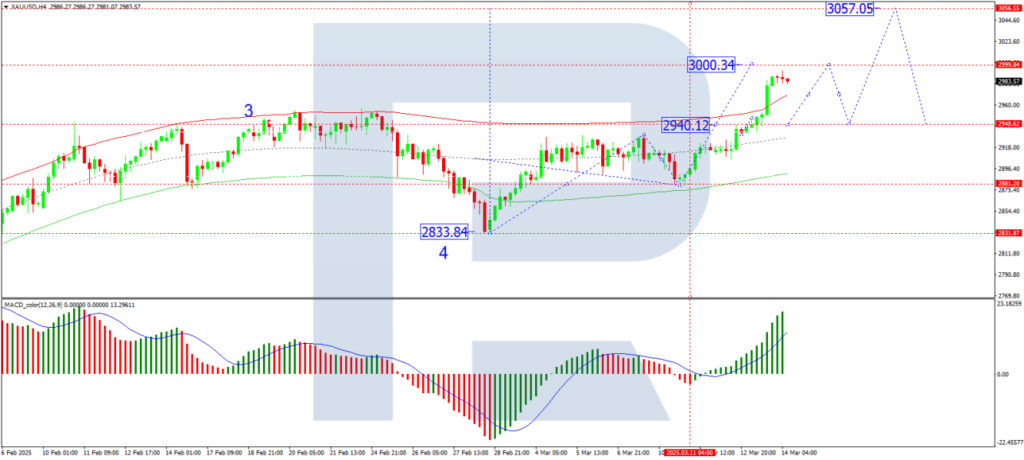

A closer technical analysis of gold, denoted as XAU/USD in the financial markets, underscores its bullish momentum. Examination of the H4 (4-hour) chart reveals a decisive breach of the $2,940 level, setting the stage for further advancement towards the $3,000 mark—a target that analysts predict could be met imminently. Following this achievement, a temporary retraction to the $2,940 threshold may occur, potentially establishing a foundation for another ascent aimed at the $3,057 level. This outlook is corroborated by the MACD indicator, whose signal line maintains a position above zero and exhibits a pronounced upward trajectory.

The H1 (1-hour) chart offers corroborative evidence, with the market having completed an upward structural wave to the $2,940 level before entering a phase of consolidation. The continuation of this upward trajectory, as evidenced by a potent breakout towards the $3,000 threshold, appears to be well underway. Technical indicators such as the Stochastic oscillator, which reveals a signal line descending towards the 20 mark, further reinforce this trend.

### Concluding Thoughts

Gold’s remarkable rally is underpinned by a constellation of macroeconomic factors, ranging from geopolitical tensions and policy anticipations to strong institutional demand. Its journey towards the $3,000 milestone is marked by potential for brief corrections, but the overarching trend remains decidedly bullish. Investors and market watchers would do well to keep a close eye on evolving macroeconomic narratives and key technical thresholds to navigate the subsequent phases of gold’s market movement effectively.

A note from the RoboForex Analytical Department serves as a reminder that the foregoing analysis is rooted in the particular perspectives of the author. It should not be construed as investment advice. As markets are subject to change, RoboForex assumes no liability for any trading outcomes that may arise from adhering to recommendations or insights delineated in this article.