As the landscape of international trade and geopolitics continually alters, recent developments have once again placed investors on a tumultuous ride, challenging the burgeoning optimism around the world’s economic recovery. In the heart of these oscillations stands President Trump, whose recent proclamations of imposing unilateral tariffs have sent ripples across financial markets globally. Aimed at more than 20 trading partners, these threatened tariffs, with details expected to be outlined in imminent letters prior to a critical July 9 deadline, have rightly caused a stir, manifesting in a downturn in US equity futures and propelling the euro to its zenith since 2025, reaching approximately the 1.16 marker.

This new twist in trade policy arrives unexpectedly, momentarily hindering the momentum of a robust rally from the lows observed in April. Market participants are now ensnared by a deluge of inquiries; chiefly, in the absence of substantial progress on trade relations and considering the soaring stock valuations, is the continued possession of risk-laden assets justifiable?

Past responses to tentative positive signals regarding US-China trade discussions have been tepid at best. This lukewarm reception possibly stems from the investors’ weariness tied to ambiguous assurances, with a growing demand for palpable outcomes. Understandably, when the discourse is dominated by ultimatums emanating from Washington, investor apprehension assumes a justifiable position.

Adding complexity to this is the escalating tension in the Middle East. Reports indicating Israel’s potential preparation for military action against Iran stoke fears of a possible extensive regional conflict. The Iranian defense minister’s warnings of retaliation against US interests in the area have only heightened these concerns. With nuclear deal negotiations languishing after numerous rounds of discussions, the possibility of military escalation seems ever more probable.

This conflation of trade discord and geopolitical anxiety has unsurprisingly led to a classic flight to safety among investors. Flight to safer assets is evident in the performance of gold, bonds, and the observed downward pressure on equities.

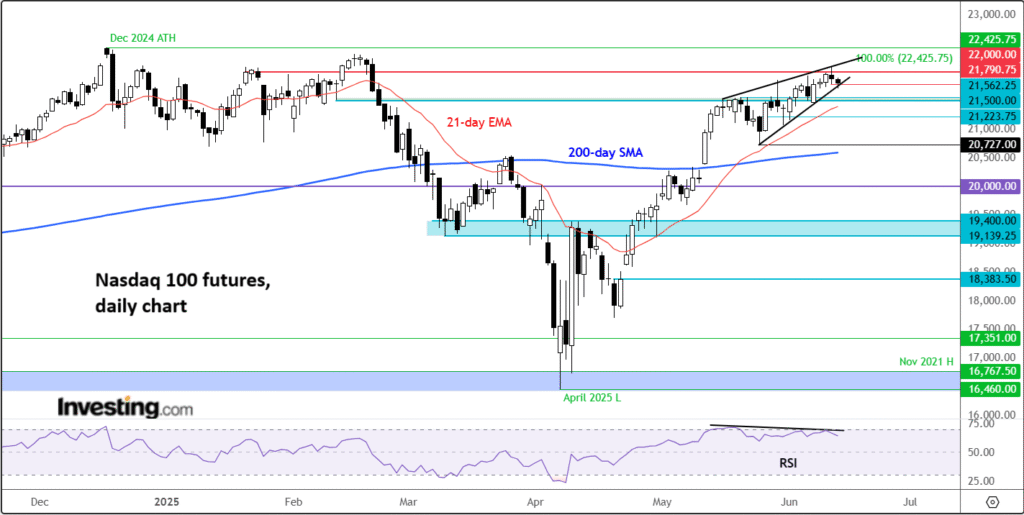

Delving into the technical perspective focusing on the Nasdaq 100, future attempts to breach the 22,000 threshold have repeatedly failed, underscoring a contentious resistance level. Despite various efforts to break out, this resistance remains unyielding, with the index exhibiting potential signals of a bullish momentum waning, as indicated by a developing breakdown in a rising wedge formation alongside a negative divergence in the RSI, particularly given its proximity to overbought territories.

Should the ongoing weakness continue, the focus then shifts to the 21,500–21,560 zone, which has previously served as a pivotal arena for the tug-of-war between bulls and bears. A decisive descent below this range could herald more profound losses, especially if the index slips beneath the May 23 low at 20,727 – a movement that could [predict a trend reversal.

Conversely, surmounting the obstinate barriers established around the 21,790 (yesterday’s low) and the psychologically significant 22,000 mark could signal a bullish resurgence, potentially ushering in new all-time highs.

As the crucial July 9 date approaches, with trade tensions and Middle Eastern unrest darkening the prospects of the market’s previous upward trajectory, caution becomes a trader’s best companion. The broader uptrend may still be salvageable, but volatility’s re-emergence demands a vigilant eye on pivotal market levels and preparedness for swift directional shifts.

In a climate fraught with uncertainty, tools like InvestingPro offer a beacon for both novice and experienced investors seeking to navigate the challenging waters of investment, reducing risks while uncovering a spectrum of opportunities. With features such as ProPicks AI, InvestingPro Fair Value, Advanced Stock Screener, and insights into the investment moves of billionaire investors, InvestingPro is structured to empower your trading strategies in an unpredictable market landscape.

Please note, the content provided herein is for informational purposes only and should not be construed as an enticement to invest. Investing in various assets carries a multitude of perspectives and inherent risks, leaving any investment decisions and associated risks squarely with the investor themselves.

Trade Tensions Resurface Just as Optimism Builds

Just when investors began to hope for progress on the global trade front, President Trump has reignited tensions with new threats of unilateral tariffs. These proposed measures, aimed at over 20 trading partners, are expected to be detailed in letters sent out before a looming July 9 deadline. That announcement sent a shiver through financial markets, triggering a sell-off in US equity futures and a slide in the , while pushing to new 2025 highs around the 1.16 mark.

This development puts the brakes on what had been a strong rally from the April lows. Market participants are now asking tough questions: without tangible progress on trade and given elevated stock valuations, is it worth holding risk assets?

The market’s reaction to seemingly positive US-China trade signals was lukewarm—investors may be tired of vague promises and more focused on concrete outcomes. And when headlines are dominated by “take it or leave it” deals from Washington, investor caution is understandable.

Geopolitical Fears Stoke Risk Aversion

Compounding the uncertainty, tensions in the Middle East have escalated sharply. Reports suggest Israel may be preparing for military action against Iran, raising concerns of a broader regional conflict. Iran’s defense minister has warned of retaliation against US assets in the region, and with nuclear deal negotiations at a standstill after five rounds of talks, the probability of military escalation is rising.

This mix of trade friction and geopolitical strain has triggered a classic flight to safety: is up, have jumped, and equities are under pressure.

Nasdaq 100 Technical View: Resistance Holds, Support in Sight

From a technical perspective, the future’s struggle at the 22,000 mark is telling. Despite a couple of breakout attempts, the index couldn’t hold above this key resistance. A rising wedge formation appears to be breaking down, and the RSI is flashing negative divergence near overbought levels—both signs that the bullish momentum may be running out of steam.

If current weakness persists, watch the 21,500–21,560 zone. This has been a critical battleground between bulls and bears and could offer some support. A decisive break below this level, however, would open the door for deeper losses, particularly if the May 23 low at 20,727 is breached. That would mark the first low since the April rally and potentially signal a trend reversal.

On the upside, the 21,790 level (yesterday’s low) and the psychological 22,000 mark remain the key hurdles. A daily close above 22,000, despite all the macro uncertainty, would be a bullish sign and could pave the way for fresh all-time highs.

So, the market’s fate hangs in the balance. Trade tensions and Middle East unrest have taken the wind out of the market’s sails just as it was gearing up for new highs. While the broader uptrend is still intact for now, caution is warranted. With July 9 approaching and volatility creeping back, traders should keep an eye on key levels—and be ready for swift moves in either direction.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.