In our exploration of the Semiconductor Index (SOX) published on May 20th, we delved into an analysis utilizing the Elliott Wave (EW) Principle, revealing an enticing trajectory for the index. We hypothesized, based on the principle’s predictive prowess, that the index was on the verge of completing a series of five ascending waves – a hallmark of the Elliott Wave theory. Our projections suggested that, following a departure from the late-April nadir, the index would navigate through an upward trajectory, indicated as the orange W-4 wave, with an envisaged target in the vicinity of $4800, give or take $100. This ascent was to be succeeded by the orange W-5 wave, with an anticipated peak around $5150, plus or minus $50.

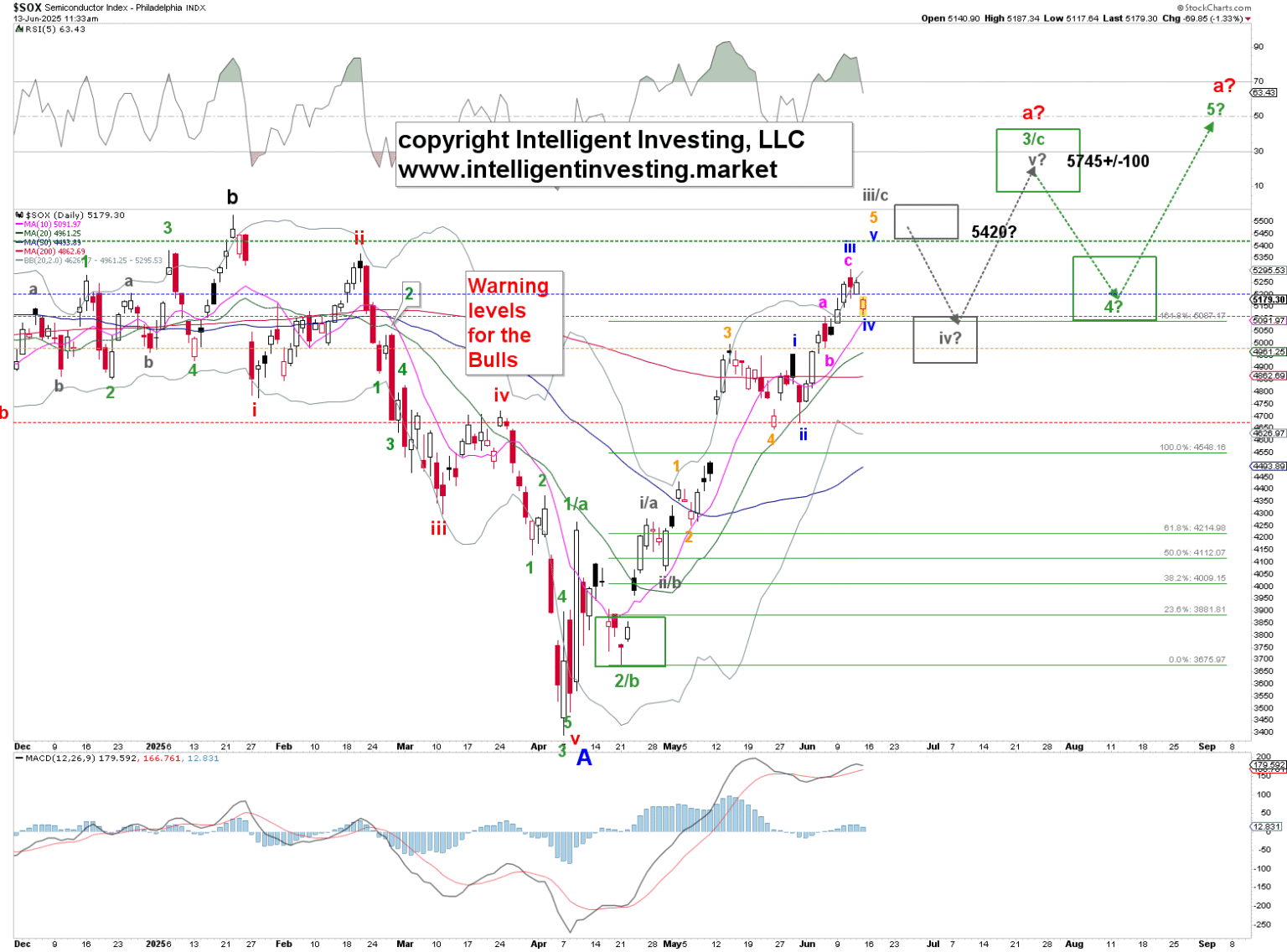

Progressing to more recent events, the SOX index demonstrated a compelling performance, touching $4647 on May 23rd, before climbing to an apex of $5303. At present, the index hovers around $5180, showcasing the remarkable precision of our Elliott Wave-based forecasts. The illustration below, designated as Figure 1, encapsulates our preferred short-term Elliott Wave count, enriched with multiple technical indicators and moving averages.

Despite the index surmounting our projected ideal target of $5150—an occurrence not uncommon with wave extensions which, while unpredictable, are known to manifest—we remained undeterred. Our methodology incorporates a dynamic system of colored warning levels (spanning blue, gray, orange, to red), each serving as a harbinger for potential trend conclusions. These warning levels ascend with the price, providing an invaluable tool for our premium newsletter subscribers, enabling informed decision-making and sustained alignment with profitable market movements. In this context, the SOX index steadfastly remained above our critical warning levels—orange and red—thereby reaffirming our conviction to maintain our long positions.

In the realm of immediacy, our analysis envisions an ending diagonal for the orange W-5 wave, comprising a quintet of smaller blue waves and adopting a “3-3-3-3-3” formation. This intricate pattern observed its blue W-iii phase culminate on Wednesday, with the blue W-iv phase potentially concluding today. The target for the culmination of the blue W-v and, by extension, the grey W-iii/c, is estimated around $5420. Notwithstanding this, the presence of the “3-3-3-3-3” formation allows us to consider the completion of the grey W-iii/c, with an ensuing grey W-iv phase poised at an approximate $4925, with a margin of $100, now underway—our alternative scenario as elucidated in Figure 2 below.

For this alternate scenario to gain traction, a breach below today’s lowest point—precisely at the gray warning level—is imperative. Nonetheless, considering the inherent variability and unpredictability of short-term market movements, it is discernable that the SOX index is primed for at least another upward thrust to etch new highs, a rally that took its initial steps on April 7.

Consequently, any dips in the short term are perceived as golden opportunities for those navigating the market with shorter investment horizons. Aligned with our bullish stance initiated in early April, our strategy has been to accumulate long positions from that point onwards, a testament to our unwavering confidence in the enduring upward trajectory of the SOX index. Through meticulous application of the Elliott Wave Principle, complemented by a robust system of warning levels, our analytical approach has consistently illuminated the path for navigating the semiconductor market’s vicissitudes, offering a blend of predictive insight and strategic foresight to investors.

In our previous update from May 20th, we found for the (SOX) based on the Elliott Wave (EW) Principle,

“Assuming five orange waves upward from the late-April grey W-ii/b low, the index should now be in the orange W-4, [to ideally $4800+/-100] followed by orange W-5, ideally reaching $5150+/-50, etc.”

Fast-forwarding, the index reached $4647 on May 23rd, peaked at $5303 on Wednesday, and is currently trading at around $5180. See Figure 1 below. Thus, over the last several updates, our preferred EW count has kept us on the right track, and we must continue to apply it until proven otherwise.

Figure 1. Our preferred short-term EW count with several technical indicators and moving averages

Although the index surpassed the ideal target of $5150, we aren’t worried about that, as wave extensions can occur but are impossible to predict in advance. Namely, we have our colored warning levels (blue, gray, orange, and red), which indicate whether a move is likely to conclude. These levels rise as prices increase, allowing our premium newsletter members to stay on the right side of the trade for as long as possible. In this case, the index never dropped below the critical levels (orange and red), so we happily continued to stay long.

In the short term, our preferred EW count is for an ending diagonal orange W-5, which consists of five smaller blue waves, forming a “3-3-3-3-3” pattern. In this scenario, on Wednesday, the blue W-iii was completed, and today, the blue W-iv may also have been finished. The ideal target for the blue W-v and all of the grey W-iii/c is approximately $5420. However, due to the 3-3-3-3-3 pattern, we can consider the grey W-iii/c as complete, and the grey W-iv, ideally at $ 4925 ± 100, is now in progress. This is our alternative option. See Figure 2 below.

Figure 2. Our alternative short-term EW count with several technical indicators and moving averages

But it requires breaking below at least today’s low, which is right at the gray warning level, to shift focus to this alternative option. Regardless, given that the short-term is more variable and, therefore, less certain than the intermediate- to long-term, we can observe that the SOX needs at least one more push to new highs to complete the rally that began on April 7.

Therefore, we still see pullbacks as opportunities to buy for those trading on shorter timeframes. Meanwhile, since our bullish outlook began in early April, we continue to maintain our long positions accumulated since then.