In recent months, the financial markets experienced a tumultuous journey that saw a significant downturn, marking a period of heightened unease and uncertainty amongst investors. This was particularly evident in the dramatic fluctuation witnessed in the span of roughly two months from February 19, when the markets enjoyed a pinnacle of prosperity, to the notable dip on April 8. Specifically, the downturn saw the S&P 500 tumbling from an all-time high of 6,144 points down to 4,983 points, encapsulating a precipitous decline of 18.9%. This period not only tested the resilience of investors but also underscored the volatile nature of financial markets.

The catalyst for this whirlwind of market activity was driven by a combination of peak panic and drastic policy uncertainty, precipitated primarily by the announcement of reciprocal tariffs by the administration. This announcement sent shockwaves through the investment community, fostering a pervasive sentiment of ‘sell now, ask questions later’. Astonishingly, during this maelstrom of market activity, the Treasury market, traditionally seen as a bastion of safety during turbulent times, did not attract the usual safe-haven flows. Instead, yields surged across the board, further complicating the economic landscape.

In response to these developments, and notably the volatile movements in the bond market, the White House made a strategic pivot. The administration announced a 90-day hiatus on most reciprocal tariffs, signifying a shift towards a more diplomatic stance on trade policy. This move was part of a broader strategy to mitigate the ongoing trade tensions, and it was accompanied by marked progress in trade negotiations, as well as earnings from the S&P 500 that were not as dire as many had feared.

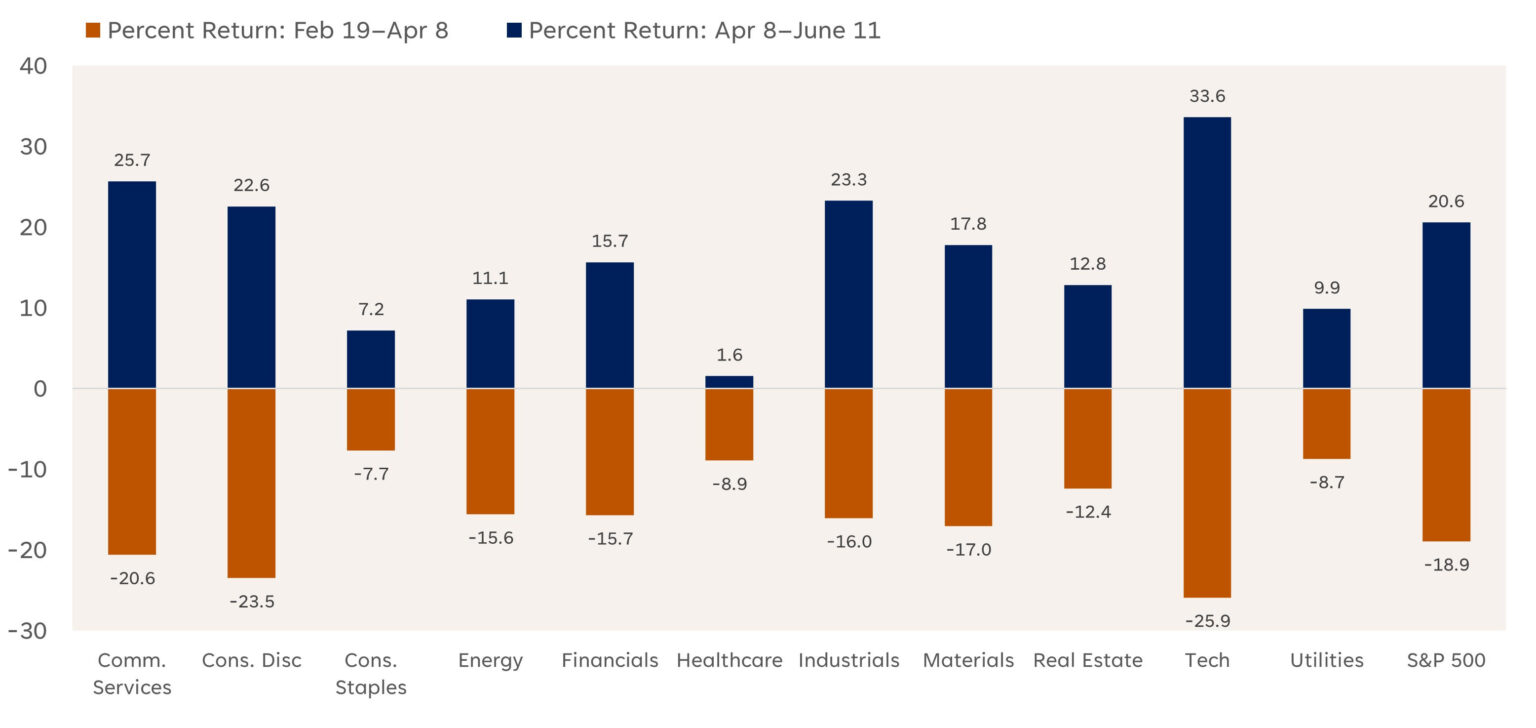

The market’s recovery from this correction has been nothing short of remarkable. The broader market rapidly recuperated from its losses, inching closer to its record highs in a show of resilience and optimism. Leading the charge in this bounce-back was the technology sector, which represents the largest weight of approximately 32% in the S&P 500. This sector, despite being the hardest hit during the downturn, witnessed a robust rally of nearly 34% since April 8.

Other sectors, including industrials, consumer discretionary, and financial services, also saw significant gains, each surpassing the 20% mark in their recovery trajectory. However, it is worth noting that defensive sectors such as utilities, consumer staples, and healthcare lagged in performance during this period. This shift back towards cyclical sector leadership, accompanied by broad participation in the recovery, has been instrumental in championing a sustainable rebound for the broader market.

Looking back on past recoveries, the patience of investors is often rewarded. For context, it is useful to recall the protracted recovery period following the Great Depression, where it took the S&P 500 approximately 25 years to revisit the highs set before the economic collapse. By comparison, the current market shows signs that the wait for new record highs may soon be over, given that the S&P 500 is now within a mere 2% of recapturing its February 19 high.

Historical patterns suggest that once a new high is achieved, the momentum often continues, a sentiment echoed by market analysts and reinforced by historical market performance data. Analysis of past periods where the S&P 500 achieved new record highs reveals a positive skew in the subsequent 12-month period returns. Specifically, in 74% of the analyzed periods, the market posted positive returns, signalling the potential for continued upward momentum following a break to new highs.

Despite the optimistic outlook predicated on technical evidence of a sustainable recovery, it is crucial for investors to remain vigilant of underlying fundamental and macroeconomic risks. The current market valuation, high Treasury yields, and ongoing trade policy uncertainties pose notable challenges. The U.S. economy, however, continues to show resilience, as evidenced by recent employment data, suggesting that the market is fairly valued.

For the market to sustain its upwards trajectory, several factors may play a critical role. These include the potential for upside earnings surprises, lower-than-expected tariff rates, legislative achievements, notably the passage of significant bills with minimal concessions, and a balancing act in lowering Treasury yields without triggering unintended consequences.

In summary, the financial markets are at a pivotal point, with the S&P 500 teetering on the brink of setting new record highs. This scenario presents a mix of opportunities and risks, underscored by a complex interplay of technical momentum, fundamental strengths, and macroeconomic uncertainties. As the market navigates this intricate landscape, the outcomes will invariably be shaped by a confluence of factors, both within and beyond the control of policymakers and investors alike. The journey ahead promises to be both challenging and rewarding, as the markets continue to adapt and respond to an ever-evolving economic environment.

It has only been about two months since the market spiraled into the April 8 correction low. The fall from grace was sharp and painful, as the went from a record high of 6,144 on February 19 to the April 8 correction closing low of 4,983, marking a peak-to-trough drawdown of 18.9%.

Peak panic and peak policy uncertainty triggered indiscriminate selling, as the administration’s reciprocal tariff announcement created “sell now, ask questions later” sentiment among most investors. To the surprise of many, the Treasury market failed to attract any safe-haven flows amid the chaos, pushing yields substantially higher across the curve.

The move in the bond market caught the White House’s attention, prompting the announcement of a 90-day pause on most reciprocal tariffs. The pivot to a more diplomatic trade policy was accompanied by subsequent progress in trade negotiations and better-than-feared S&P 500 earnings.

The recovery has been nothing short of impressive as the broader market quickly pared its correction losses and climbed back toward record highs. Technology — the largest S&P 500 weight (~32%) and the hardest hit during the drawdown — has led the charge with nearly a 34% rally since April 8.

, , and round out the rest of the recovery leaderboard with gains of over 20%. Defensive sectors, including , , and , have underperformed significantly over the last two months. The shift back to cyclical leadership and broad participation in the rally off the correction lows are key factors supporting a sustainable recovery for the broader market.

Returns Into and Out of the Correction Lows

Source: LPL Research, Bloomberg, 6/11/2025

Disclosure: Past performance is no guarantee of future results. Indexes are unmanaged and cannot be invested directly.

Good Things Come to Those Who Wait

Investors have been waiting nearly four months for the S&P 500 to reach a record high. While for many, it may feel like an eternity given all of the volatility and market drama since February.

However, the waiting game could be much worse when comparing the current pause in new highs to prior periods. For example, it took the S&P 500 6,249 trading days (~25 years) to recapture the pre-Great Depression highs set in 1929. Fortunately, we suspect the wait could be over soon — not a bold call considering the S&P 500 is only around 2% away from recapturing the February 19 high at 6,144.

If the market registers a new high, the next obvious question from investors is, what happens next? As the saying goes, momentum often begets momentum, an adage also supported by historical price action. The scatterplot below compares the number of trading days between record highs on the S&P 500 and the index’s performance 12 months after each new high.

To eliminate some of the noise and focus more on meaningful record highs, we filtered for new highs occurring at least 60 trading days apart. As highlighted in the “S&P 500 Returns After Record Highs” chart, returns skewed positive after a new record was reached, with the index generating average and median 12-month returns of 9.7% and 8.6%, respectively.

Furthermore, 74% of the 25 periods analyzed produced positive returns over the 12-month period, though past performance does not indiciate future results.

S&P 500 Returns After Record Highs* (1954-2024)

Source: LPL Research, Bloomberg 6/11/2025 *Filtered for new highs occurring at least 60 days apart.

Disclosure: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Summary

A record-high watch is now in effect for the S&P 500 as it hovers about 2% below its February high.

Technically, a close above 6,144 would validate a breakout to new highs. Bullish but not overbought momentum, relatively light investor positioning, and sanguine but not stretched investor sentiment all suggest this rally could have more room to run. The return of cyclical leadership and broad participation since the April 8 low provides additional technical evidence of a sustainable recovery.

Historical data also suggests momentum tends to continue after a record-high drought finally ends. While the technical setup continues to improve, fundamental and macro risks remain. A lot of good news is arguably priced into the market, longer duration Treasury yields remain uncomfortably high, and trade policy uncertainty is still elevated despite some notable progress.

The U.S. economy continues to hold up well, highlighted by last week’s better-than-feared employment report, and the S&P 500 is fairly valued. Any further material gains will likely require an upside earnings surprise, lower-than-anticipated tariff rates, passage of President Trump’s “Big Beautiful Bill” with limited concessions, and carefully balanced lower Treasury yields.