Since its inaugural entry into the public domain in 2020, SoFi Technologies, traded under NASDAQ, has navigated through numerous investor apprehensions to establish itself firmly in the financial technology landscape. This journey hasn’t been without its challenges, particularly around profitability concerns which, until recently, hadn’t been a major hurdle. However, the turn of 2023 brought with it a shift in investor perception as SoFi announced its transition into profitability, prompting a reassessment of its market valuation. The transition has led to a questioning of whether a price-to-earnings (P/E) ratio of 40 times is justifiable for the stock, possibly tempering its preceding upward momentum.

The Catalysts Behind SoFi’s Upward Trajectory

SoFi’s stock has witnessed a commendable over 25% surge in the past three months, a period encapsulating the company’s impressive first-quarter earnings report announced at April’s end. Reporting a 33% year-over-year increase in revenue at $770.72 million, with notably robust expansion in its Financial Services segment, SoFi has evidently been on an uptrend. Additionally, the company’s earnings per share (EPS) saw a significant leap from 2 cents to 6 cents year-over-year, reflecting strong financial health.

The forward outlook provided by SoFi also appears to have played a pivotal role in buoying investor sentiment. With projections pointing towards approximately 33% year-over-year revenue growth in the ensuing quarter and an adjusted full-year revenue growth estimated at 25.6%, expectations are high. Further, the anticipated 27% adjusted EBITDA margin, slightly ahead of the previous year’s performance, alongside the forecasted addition of 2.8 million members within the year, collectively paint a promising picture for future growth.

Tackling Challenges Head-On

The narrative of SoFi Technologies since its public debut via a Special Purpose Acquisition Company (SPAC) is one of overcoming adversity. It’s noteworthy that merely 10% to 15% of firms that went public via a SPAC during the same period have achieved profitability, based on data from PitchBook, highlighting SoFi’s distinguished performance in this arena. Even within the fintech sector, SoFi’s attainment of profitability, as per generally accepted accounting principles (GAAP), places it in a league shared only with the likes of OppFi.

The trajectory SoFi has charted since then is a tale of resilience, triumphing over hurdles including:

-

Profitability: Initially, the lack of profitability earmarked SoFi as a gamble in an environment of escalating interest rates. Yet, by 2023, the company not just reported its first GAAP net income but also showcased consistently improving net margins.

-

Sustainable Revenue Growth: Transitioning from a student loan provider to a full-service bank, SoFi has maintained significant year-over-year growth, demonstrating a revenue model not overly reliant on any single segment.

-

Student Loan Exposure: The 2020 moratorium on student loans sparked concerns among investors about SoFi’s exposure. Nonetheless, the company has effectively diversified its loan portfolio since.

-

Customer Acquisition Costs: SoFi’s aggressive marketing strategies initially raised eyebrows over resource allocation efficiency. This notion, however, has been quashed as unjustified in hindsight.

Evaluating SoFi’s Valuation: Is It Justified?

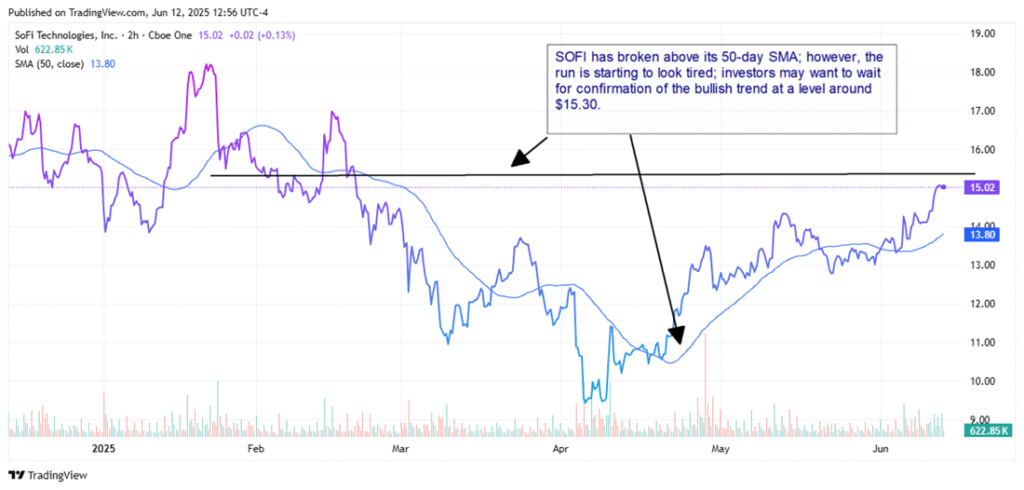

Despite the significant strides, as of 2025, SOFI stock has seen a slight downturn of about 2.7% since April, suggesting there could be room for growth. However, trading above the consensus price target of $14.73, as tracked by MarketBeat, the stock seemingly hovers around a 1.8% overvaluation mark. The crucial aspect under scrutiny is the company’s P/E ratio. When juxtaposed with Robinhood Markets (NASDAQ:), which trades at approximately 47 times earnings and has seen over a 200% surge in the past year, SoFi’s valuation invites a nuanced evaluation.

The competitive landscape for financial technology firms is nuanced, with technical analyses of SoFi stock presenting a mixed picture. Nevertheless, with SoFi’s robust long-term growth trajectory, potential investors might find it prudent to await further earnings announcements or look for technical confirmations before making investment decisions. A keen eye on the stock’s performance, especially around the $15.30 mark, could indicate a continuing bullish trend, while dips below could signal a recalibration of market expectations.

In conclusion, SoFi Technologies stands as a testament to resilience in the fintech sector, having navigated the complexities of profitability, market positioning, and investor perceptions with notable adeptness. Its journey from a nascent SPAC to a profitable full-service banking entity, amidst fluctuating market sentiments and evolving investor standards, underscores the dynamic nature of the financial technology landscape and the continuous reevaluation of growth prospects and valuation benchmarks therein.