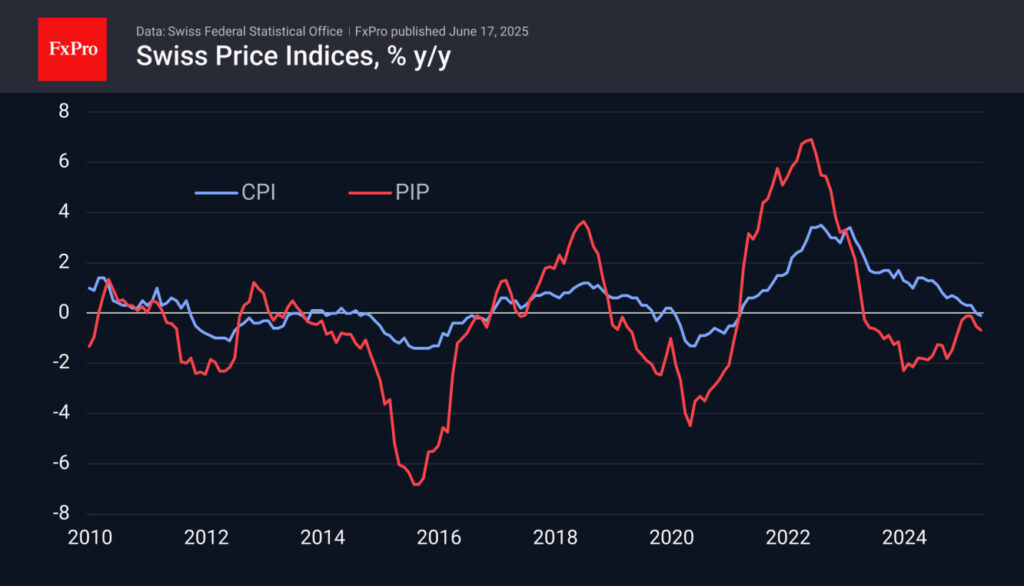

In recent data unveiled this past Monday, a surprising downturn was observed in Switzerland’s economic landscape, marked by a 0.5% drop in its import and export price index for May, which starkly countered the predicted 0.1% rise. This decline, noted as the most significant in the past half-year, exacerbates the annual reduction to 0.7% from a previous 0.5%, highlighting a persistent and troubling deflationary trend. The figures now underline 25 consecutive months of negative movement, propelling the index to its lowest ebb since February of the previous year.

This phenomenon has its roots deeply embedded in the broader economic strategies and global financial interactions of Switzerland. The nation, renowned for its fiscal stability and as a sanctuary for international capital, finds its currency, the Swiss Franc, at the crux of this situation. Over recent months, the currency has experienced an appreciable fortification, a development that, while beneficial in certain respects, has its drawbacks, particularly in the realm of export competitiveness and import costs contributing to the noted deflationary pressure.

The Swiss National Bank (SNB), in response to global economic shifts and within its mandate to maintain monetary stability, has taken a more accommodative stance since the dawn of 2024. This includes a cumulative reduction of its policy rate by 150 basis points during this period. However, this pales in comparison to the European Central Bank’s (ECB) more aggressive easing, which has slashed its rates by 210 basis points, suggesting a relatively tighter policy stance from Switzerland.

Adding complexity to the SNB’s policy environment is the franc’s performance against major currencies, particularly noted in its trading levels last week and at the close of April. The USD/CHF exchange rate, for instance, registered dips to 0.8050 levels, reminiscent of its stance during notable periods in January 2015 and the summer of 2011. Similarly, the EUR/CHF pair teeters precariously near its historical lows, raising alarms over the franc’s strength and its broader economic implications.

These dynamics signal the need for more substantive measures, beyond the conventional monetary policy tools. The SNB’s forthcoming quarterly meeting, slated for Thursday, is hence highly anticipated. Market pundits are predicting a likely 25-basis-point cut in the key rate, with expectations of a similar move before the year’s end. However, given the depth and complexity of the situation, the SNB might opt for a more robust response, potentially ramping up currency interventions or even signaling a willingness to push the rate further into negative territory. Such steps aim to mitigate the attractiveness of the franc as a deposit currency, intending to stir liquidity towards productive economic activities.

Each decision by the SNB carries profound implications, not just internally but also in the broader international financial framework. Past instances of policy shifts have set trends, loosening the franc’s strength and spurring elevated activity in the EUR/CHF and USD/CHF exchanges. A continued strategic adjustment could thus potentially herald a substantive change, driving a 10-20% rise in these pairs in the following quarters and repositioning Switzerland within the global economic landscape.

As we edge closer to the SNB’s decision day, all eyes remain fixed on Switzerland, not just as an economic case study but as a testament to the intricate balance nations navigate between domestic monetary policies and the relentless undercurrents of global finance.

In essence, Switzerland’s current economic scenario serves as a beacon for understanding the delicate interplay between currency strength, inflation (or deflation), and monetary policy within the realms of national and international economics. As the SNB ponders its next move, the potential outcomes underscore the significance of strategic monetary management in an interconnected world, signaling important lessons for central banks and economies worldwide.