In 1792, a transformative piece of legislation known as the Coinage Act was ratified under the leadership of President George Washington, a mere year following the adoption of the Bill of Rights. This pivotal Act marked the inauguration of the United States Dollar as the nation’s formal currency, thereby embedding a financial foundation that would fundamentally shape the American economy. At its core, the Coinage Act delineated the dollar with precise weights in gold and silver, cementing a monetary system that has evolved significantly over the centuries.

Interestingly, what we regard today as “dollars” in our transactions – those green pieces of paper or digital figures in our bank accounts – are technically identified as Federal Reserve Notes, a notable departure from the definitions established in 1792. Initially, one dollar was defined as equivalent to roughly 24 grams of pure silver or about three-quarters of a troy ounce. Furthermore, the legislation stipulated that ten dollars was on par with around 16 grams of pure gold, equating to about half a troy ounce. This calculation set the gold-to-silver exchange ratio at a steadfast 15:1.

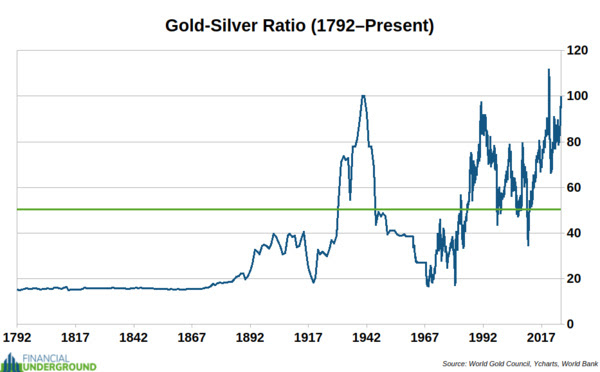

The persistence of the 15:1 ratio intrigues many, even as the contemporary financial landscape no longer upholds such fixed relationships between gold and silver. It’s a reminder that this ratio, like many aspects of economic policy, was a construct of political decision-making rather than an immutable law of market dynamics. In essence, the ratio’s significance is not rooted in any natural law but is a historical artifact, subject to change as market conditions dictate. Attempting to rigidly adhere to such ratios is akin to other forms of government price control, which are often overridden by the inexorable forces of the market.

The discourse around gold and silver’s value extends to broader perspectives on money itself. Contrary to traditional views which fixate on ratios, I advocate for a view of silver’s value in terms of gold, understanding this measurement as reflective of silver’s price in the gold standard. This perspective arises from gold’s storied history as a reliable medium of exchange, a vehicle of wealth that surpasses the ephemeral values of fiat currencies. In this light, the fluctuations in the gold-silver ratio, especially its recent surge beyond 100:1, underscore more than historical curiosity; they reveal silver’s unprecedented undervaluation in the annals of human history.

Silver’s investment potential, particularly in the current financial milieu, cannot be overstated. Despite the broad spectrum of investment avenues, silver stocks present a compelling opportunity for substantial returns, especially given the scarcity of pure-play silver mining companies. These entities, often based in regions rich in mineral resources such as Mexico and Peru, offer a direct stake in the silver market’s future.

Yet, it’s critical to approach the idea of holding physical silver with discernment. While gold unequivocally retains its status for long-term wealth preservation, possessing a limited quantity of physical silver coins can serve a practical role in emergency situations, facilitating basic transactions when conventional monetary systems may falter. Recognizable coins like the Canadian Silver Maple Leaf and American Silver Eagle could, in dire circumstances, become invaluable for bartering.

The investing landscape for silver, thus, confronts us with a multifaceted picture. On one hand, the intrinsic and industrial value of silver, combined with its current low valuation measured in gold, augurs well for its long-term appreciation. On the other, the tangible utility of physical silver in crises underscores the enduring relevance of precious metals in a diversified investment strategy.

Conclusively, as we witness the gold-silver ratio stretching to historical extremes, the market signals a rare investment opportunity in silver – a chance that arises once in several generations. Whether through judicious speculation in select silver stocks or strategic acquisition of physical silver, the current scenario beckons astute investors to act decisively. Amid the flux of markets and economies, silver shines not merely as a relic of the past but as a beacon for future financial resilience.