Understanding Inflation: A Dual Perspective and Its Implications on Economic Policy

In recent times, the topic of inflation has found itself at the heart of financial debates, sparking a division among investors and economic analysts alike. This division centres around two distinct views: those who perceive inflation as a significant threat necessitating immediate response, and those who view it as a temporary obstacle that will resolve in due course. Such a divide not only reflects the complexity of economic phenomena but also underscores the challenges in formulating responses that could have wide-ranging implications for the economy.

Central to the discourse on the implications of inflation is Treasury Secretary Janet Yellen, a figure of notable academic and professional standing, having formerly chaired the Federal Reserve. Despite her extensive background in economics, Yellen’s status as a political figure has led to increased scrutiny of her reassurances regarding inflationary trends. Her position, echoing a less alarmed perspective on inflation, suggests a cautious approach towards aggressive monetary tightening or interest rate hikes by the Federal Reserve.

In a noteworthy assertion, Yellen reiterated her expectations that inflation would retreat to the anticipated 2% mark by mid-2022. This forecast, however, projects a timeline that extends nearly a year into the future, leaving room for unpredictability and the potential impacts it might have on investment strategies in the interim.

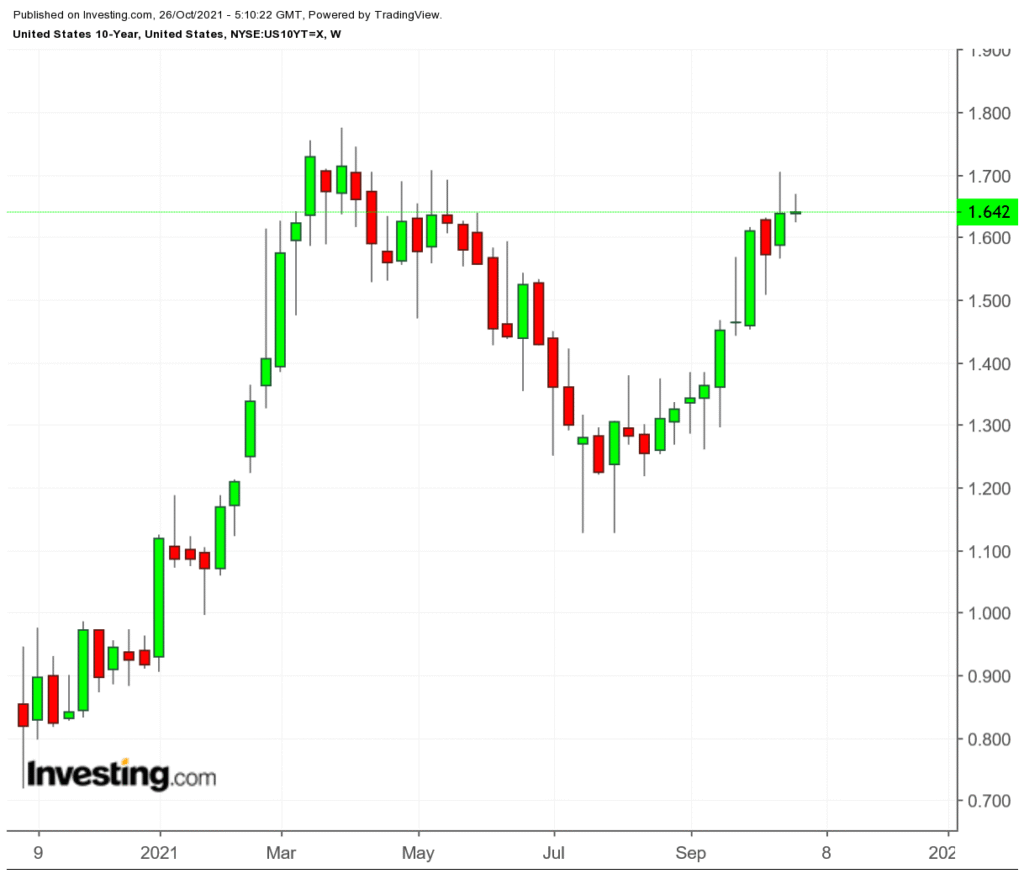

The movements in the yield of the benchmark Treasury further illustrate the prevailing economic sentiment. Following a slight increase, yields dipped back below 1.64% after previously reaching 1.67%. This fluctuation was seemingly in response to labour market data, which, despite presenting lower-than-anticipated job numbers, portrayed a robust economic recovery. Such developments serve to highlight the ongoing debate surrounding inflation—whether it stems from transitory factors or persistent demand-driven pressures.

The debate garners additional complexity when considering the perspectives of other financial leaders and institutions. For instance, Jens Weidmann’s announcement of his departure as the head of Germany’s central bank, after a decade of opposing lenient monetary policies within the European Central Bank’s governing council, marked the end of an era for one of the most steadfast inflation hawks. Though his successor may maintain a degree of conservatism, a shift towards a less hawkish stance seems probable.

This anticipated shift raises pertinent questions about the fundamental assumptions underpining economic policy. Historically, the significant expansion of central bank balance sheets following the 2008 financial crisis was expected to precipitate inflation—this prediction, however, did not materialize, leading to a reevaluation of longstanding economic beliefs.

Current economic thought tends to favour post-Keynesian perspectives, often sidelining earlier monetarist views, such as those by Milton Friedman, which correlated an increase in money supply directly with inflation. Yet, the recent focus on cost-push inflation, as articulated by Brian Reading, a seasoned economist and advisory board member at OMFIF, introduces a nuanced understanding of inflationary mechanics. Reading suggests that overlooked cost-push inflation could usher in stagflation—a situation where price increases lead to higher unemployment, contrary to demand-pull inflation, which ties decreasing unemployment to inflation.

Reading’s analysis, presented in recent publications, draws a parallel between transitory price shocks and the spread of contagions like COVID-19, proposing that these initial shocks may trigger wage demands and further price hikes, thereby sustaining inflation longer than central banks anticipate. This scenario presents a significant challenge to central banks, implying a need to reassess their support for what he describes as “unsustainably overvalued equities.”

Confronted with these analyses, the question that looms over policymakers and investors is whether the current economic trajectory indeed signals an inevitable downturn, and if so, the potential benefits of preemptive action by central banks.

In navigating these complex economic waters, it is essential to consider the multifaceted nature of inflation and its underlying causes. While transitory factors may indeed play a role, the possibility of sustained inflation driven by other dynamics—be it heightened demand or cost-push factors—cannot be dismissed. Therefore, a balanced and informed approach, cognizant of historical precedents and current economic indicators, is paramount in devising strategies that will steer the global economy towards stability and growth in these uncertain times.