Following a period of mild disinflationary easing, there are emerging signals within the bond market that suggest a potential shift towards an inflationary steepening of the Treasury Yield Spread—a phenomenon that can significantly influence financial markets and economic forecasts.

In the financial realm, the concept of a yield curve plays a pivotal role in understanding market dynamics. Essentially, a yield curve can steepen due to various factors, mainly categorised into inflationary and deflationary pressures.

An inflationary environment is typically characterised by a scenario where long-term yields increase more significantly than short-term yields, causing the curve to steepen. This can happen for several reasons, but most commonly, it’s due to expectations of higher inflation in the future, leading investors to demand higher yields on long-term investments to compensate for the anticipated decline in purchasing power over time.

Conversely, a deflationary steepening occurs when short-term yields fall more sharply than long-term yields, often as a result of immediate economic concerns that prompt investors to favour short-term over long-term securities. In such cases, both short and long-term yields might nominally decrease, yet the greater drop in short-term yields causes the curve to steepen.

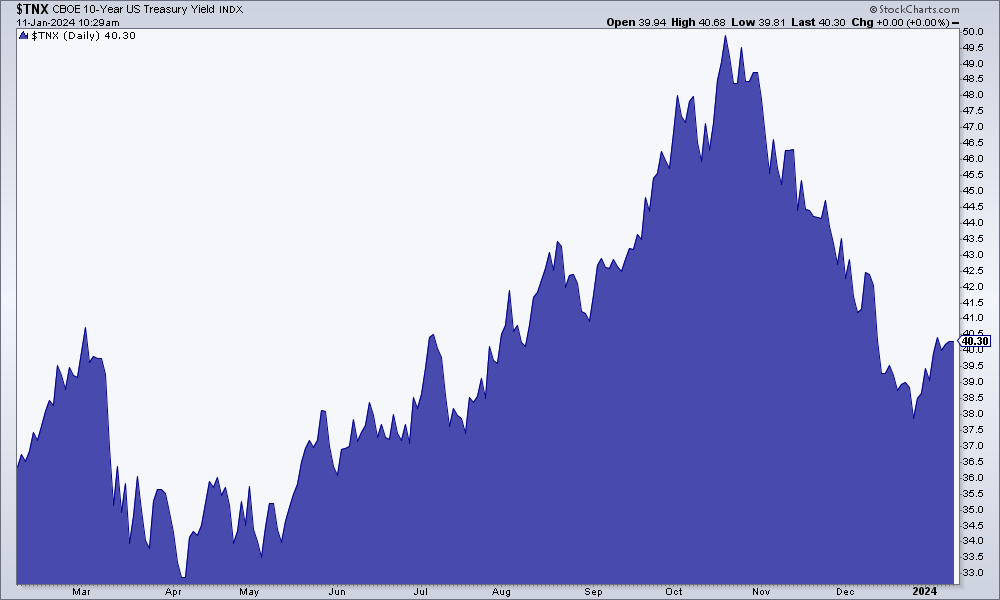

Throughout the latter part of the previous year, particularly since the stock market lows observed in October, the narrative has largely been one of disinflationary relief. This was highlighted by the fall of Treasury bond yields from close to 5% to 3.8%, indicating a period of eased inflationary pressures and a more favourable economic outlook dubbed as the ‘Goldilocks phase’. However, reflecting on historical market patterns, these phases often serve as preludes to potential shifts in the macroeconomic environment.

As of December, a subtle yet significant continuation in the steepening of the yield curve was noted, arguably introducing hints of an upcoming inflationary phase. If the nominal yields continue on this trajectory, this could mark the onset of a more pronounced inflationary period, necessitating continuous observation for confirmation.

The decline in yields from October to December was interpreted as the optimal outcome of the Goldilocks scenario for 2023, underpinned by a narrative of disinflation that emerged as an unexpected accelerant for a seasonal uplift in market sentiment. This optimistic outlook was further supported by anticipatory adjustments from the Federal Reserve, which seemed to temper inflationary signals from the macroeconomic landscape.

However, the discourse began to shift as we broached the topic in our analysis, cautioning against resting on the laurels of the disinflationary/Goldilocks prediction made a year earlier. Despite the optimism and a still robust US dollar, indicators such as the Gold/Silver ratio suggested a readiness for fiscal strategies aimed at stimulating inflation, especially in the face of potential political pressures and upcoming electoral considerations.

One cannot overlook the so-called ‘inflation trades’ in commodities and resource-related sectors that have been significantly depressed, mirroring the pattern observed with disinflation-impacted sectors in 2020. A pivot towards an inflationary macro environment, even if transient, could potentially revitalise these previously subdued investment avenues.

This preliminary analysis serves as a cautionary note not to overcommit to a disinflationary outlook indefinitely. The observed indicators, particularly the continued steepening of the yield curve with an inflationary inclination since mid-December, suggest that those anticipating a seamless Goldilocks style soft landing may need to recalibrate their expectations. Moreover, strategies that have been positioned opposite to the prevailing disinflationary trend of 2023 might find newfound success in the wake of these shifts.

In essence, the evolving dynamics of the yield curve and the broader financial markets underscore the importance of continuous monitoring and adaptability within investment strategies. As the landscape subtly hints at an impending change, the ability to interpret these nuances and respond effectively will be crucial for navigating the uncertainties of the coming year, contributing to a more nuanced understanding of the inherently fluctuating nature of economic trends and market behaviours.