In the bustling world of cryptocurrency, Bitcoin (BTC) is once again at the forefront of investors’ minds as it oscillates around the $107,500 mark. Despite making several forays towards breaching the $108,000 threshold—a weekly pinnacle—over the past 48 hours, it has yet to secure a position above this level. This development has enthralled market watchers and participants alike, highlighting the $108,000 mark as a considerable level of interest.

The resilience of Bitcoin has been prominently on display, particularly in its capacity to navigate through the tensions that have recently roiled the geopolitical landscape in the Middle East. Investors have recalibrated their focus towards more supportive factors that have bolstered Bitcoin throughout much of 2025. This includes a robust demand from institutional and corporate entities, favourable regulatory developments, and a growing optimism driven by potential monetary policy shifts from the Federal Reserve.

The buzz around possible rate cuts by the Federal Reserve has intensified. Market sentiment has been influenced by speculative reports that President Trump is considering an earlier-than-expected nomination for Federal Reserve Chair Jerome Powell’s successor. With Powell’s term not due to end until May 2026, the potential for an announcement in September or October of this year could significantly alter the dynamics within the Federal Reserve. The prospect of appointing a chair more aligned with Trump’s preference for aggressive interest rate cuts has swayed market expectations, prompting a reevaluation of future interest rate trajectories.

During a Congressional testimony, Powell aired concerns regarding the inflationary pressures that Trump’s trade tariffs might impose. Yet, he also suggested that the Federal Reserve could continue its rate-cutting measures if these inflationary pressures fail to materialize. This dovish stance, particularly in contrast to the Federal Reserve’s decisions last week, has led markets to anticipate further cuts, with expectations now set at 66 basis points for the year, up from 51 basis points a week earlier. In environments where interest rates are low, Bitcoin tends to thrive due to increased liquidity and a subdued United States Dollar (USD).

Speaking of the USD, it has experienced a notable decline, dropping by nearly 10% throughout 2025, marking its most considerable decrease in the first half of a year in almost four decades. Historical patterns suggest such depreciations of the dollar often coincide with surges in Bitcoin investment, as investors seek refuge in higher-yielding assets amid periods of significant monetary shifts. A weaker dollar is synonymous with reduced borrowing costs and heightened liquidity, creating an environment ripe for risk-tolerant behaviours, which in turn benefits digital assets.

The institutional and corporate appetite for Bitcoin is undeniably growing, as evidenced by the steady increase in BTC exchange-traded funds (ETFs) seeing inflows for the twelfth consecutive day. Glassnode data reveals a substantial proportion of these inflows are attributed to unhedged, long-only positions, showcasing a deep-seated belief in Bitcoin’s value proposition rather than a fleeting arbitrage opportunity.

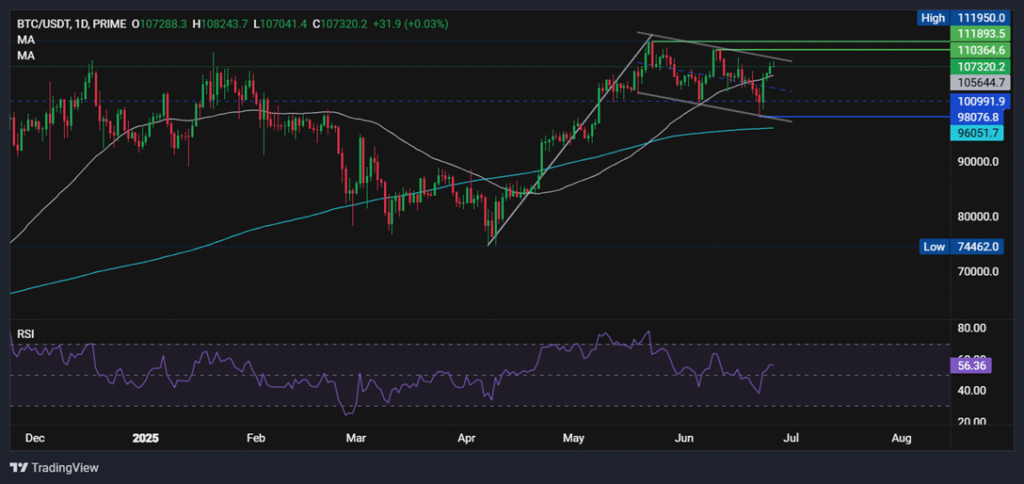

Turning our attention to the technical analysis of Bitcoin, the cryptocurrency has showcased a remarkable recovery from its $98k low, climbing by 10% in just four days. The formation of a bull flag pattern is a strong indicator of a potential bullish continuation. For breakthrough enthusiasts, the target lies above the $108.5k mark, the upper band of the bull flag pattern, with ambitions extending towards setting new record highs, potentially reaching the $120k marker.

However, should Bitcoin fail to ascend beyond $108.5k, it might experience a pullback, with pivotal support positioned at $105k, represented by the 50 Simple Moving Average (SMA). A descent below this threshold could pave the way to the $100k psychological level and further down to $98k, the lower band of the pattern.

In closing, it’s essential to approach financial engagements with due diligence, recognizing the complex nature of leveraged products and the inherent risks of rapid financial losses. The dynamism of Bitcoin and the broader cryptocurrency market continues to captivate and challenge investors, oscillating between periods of exhilarating gains and sobering corrections. As we navigate through these unpredictable waters, the unfolding narratives around Federal Reserve policies, institutional demand, and macroeconomic factors promise to play pivotal roles in shaping the future of digital currencies.