In recent times, amidst the cascading uncertainties stirred by geopolitical conflicts and fluctuating market sentiments, the preeminent digital currency, Bitcoin, has showcased a commendable degree of resilience, challenging the tumults that have otherwise jolted traditional risk assets. The backdrop of escalating tensions between Israel and Iran, coupled with the nervous ebbs and flows of the global market, set a stage where Bitcoin’s steadfastness was put to the test. Unlike its contemporaries in the risk asset domain, which saw dramatic fluctuations in response to the evolving geopolitical narrative, Bitcoin presented an intriguing counter-narrative by maintaining its composure and, in doing so, signaling a potent resilience intrinsic to its market dynamics.

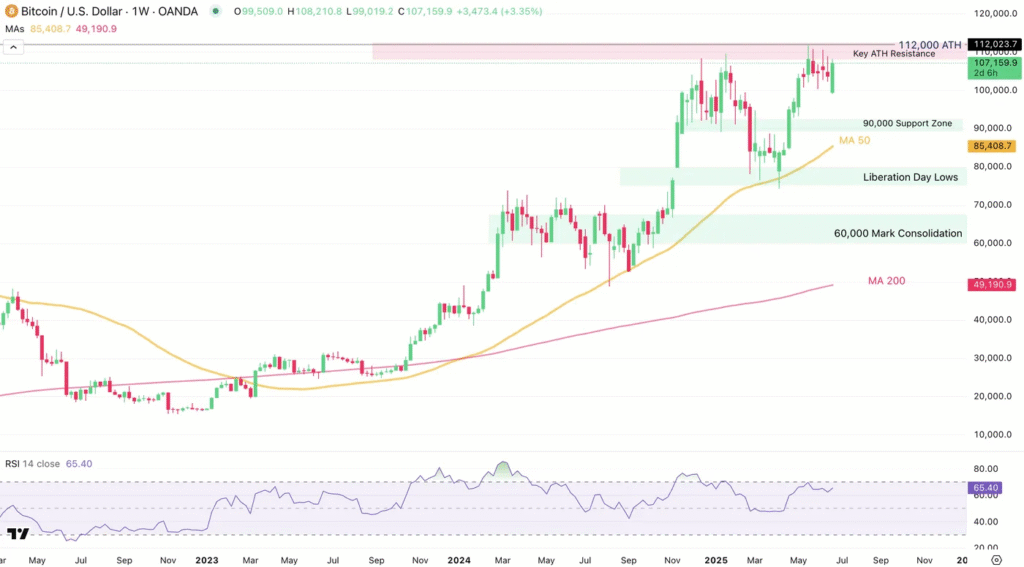

Delving deeper into Bitcoin’s market journey, it reached an unprecedented zenith in May, with its value soaring to a new all-time high of $112,030. This peak, however, was followed by a retraction, with Bitcoin’s value retreating to test the psychologically significant benchmark of $100,000. The situation became even more precarious during a weekend marked by escalated tensions, as the United States initiated strikes on Iranian nuclear facilities. Amidst this turmoil, Bitcoin’s value briefly plummeted, touching $99,000. Nevertheless, defying the prevailing market pessimism, sellers found themselves unable to sustain the digital currency below the $100,000 threshold.

This inability to force a sustained downturn was shortly succeeded by a robust rebound in Bitcoin’s value, as market sentiment began to pivot away from the fears spurred by the potential of an escalating conflict. In rebounding, Bitcoin not only reclaimed but exceeded its recent trading range, signaling a possible resurgence of bullish momentum within the market.

To comprehend this remarkable resilience and potential market trajectory, an analysis encompassing various timescales—from weekly to intraday—is essential. On a weekly scale, the candlestick patterns preceding this rebound depicted a narrative of indecision, characterized by long-wicked doji patterns fluctuating near the apex of Bitcoin’s valuation. However, the week that followed marked a significant departure from this indecision, showing a bullish momentum that could, pending a weekly close near this new high, underscore a rejuvenated investor confidence in Bitcoin.

Despite the resurgence, the overbought condition of weekly momentum indicators signals the likelihood of an impending consolidation phase, a prediction already hinted at by shorter timeframe analyses. Transitioning to a daily perspective, Bitcoin has been observed posting consecutively bullish candles, reinforcing the ‘risk-on’ sentiment permeating through broader markets. The 50-day moving average, previously a level of resistance during February’s pullback, now provides robust support, fortifying the optimistic technical outlook.

Intra-day insights, particularly from the 4-hour chart analysis, portray a definitive transient consolidation phase, which eventually gave way as Bitcoin tested and exceeded recent highs. The formation and subsequent breakout of a descending channel in this timeframe are indicative of a shift in market sentiment, bolstered by key supports and resistances along Bitcoin’s path. Amidst this, the resilience to drift into oversold territories emphasizes the sustained buyer interest at critical junctures, particularly around the $100,000 support level, signifying a collective market sentiment that deems a deep correction improbable barring unforeseen bearish catalysts.

Highlighting specific intra-day supports and resistances, levels ranging from $99,000 to $100,000 and upwards towards $106,000 form critical junctures that Bitcoin must navigate to maintain its bullish trajectory. Resistance levels, conversely, loom in the vicinity of $112,000, marking the previous all-time high, with further potential hurdles expected between $115,000 and $117,000, as projected by Fibonacci extension analyses.

As Bitcoin endeavours to breach and, crucially, sustain above these pivotal marks, its ability to do so will not only reflect its immediate market standing but also delineate broader market sentiments aligning around digital currencies as viable risk assets amidst global uncertainties. In tracing Bitcoin’s journey, from tumult to resilience, one discerns not merely the narrative of a digital currency but a reflection of the evolving dynamics of risk, resilience, and recovery within the modern financial landscape.