In the ever-dynamic landscape of global finance, the position of the US dollar within the markets has recently caught the attention of analysts and investors alike. Yesterday’s analysis brought to light the fact that the dollar is notably oversold and appears to be on the cusp of a reversal. To delve into this topic, it’s vital to understand the mechanisms and implications behind such financial movements.

The dollar has significantly strayed from its long-term average, showing signs of being oversold across various indicators. Since April, there has been a noticeable foundation building for potential recovery. As highlighted last Friday, the pronounced negative sentiment and positioning against the dollar stand as compelling indicators for a forthcoming counter-trend rally. In the realm of financial analysis, such contrarian signals are often harbingers of a shift in market dynamics.

Central banks and international entities holding reserves in currency form face a limited set of options for their investments, mainly consisting of US stocks, US Treasury Bonds, and gold — all predominantly traded in US dollars. The preceding two years have seen a preference towards gold as a reserve asset, driven by the weaker dollar. Nonetheless, should the trend reverse, a significant reallocation of reserves from gold into stocks and bonds might occur, potentially yielding superior returns as the dollar gains strength. This strategic shift amongst central financial institutions is something market watchers are advised to monitor closely.

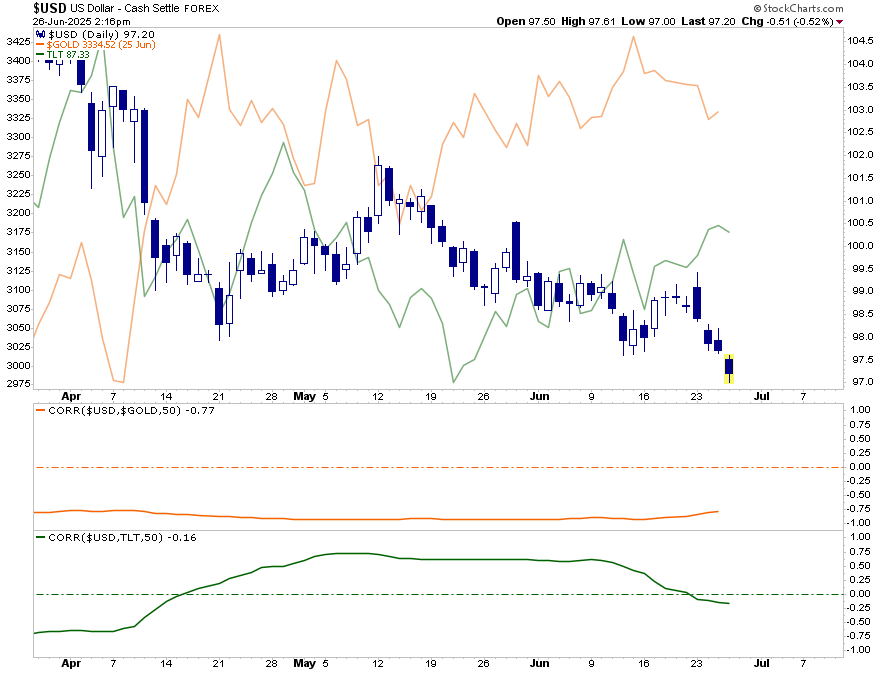

This brings us to the crux of our discussion: If predictions of a dollar resurgence hold true, what could be the ramifications for gold and bond markets? It’s instructive to examine the recent interplay between the dollar, gold, and bonds since early April, a period marked by heightened volatility after the announcement of Liberation Day tariffs by Trump’s administration. Analysis reveals that during this phase, while bond prices and the dollar experienced a downturn, gold remained robust. The underlying correlations have shown that gold tends to move inversely to the dollar, whereas bonds display a more positive correlation with the currency.

As such, a reversal in the dollar’s fortunes may presage higher bond prices, translating to lower yields, and a depreciation in gold prices. This phenomenon underscores the interconnectedness of global financial markets, where shifts in currency valuations can ripple through various asset classes, influencing their performance.

Yet, the dialogue doesn’t end with the analysis of correlations and potential shifts. The broader context includes recent economic data and regulatory developments that could further influence market movements. For instance, the current predisposition towards lower yields is corroborated by recent economic indicators pointing to underlying weaknesses. This aligns with the anticipation of a dollar rally, which could invigorate a bond rally as foreign reserves pivot back towards US Treasuries to capitalize on yield and the appreciation of the dollar.

Another layer to this intricate financial narrative is the speculation around regulatory adjustments, particularly concerning the Supplementary Leverage Ratio (SLR) for banks. Elevated Treasury yields, approaching 5%, have sparked predictions that banks might intensify their acquisition of Treasuries once SLR constraints are loosened. A proposal by the Federal Reserve to relax leverage requirements has already garnered approval, poised to potentially free up significant capital for large US banks. This regulatory easing could unlock new dimensions in managing reserves and assets, fostering a conducive environment for banks to expand their holdings in low-risk assets such as US Treasury securities.

In conclusion, the emerging scenario within the global financial landscape is multifaceted, involving a confluence of market sentiments, economic data, and regulatory shifts. The anticipated reversal of the dollar’s position portends a reshuffling of investment preferences and strategies across currencies, gold, and bonds. Observers and participants of the financial markets are thus encouraged to maintain a vigilant stance, as these developments could usher in a period of notable shifts in asset valuations and investment returns.