In the early stages of this month, the British economy showed signs of fragility. Coupled with persistently high inflation rates, these conditions nudged the Bank of England towards maintaining higher interest rates, dismissing any speculation of financial easing until the latter part of summer. Notably, recent economic indicators have presented a mixed picture: unemployment rates in the United Kingdom have seen a slight increase, while consumer spending and manufacturing output have experienced marginal declines. A lone ray of optimism emerged last week when certain financial metrics outperformed expectations, offering a glimmer of hope amidst the prevailing economic gloom.

The financial markets, by their very nature, are oriented towards the future. Investors and analysts alike are keenly observing the prospects of the United Kingdom, a nation that charted a new course following its historic departure from the European Union in 2016. In the wake of Brexit, there is an anticipation of more streamlined trade operations, fostered by key agreements forged between the European Union and the United States. These developments signal a potential reduction in trade barriers for the UK, enhancing its economic outlook on the global stage.

Concurrently, the currency markets have evidenced fluctuations, particularly in the relationship between the British pound and the US dollar. The greenback has encountered periods of instability, attributed partly to geopolitical tensions and uncertainties surrounding the US political landscape. Market sentiments have shifted, driven by mixed signals from the Federal Reserve and erratic stances from US leadership, further exacerbated by recent downgrades in the US credit rating. Despite these challenges, the US economy continues to surpass expectations, highlighting the complex dynamics at play in global finance.

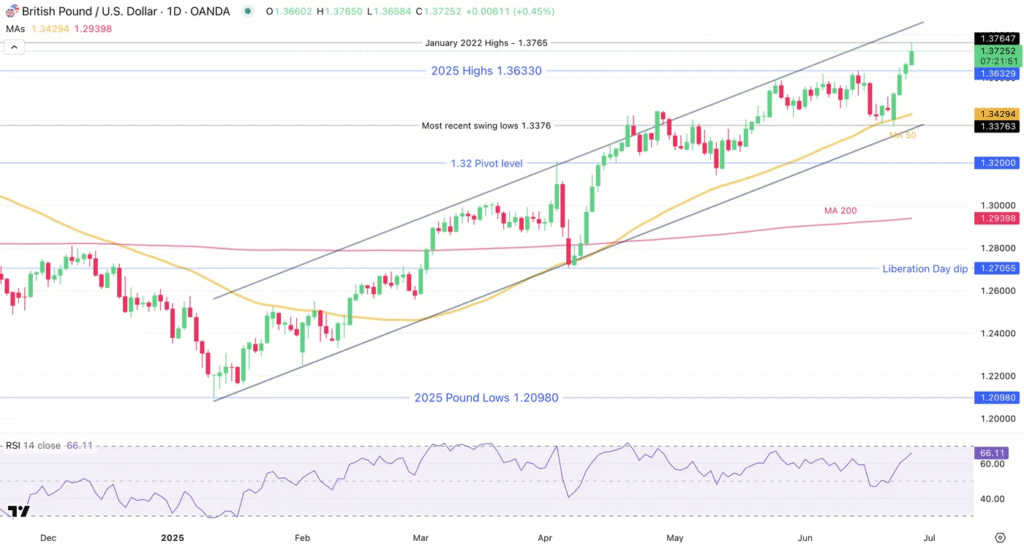

Turning our gaze to the technical analysis of the GBP/USD currency pair, often referred to as Cable, a detailed examination offers insights into recent movements and potential future trajectories. Earlier this month, the pair underwent a significant correction, prompted by market reactions to geopolitical events and less than favorable economic data emanating from the UK. This led to a notable dip, with the pair touching monthly lows.

However, the narrative soon shifted as the GBP/USD pair demonstrated resilience. A rejuvenation saw the currency pair not only recover from its losses but also ascend to levels not witnessed since January 2022. This rally was underpinned by a robust support at the 50-Day Moving Average, propelling the pair to new heights. Despite these gains, the Relative Strength Index (RSI) on the daily chart does not yet signal an overbought condition, suggesting that there might still be room for upward movement within the bounds of its ascending trading channel.

For more granular analysis, the 4-hour chart reveals that the market is currently in an upward trend, with recent price action forming a bullish channel. Despite a potential overbought condition indicated by the RSI, the current momentum suggests a continued rally might be on the horizon, potentially testing the psychological resistance level at 1.38. Any corrections in the near term are expected to find support around the 1.36 pivot zone, a key level of interest for traders.

Delving deeper, the 1-hour chart shows continued dominance by buyers, with the pair riding a steep upward trendline and consistently finding support above the 20-hour moving average. For the upward trend to sustain its momentum, the GBP/USD pair needs to surpass the immediate resistance level marked by the last swing high. Failure to achieve this could signal a potential retracement towards the 1.36 pivot zone, further underscored by the 50-hour moving average, presenting an intriguing juncture for traders.

As we navigate these volatile currency markets, it’s pivotal to approach trading with caution. The intricate dance between economic indicators, geopolitical events, and market sentiments can sway currency values, requiring a meticulous analysis and a well-thought-out trading strategy.

In conclusion, the landscape of the GBP/USD currency pair is emblematic of the broader economic and political undercurrents that influence global financial markets. As the UK forges ahead post-Brexit, its economic indicators, along with geopolitical dynamics and policy decisions from major economies like the US, will continue to play a crucial role in shaping the future trajectories of this key currency pair. Investors and traders, thus, remain poised on the edge of their seats, watching these developments unfold, eager to navigate the ebbs and flows of the currency markets.