In the rapidly evolving landscape of digital finance, the introduction of cryptocurrencies has heralded a revolution that echoes the transformative powers of the internet itself. Within this dynamic realm, one cryptocurrency catching the eyes of investors and analysts alike is Sui. As of the latest evaluations, Sui has ascended to become the 13th largest cryptocurrency by market capitalization, nearing the enviable $9 billion mark. This piece does not intend to unravel the complexities of Sui’s technology or its promises of revolutionizing finance, money, and the digital sphere—a narrative familiar to many within the sector since the inception of cryptocurrencies by Satoshi Nakamoto over 17 years ago. Despite the revolutionary potential, the practical use of cryptocurrencies beyond speculative investments remains limited.

This discussion pivots instead to an analysis of market trends and patterns surrounding Sui, specifically through the lens of Elliott Wave theory. The Elliott Wave principle, a method of market analysis that predicts future price movements by identifying crowd psychology manifesting in waves, provides a structured approach to deciphering the seemingly chaotic price actions of cryptocurrencies including Sui.

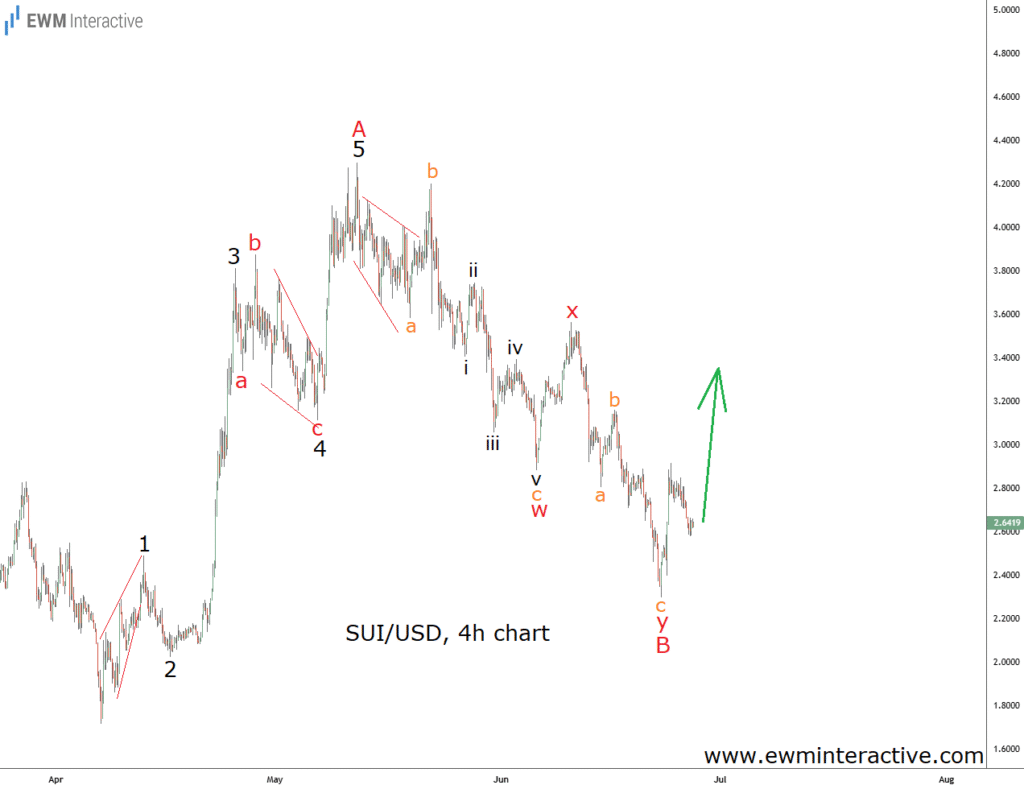

Upon examining Sui’s price movements more closely, particularly through the 4-hour chart, an intriguing pattern emerges. The chart delineates a classic five-wave impulse sequence, a hallmark of Elliott Wave theory. This sequence charts Sui’s price trajectory from an initial value of $1.72 to a peak of $4.30. The price movement is segmented into five distinct waves, labeled 1 through 5, with Wave A encapsulating this entire impulse.

In the initial stages, Wave 1 establishes itself as a leading diagonal, laying the groundwork for what is to come. Wave 4 introduces complexity to the pattern with an a-b-c expanding flat correction, culminating in an ending diagonal in wave ‘c’. The market narratives embedded within these waves communicate the dynamic interplay between optimism and caution among investors.

This impulsive sequence is subsequently succeeded by a double zigzag correction labeled w-x-y in Wave B, which sees the price retract to just under $2.30. This correction phase is critical, acting as a counterbalance to the preceding rally and setting the stage for what Elliott Wave theorists anticipate next: the resumption of the trend in the direction it initially embarked upon.

According to the principles of Elliott Wave theory, the completion of a 5-3 cycle—such as the one identified in Sui’s price movements—presages the continuation of the initial trend. For Sui, this translates to predictions of an impending upward trajectory in what is termed Wave C. The expectation here is not just a return to form but an ascent that surpasses the previous high recorded in Wave A, with analysts setting their sights on targets around the $4.50 mark.

This analytical journey through Sui’s market behavior illustrates not merely the application of Elliott Wave theory to a fresh context but also underscores the speculative dynamics that drive much of the cryptocurrency market today. As investors and enthusiasts look toward these digital assets with a mixture of hope and skepticism, analyses such as these offer a compass in what is often a nebulous financial landscape.

As Sui navigates this predicted bullish phase, the broader implications for the cryptocurrency market, the uptake of blockchain technologies, and the future of digital finance remain to be seen. While the predictions founded on Elliott Wave theory provide a semblance of structure amidst the market’s volatilities, they also remind us of the speculative nature inherent to cryptocurrencies. Nevertheless, as we stand on the threshold of potential expansive growth in digital finance, tokens like Sui invite us to contemplate the possibilities of a future where digital currencies play a central role in our financial systems.

In conclusion, while the journey of Sui and its position within the cryptocurrency market is a reflection of the broader digital finance revolution, it is also a testament to the speculative currents that underpin this burgeoning economy. As market analysts and investors alike watch eagerly for Sui’s next move, the narrative of cryptocurrencies continues to evolve, promising a future as unpredictable as it is exciting.