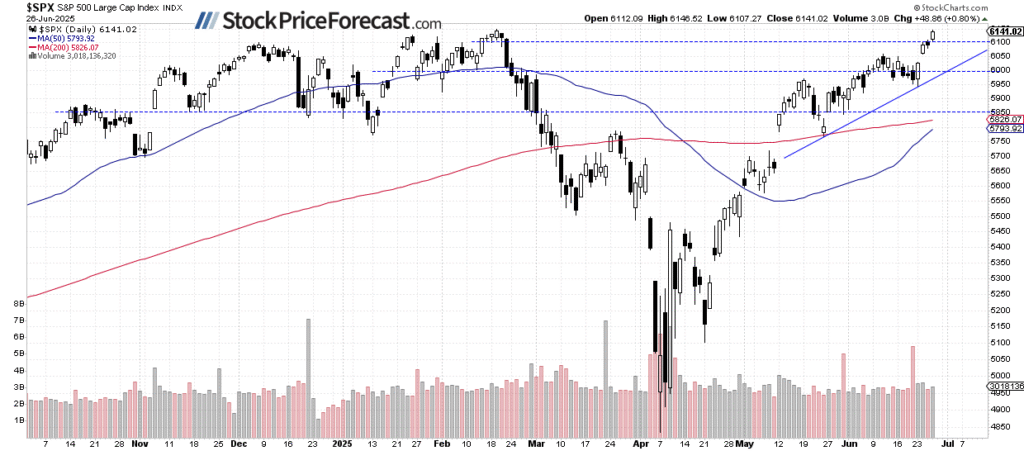

As the market edges closer to its zenith, achieved in February, one might ponder whether the momentum still thrives among investors, propelling the financial indices to new heights. The narrative surrounding stock market advancements continued on Thursday, as the S&P 500 notched up by 0.80%, flirting with the acclaim of its February 19 peak standing at 6,147.43. The undercurrent of optimism was palpable, bolstered significantly by the subsiding geopolitical tensions in the Middle East and a hopeful anticipation of future tariff negotiations.

Predictions for the forthcoming trading sessions hint at a continued ascendancy, with expectations set on a 0.3% increase for the S&P 500, potentially thrusting it into the realm of new historic highs. Recent data echoes a similar sentiment among individual investors; according to Wednesday’s AAII Investor Sentiment Survey, an optimistic outlook is shared by 35.1% of respondents, despite a prevailing bearish sentiment among 40.3%.

The upward trajectory of the S&P 500 seems unhampered, as depicted by its daily chart analysis. This burgeoning climb is not solitary, as the Nasdaq 100 too heralded its superiority by advancing 0.94% to register new record highs at 22,466.99, with pivotal support stationed around the 22,220 mark. Although the ascent is apparent, the index’s progression into what might be considered overbought territory suggests a phase of short-term consolidation might be on the horizon.

An equally noteworthy trend is the descent of the Volatility Index (VIX), which plummeted to a low of 16.11 on Thursday, marking its nadir since February 21. This aligns with the tranquillity the equity markets have recently enjoyed and sends a signal of relatively calmer market conditions ahead. It’s essential to understand that traditionally, a descending VIX symbolizes diminished market fear, while an ascending VIX usually accompanies stock market downturns. However, it’s critical to consider that excessively low VIX levels could precede a market downturn, just as elevated VIX levels could predict market upturns.

In early trading, the S&P 500 futures contract has seen a buoyant uptick, surpassing the 6,200 level and signalling continued market optimism, with support around the 6,150 mark, delineated by recent periods of consolidation. Nevertheless, it’s prudent to acknowledge that markets remain delicately tuned to geopolitical nuances and could exhibit volatility in response to emerging global developments.

As we stand on the cusp of potentially breaking the February 19 record, the S&P 500 seems ready to overturn the lingering shadows of past tariff-related drawbacks. In the immediate future, a sense of caution is advised as the market navigates through potentially overbought territories, which might culminate in a consolidation phase or a minor pullback, despite the absence of explicit bearish indicators.

To encapsulate, the financial markets, especially the S&P 500, appear to be on a relentless pursuit of surpassing their previous high-water mark established in February, buoyed by a confluence of positive factors such as geopolitical easements and optimism over tariff negotiations. The absence of evident bearish signals augurs well for investors, yet the spectre of a forthcoming correction, however mild, cannot be entirely discounted. In summary, it remains a period marked by heightened vigilance and cautious optimism as the markets tread into historically uncharted territories, underpinned by the resilience and fervour of the investor community.