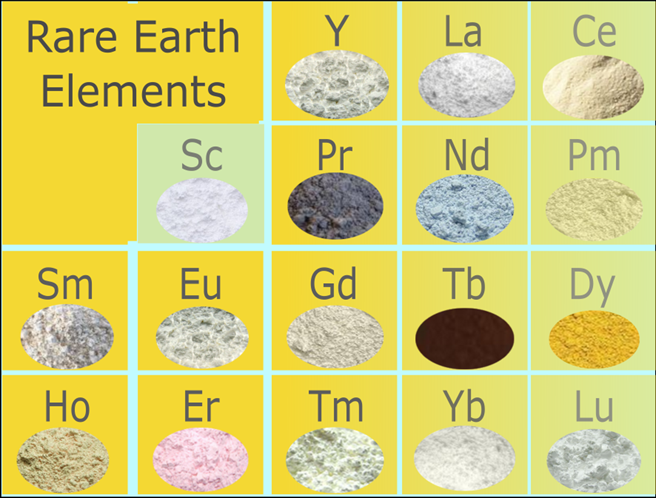

In today’s geopolitical landscape, the significance of rare earth elements (REEs) cannot be overstated. These 17 metallic elements, while seemingly abundant, are notoriously challenging and expensive to mine and refine. Yet, they are absolutely crucial to a myriad of cutting-edge technologies, ranging from renewable energy solutions and artificial intelligence to defence systems and electric vehicles. At the heart of the global contention for these critical materials lies China’s commanding hold over their supply chain, a strategic advantage that Beijing has adeptly woven into its broader contest for global influence. This dominance over the REEs, controlling approximately 70% of the world’s production and nearly 90% of its refining capacity, has transformed these elements into a formidable geopolitical bargaining chip.

### The Strategic Value of Rare Earths

The utilitarian worth of REEs spans several high-value sectors. Elements like neodymium, praseodymium, dysprosium, and terbium are indispensable for the manufacture of high-performance permanent magnets; these magnets are not only central to the functioning of electric vehicle motors and wind turbines but are also vital for military and aerospace applications due to their superior performance under extreme conditions. The importance of these materials extends into the very fabric of modern militaries, bolstering the capabilities of advanced fighter jets, missile defence systems, and stealth technologies through specialized rare earth components.

Moreover, the burgeoning demand for renewable energy sources has significantly amplified the need for these materials. According to the International Energy Agency (IEA), the call for REEs in clean energy technologies is projected to quadruple by 2040, propelled by ambitious global climate targets. Beyond military and energy applications, rare earths also play critical roles in consumer electronics, medical technologies, and emerging sectors like 5G communications and quantum computing.

This strategic indispensability paired with the scarcity of accessible and economically viable deposits places an asymmetric risk on economies that are heavily reliant on these resources. The development of alternative supply sources is a complex, time-intensive endeavour, fraught with regulatory, financial, and technical hurdles. Consequently, the global supply chain for REEs is incredibly fragile, making it susceptible to disruptions, price fluctuations, and geopolitical maneuvers.

### China’s Ascendancy in the Rare Earths Game

China’s emergence as the pre-eminent force in the rare earth market underscores a strategic vision that was set in motion decades ago. In the late 20th century, while the West transitioned towards service-oriented economies and outsourced heavy production, China recognized the intrinsic value of REEs and embarked on a comprehensive strategy to dominate their supply chain. This included heavy investment in mining, refining, and technological development, allowing China to rapidly scale up production while other nations curtailed their rare earth industries due to environmental concerns and economic factors.

China’s consolidation of the rare earth industry has provided it with a dual advantage. Firstly, it controls a significant portion of the raw material outputs necessary for advanced technological manufacturing. Secondly, and perhaps more critically, it possesses the lion’s share of global refining capacity – a stage of production that requires extensive expertise and technological know-how.

### Global Repercussions and the Quest for Equilibrium

The West finds itself in a precarious position due to its reliance on China for these essential materials. High-profile incidents, such as China’s temporary restriction of rare earth exports to Japan in 2010, have exposed the vulnerabilities of the current supply chain model, leading to price surges and market instability. Worries extend beyond mere supply disruptions; concerns are growing over China’s regulatory and financial tactics, which include demanding sensitive commercial information from firms operating within its borders and leveraging investments in foreign rare earth projects to expand its influence throughout the global supply chain.

Yet, China’s dominance is not unassailable. The strategic leveraging of rare earths has prompted Western nations to reconsider their reliance on external sources. Initiatives to develop domestic mining, refining capabilities, and recycling technologies are gaining momentum, signalling a potential shift towards greater supply chain autonomy. While these efforts may take years to bear fruit, they represent a crucial step towards mitigating the geopolitical leverage that rare earths currently afford Beijing.

### Conclusion

The saga of rare earth elements epitomises the intricate interplay of economics, technology, and geopolitics in the 21st century. China’s strategic command over these materials has underscored their value as more than mere industrial commodities but as pivotal instruments of economic statecraft. However, the global race for rare earths is not just about securing resources; it’s about fostering innovation, sustainability, and resilience in the face of geopolitical uncertainties. As nations strive for greater independence from external control over critical materials, the rare earths narrative remains a dynamic testament to the challenges and opportunities that define our modern geopolitical landscape.