In a notable uplift of financial spirits on Wall Street, the market jubilantly ascended to new peaks last Friday, with keen anticipation of a trade agreement fuelling the investment community’s penchant for risk. This shift in sentiment was further bolstered by economic indicators that seemed to pave the way for the Federal Reserve to implement interest rate reductions.

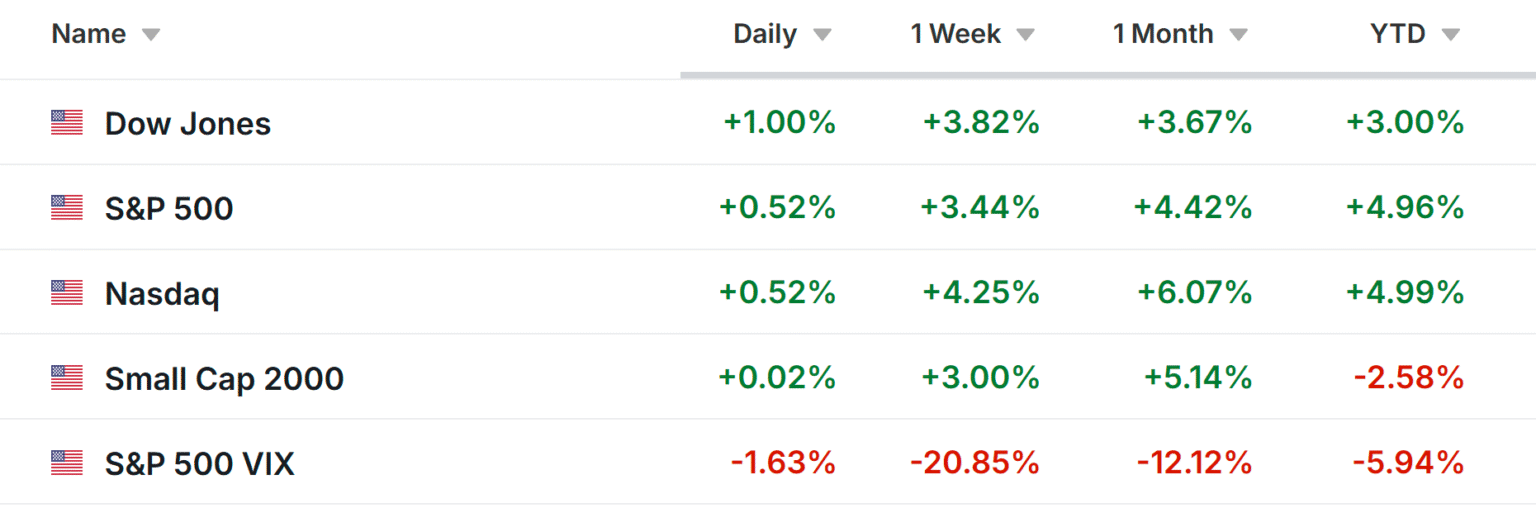

The triumvirate of major US stock indices – the S&P 500, the Nasdaq, and the Dow Jones Industrial Average – collectively enjoyed a fruitful week. The S&P 500 surged by 3.4%, the Nasdaq, known for its technological slant, leaped by 4.3%, and the Dow Jones, comprising 30 significant stocks, climbed by 3.8%.

The upcoming week, albeit abbreviated by the upcoming Independence Day holiday, promised a flurry of activity against the backdrop of President Trump’s ongoing trade negotiations. The investors stood on the brink of a week teeming with critical economic forecasts, inflation projections, interest rate speculations, and insight into corporate earnings.

The US stock markets prepared for an early closure at 1:00 PM ET on Thursday and would not open on Friday, marking the celebration of the Fourth of July. A highlight of the week’s calendar was the anticipated release of the US employment report for June, speculated to reflect the addition of 120,000 new jobs, with the unemployment rate possibly ticking upwards to 4.3%.

Compounding the economic anticipation, a slate of remarks from Federal Reserve officials, including Chairman Jerome Powell, was on the horizon. Market participants had already factored in a high probability of a Fed rate cut come September, with a smaller faction holding out hope for such a move as early as July.

In terms of earnings, while the season was nearly at its close, eyes were turned towards updates from notable companies, including Constellation Brands and Progress Software.

A focus for investors in the following session would likely pivot around two significant stocks, Tesla for potential buying opportunities, and Constellation Brands, which seemed poised for a downturn.

Tesla, the vanguard of electric vehicles, was set to unveil its global vehicle delivery and production statistics for the second quarter. Given the conservative analyst forecasts that trailed behind the official consensus, Tesla appeared well-positioned for outperforming expectations. The anticipation of this reveal sparkled amid speculation that Tesla could surpass the more cautious delivery estimates set by some analysts.

As Tesla continued to dominate the electric vehicle market, capturing significant shares both in the U.S. and China, investors keenly awaited updates on the company’s production figures and energy segment development.

Shifting the gaze to Constellation Brands, the company, a leading name in the beer, wine, and spirits industry, prepared to share its fiscal first-quarter earnings amidst challenging market conditions. Macroeconomic pressures, stagnating growth, and tariff concerns particularly plagued its wine and spirits segment. Analyst pessimism reflected in downward earnings revisions hinted at tough times ahead.

While the beer segment had been Constellation Brand’s stronghold, shifting consumer preferences towards new-age beverages posed a threat. The forthcoming earnings update was crucial, with analysts bracing for potential volatility in its stock price.

Investment enthusiasts and seasoned traders alike weighed these developments, keenly aware of the implications for their portfolios. With the market’s pulse quickening in anticipation of these fiscal disclosures, the investment community remained alert to position themselves advantageously in a landscape marked by pivotal economic and corporate revelations.

This nuanced canvas of market dynamics underscored the essence of staying informed and agile, leveraging platforms like InvestingPro for incisive analysis and insights, thereby navigating the ebb and flow of financial markets with informed conviction.

In a world where investment decisions pivot on the axis of timely and accurate information, the unfolding week promised both challenges and opportunities, encapsulating the perennial dance of risk and reward that defines the stock market’s vibrant landscape.