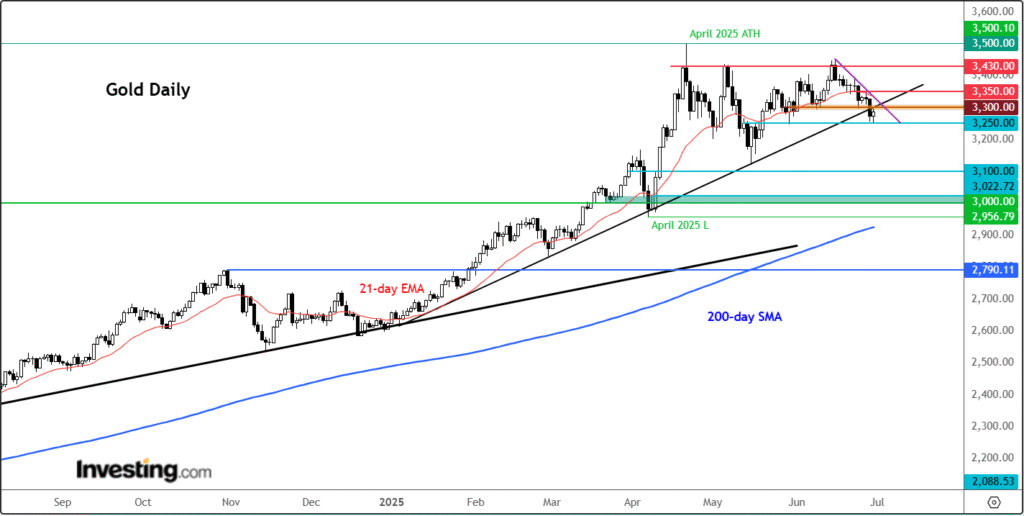

In recent times, the financial market has witnessed a noticeable fluctuation in gold prices, a trend that has captivated traders and investors alike. Over the past few weeks, the yellow metal’s value has experienced a downturn after it failed to surpass previously set benchmarks, despite a resurgence of selling activities. Last week specifically saw a 2.8% decline in gold prices, following a significant drop through the $3,300 support level that Friday. While there was a slight recovery at the onset of this week, the future trajectory of gold remains uncertain amidst the fading momentum of bullish investors.

Historically, gold has been regarded as a haven asset, offering investors a safe harbour during geopolitical and economic uncertainties. The metal closed the previous month on a stable note, similar to its performance in May, a stability attributed largely to such qualities. However, the current stagnation in price growth can be linked to multiple factors. Prominent among these is the ‘profit-taking’ strategy adopted by some investors, but more crucially, the diminished demand for haven assets is a direct consequence of the calming tensions in the Middle East conflict.

Despite the long-term positive outlook, the near-term prospect for gold appears to be leaning towards further weakness. This outlook is particularly likely if the equity markets continue to rise and gold remains below the significant bullish trend line, which was breached around the $3,295 mark.

### Analyzing the Gold Market’s Dynamics

Breaking down the recent market movements, gold has notably breached its 2025 bullish trend line at approximately the $3,295 area. This level now acts as a pivotal point of potential resistance—a keen interest for market watchers today. Should gold close significantly above this trend line, it could signal a false breakdown, trapping bears in their positions. Such a scenario, if followed by surpassing the recent local high of $3,350, could herald the onset of renewed bullish momentum, effectively nullifying the bearish downturn.

If gold fails to rise above the broken trend line, early July could see a deeper correction. Potential levels of interest in such a downturn include the $3,250 mark, representing today’s low and horizontal support; the $3,200 level as the next significant round figure; and $3,167, which marked the early April high before being overtaken. Beyond these, the $3,000 mark stands as a significant psychological barrier, posing the question of whether gold will experience correction to such depths amid the loss of bullish momentum and the breaking of the bullish trend line.

### The Impact of Global Events on Gold Prices

The recent de-escalation of tensions between Israel and Iran has led investors to pivot back towards the more volatile tech sector, propelling equity indices like the Nasdaq and the S&P 500 to new heights. This shift has directly impacted the allure of gold. Despite a weakening dollar, the diminished demand for haven assets has prevented gold from benefiting from the dollar’s downturn. However, this retreat in gold prices might not necessarily be adverse, providing an opportunity for the long-term technical overbought conditions on higher timeframes to dissipate, potentially setting the stage for gold’s resurgence under more favourable macroeconomic conditions.

This week, the market’s attention will be riveted on key US economic indicators. While the outcome of these events might traditionally influence gold prices, the absence of a significant escalation in the Middle East could mean that gold may find it challenging to rally based solely on these data or events. Yet, the possibility of surprises always exists, with trade talk progress (or lack thereof) potentially serving as a significant catalyst for gold leading up to the crucial July 9 deadline.

### Conclusion

Navigating the complex dynamics of the gold market requires adept understanding and strategic foresight. With this week poised to unfold a series of crucial macroeconomic events from the US, alongside key discussions at the ECB Forum on Central Banking, every twist and turn could significantly impact the direction of gold prices. As investors and traders grapple with these uncertainties, leveraging sophisticated analytical tools like InvestingPro could provide invaluable insights, enabling them to make informed decisions amidst a challenging market landscape.

In a realm where investment decisions carry high stakes, keeping abreast of the market trend and integrating expert analysis can illuminate the path to successful investment strategies. As the gold market teeters on a delicate balance, the forthcoming economic developments will undoubtedly play a pivotal role in shaping its trajectory, underscoring the essence of strategic vigilance and informed decision-making in the adventurous journey of investing.