In recent weeks, the financial markets have highlighted a distinct fluctuation in commodities, with particular focus on the gold market. Despite an initial positive outlook, gold prices have experienced a downturn, not managing to strike new peaks despite a surge in selling. The past week saw a notable drop of 2.8% in gold prices, descending below the support level of $3,300, particularly after Friday’s trading session. The commencement of this week witnessed a slight rebound in gold prices, yet the long-term direction remains uncertain amid the loss of bullish impetus.

For the month, gold appears poised to conclude with little to no gain, mirroring its performance in May, which also closed unchanged. This stagnation in momentum can be attributed to various factors, including profit-taking activities. Most significantly, however, the reduced appetite for safe-haven assets has been driven by the unexpected de-escalation of tensions in the Middle East, diminishing the urgent demand for gold.

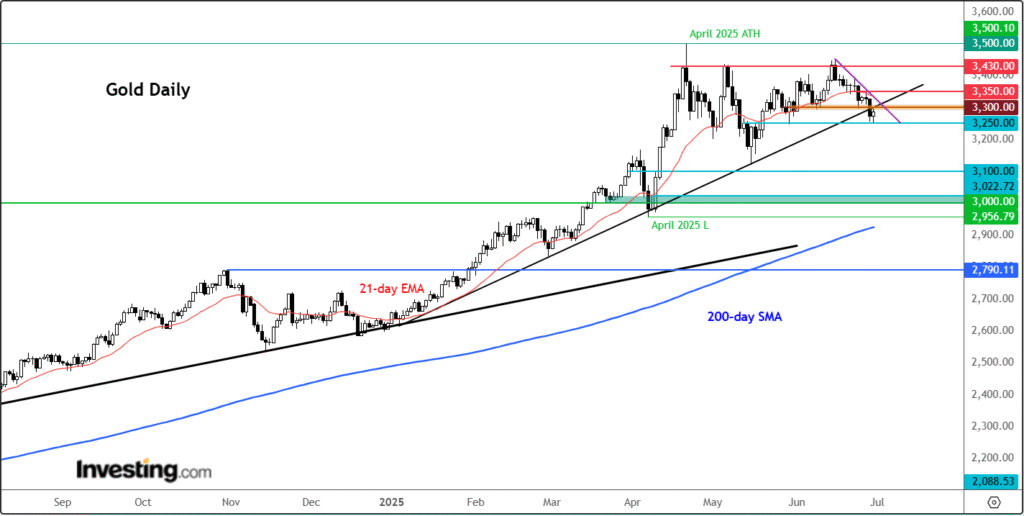

Despite the enduring positive long-term outlook for gold, near-term prospects suggest potential softening. Particularly if equity markets continue to ascend, and gold remains beneath crucial bullish trendline indicators, notably the one it breached around the $3,295 mark last Friday.

A pivotal moment occurred when gold breached a major bullish trendline established since 2025, around the $3,295 area. This breach is now a critical focal point, suggesting potential resistance and guiding market watchers on the likely direction of gold prices going forward.

Should gold conclude trading sessions above this trendline, it would suggest a negation of the breakdown—signaling a bear trap that could herald a bullish reversal. Validation of this reversal would be reinforced by surpassing the recent high of $3,350, potentially catalyzing a resurgence in bullish momentum. Conversely, should gold linger below this critical trendline, a deeper corrective phase might be anticipated, notably in the early days of July. Key levels to monitor in this scenario include the $3,250 mark, today’s low offering horizontal support, followed by $3,200, and then $3,167—the early April peak which was eventually overtaken. Beyond these, the significant support zone around $3,000 could be crucial—a psychologically significant level for market participants.

The backdrop of these gold price dynamics is the broader financial market, where stocks have seen rallying, particularly affecting gold’s allure. Following a reduction in the Israel-Iran tensions, investors have gravitated back to the high-growth tech sector, pushing indices like the Nasdaq and S&P 500 to record highs. This shift further dampened the demand for gold as a safe haven, especially as the dollar’s decline did not translate into an upturn for gold prices.

The forthcoming week’s economic updates from the US will be closely watched, potentially influencing gold’s trajectory. Although Middle East tensions have subsided, the macroeconomic calendar holds potential surprises that could sway gold prices. Key events include the ECB Forum on Central Banking, the US JOLTS Job Openings report, and the highly anticipated US Non-Farm Payrolls data. These updates will not only provide insights into the health of the global economy but could also offer directional cues for gold investors.

In this complex and ever-evolving financial landscape, tools and platforms like InvestingPro offer invaluable resources for investors and traders, providing a comprehensive analysis, AI-driven stock picks, and insights into market valuations. Such tools are instrumental in navigating market volatility, allowing individuals to make informed decisions amidst challenging market conditions.

In conclusion, the gold market currently stands at a crossroads, influenced by a mix of geopolitical developments, market sentiment, and macroeconomic indicators. While the long-term outlook remains optimistic, short-term movements carry significant uncertainty. Investors and market watchers would do well to keep a close eye on the unfolding economic landscape and leverage advanced analytical tools to guide their investment strategies. As the global economy continues to navigate through these turbulent times, the timeless allure of gold remains a focal point of interest, speculation, and strategic investment.