In recent developments, the financial world observed a significant reduction in the price of gold, with it descending to $3,280 per troy ounce as of Monday, nearing its monthly trough. This downward trend in gold prices is reflective of a declining interest in assets traditionally seen as safe havens, spurred by a cooling of geopolitical tensions and a burgeoning optimism regarding progress in international trade dealings.

The Easing of Geopolitical Tensions

In the geopolitical theatre, particularly in the Middle East, a fragile yet persisting ceasefire endures between Israel and Iran, mitigating concerns over the possibility of renewed regional conflict. This relative stability in a historically volatile region has contributed to a shift in market sentiments.

Moreover, the landscape of global trade has seen encouraging developments. Last week, US President Donald Trump made headlines with the announcement of a trade agreement with China, signifying a potential thaw in the trade war that has gripped the world’s two largest economies. In addition to this, a significant deal with India is on the horizon. Furthermore, there is talk of the United States closing in on agreements with Mexico and Vietnam, with ongoing negotiations with Japan and several other nations suggesting a possible rejuvenation of global trade relations. These advancements have helped alleviate fears of a worsening in global trade dynamics, further diminishing the allure of gold as a safe-haven asset.

Shift of Focus to US Economic Data

Investors are now redirecting their attention towards crucial US economic indicators slated for release in the coming week. These datasets are expected to shed light on the trajectory of the Federal Reserve’s monetary policy decisions, potentially influencing investor strategies and market movements.

Technical Analysis of XAU/USD

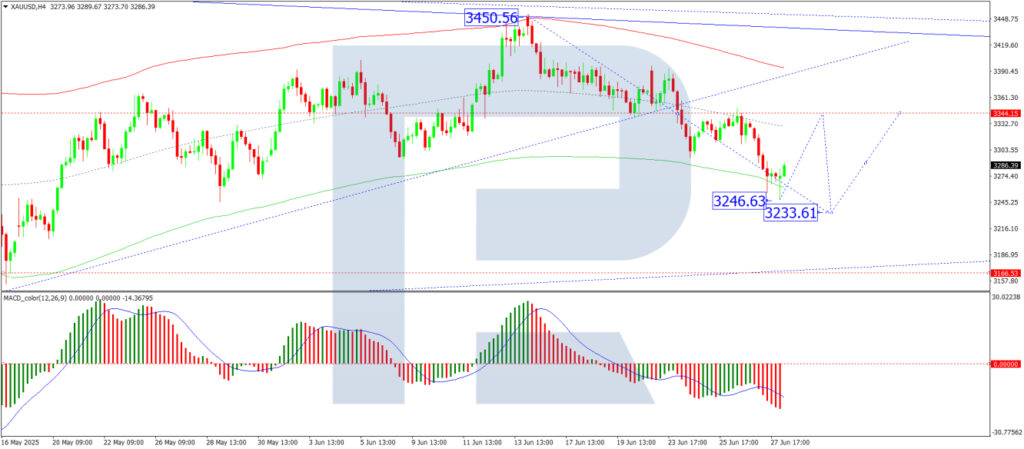

A granular analysis of gold prices against the US dollar reveals interesting insights. On the H4 chart, gold prices have broken below the $3,344 mark, hitting a local low of $3,248. Anticipations of a corrective bounce towards $3,344 are in the air, which, if followed by a further decrease, might see prices touching $3,233. The MACD indicator corroborates this scenario, with its signal line located below zero and demonstrating a strong downward momentum, hinting at sustained bearish tendencies.

Conversely, on the H1 chart, a corrective trend upwards towards $3,297 is underway, with the potential for a subsequent decrease to $3,270. The market seems to be consolidating around the $3,270 mark, suggesting that should an upward breakout occur, we could witness a correction extending to $3,319, with possibilities of continuing the upward momentum towards $3,344. The Stochastic oscillator supports this outlook, with its signal line breaching the 50 mark and making a sharp ascent towards 80, indicating an upward momentum in the short-term correction phase.

Conclusion

Amid easing geopolitical risks and an uptick in trade optimism, gold finds its safe-haven appeal waning. Technical indicators are forecasting a possible correction towards $3,344, before a continued downward trajectory potentially reaching $3,233. In the short run, market sentiments are likely to be influenced by imminent US employment data and its implications on the Federal Reserve’s policy directions.

As the financial landscape navigates through these developments, the future of gold prices hangs in a delicate balance, influenced by geopolitical, trade, and economic indicators. Investors and market observers alike remain vigilant, prepared to respond to the unfolding economic narratives that shape global financial markets.

Disclaimer: The views expressed in this article are based on the author’s analysis and do not constitute trading advice. RoboForex assumes no liability for trading outcomes based on these recommendations and analyses.