As we step into the latter half of 2025, the financial markets are navigating through a maze of complexities that challenge even the most seasoned analysts and investors. The landscape is particularly intricate for currency traders, especially those monitoring the USD/JPY exchange rate – a pair that once moved in harmony with U.S.–Japan interest rate differentials and broader risk sentiment but now dances to a different tune.

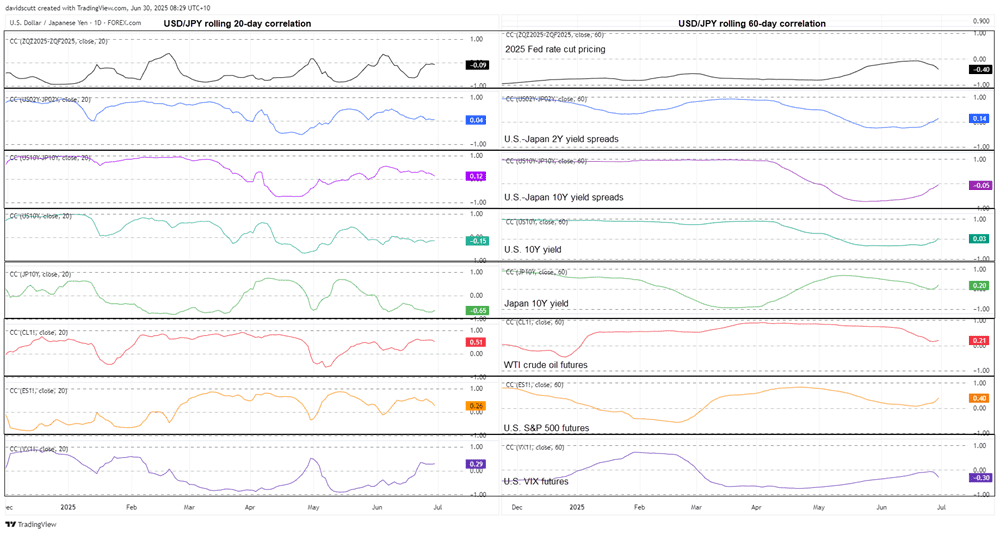

The transformation in the USD/JPY dynamics is largely attributable to a breakdown in traditionally strong correlations, a phenomenon that signals a shift in the factors driving market movements. Previously, variables such as U.S. Treasury yields, yield differentials, and risk appetite metrics could reliably predict the pair’s direction. However, recent data reveal that these relationships have significantly weakened, if not disappeared. Factors such as the and yields, traditionally seen as barometers for inflation and demand dynamics, are now having minimal impact on the USD/JPY trends.

This change reflects a broader narrative where political concerns and the ramifications of tariff policies are emerging as pivotal drivers. The flashpoint was the imposition of reciprocal tariffs on U.S. goods, marking a turning point in how the markets viewed long-term fiscal stability and growth prospects. The escalation in tariffs, particularly noticeable around U.S. ‘Liberation Day’ in early April, has precipitated a reevaluation of risks, with longer-dated U.S. Treasury yields experiencing a rise. This shift implies an increase in the term premium – the extra yield investors demand to compensate for holding bonds over longer periods due to uncertainties about inflation, fiscal policy, and economic growth.

Despite an uptick in term premium, the U.S. dollar has not benefitted. Instead, it has faltered amid growing reservations among offshore investors about America’s fiscal path and concerns over governance and trade policies under the Trump administration. The changing landscape is starkly illustrated in the trajectories of real yields on U.S. Treasuries, with investors now demanding higher returns for assuming long-term risks—a reflection of the market’s reaction not just to fiscal slippage but also to deeper structural uncertainties.

Amid these convolutions, the Federal Reserve faces a murky horizon. The front end of the yield curve has seen a decline, driven by softer inflation readings and uneven consumer data, leading to a modest dovish shift in expectations for the Fed’s interest rate path. However, overshadowing these economic indicators is the specter of political interference, hinted at by reports suggesting President Trump might pre-emptively name a successor to Fed Chair Jerome Powell. This development has the potential to skew the independence of monetary policy further, underlining the significant influence political dynamics exert on market sentiment and expectations.

In Japan, the Bank of Japan (BoJ) finds itself at a crossroads. Despite conditions that would typically justify a rate hike—firm inflation pressures and robust domestic wage growth—the cloud of trade uncertainties casts a long shadow. The ongoing saga of tariffs, especially the 25% tariffs on Japanese auto imports, poses a critical hurdle. The future policy direction of the BoJ thus hinges on the potential resolution of trade disputes with the U.S., which could either pave the way for further normalization or heighten the cautious stance due to fears of a global slowdown.

The story of the U.S. Dollar Index (DXY) encapsulates the broader narrative of uncertainty and decline. Since the reciprocal tariff announcements, the DXY has charted a course of continuous weakness, a trend that is likely to persist into H2 2025. The technical indicators underscore a bearish outlook, with both the RSI and MACD pointing towards sustained downside momentum.

Turning our gaze to the technical outlook for USD/JPY, the pair has exhibited resilience amid broader pressure on the dollar, with key support levels repelling bearish attempts. However, the path ahead remains precarious, with downside risks looming large. A weekly close below the critical 140.25 level would escalate the likelihood of a steeper decline, underscoring the fragile equilibrium that currently prevails.

In summary, the USD/JPY pair’s journey through H2 2025 is fraught with challenges, with political developments, tariff policies, and the nuanced shifts in market sentiment and expectations acting as key plot points. As traders navigate these turbulent waters, the need for vigilance and adaptability has never been greater, with the evolving landscape promising to test the mettle of even the most seasoned market participants.