In an economic landscape not witnessed for generations, the onset of the current year has emerged as arguably the most challenging period for the United States in recent memory. The situation, marred by financial unease and strategic missteps, threatens to deteriorate further as the months progress. Central to this unsettling epoch is the administration under President Donald Trump, which has unambiguously revealed its strategic inclinations and policy directives in the face of global economic frictions.

The crux of the Trump administration’s economic blueprint pivots around the conviction that the strength of the US Dollar (USD) has been excessively magnified, attributing this anomaly to decades of purported exploitation by international partners. The stance suggests that America has been at the losing end of global trade dynamics, necessitated by an overvalued currency that renders its goods more expensive and less competitive on the global stage. To rectify this imbalance, the administration proposes a trifecta of remedies.

The first proposition calls for a reduction in domestic consumption within the United States to lower the demand for imports. The second strategy advocates for a role reversal, urging trading partners to embark on expansive fiscal policies that bolster their domestic demand. Finally, the third and most contentious approach involves a unilateral effort to weaken the USD. This strategy has materialised through a combination of tariffs, challenges to the Federal Reserve’s independence, and the proliferation of uncertainty among international investors.

Achieving a rebalance through the first two options presents considerable challenges, leading to the administration’s predominant reliance on manipulating the dollar’s strength. This approach, however, raises fundamental questions about the desirable extent of devaluation needed for the USD to effectively serve as the lynchpin in this rebalancing act.

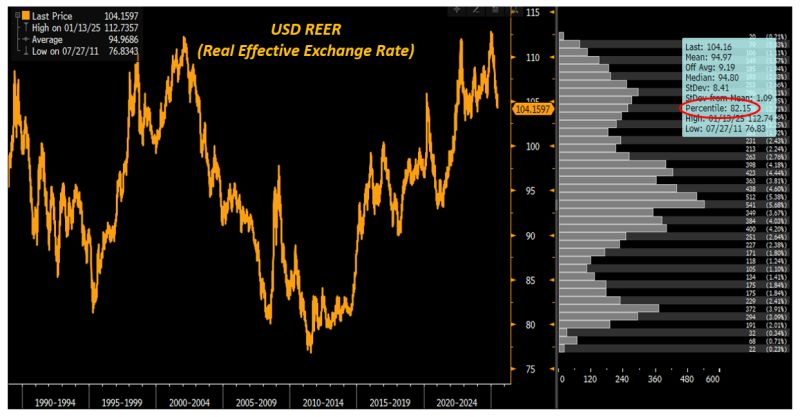

A pivotal tool in assessing the fair value of the USD in this context is the Real Effective Exchange Rate (REER). The REER examines the value of the USD against a basket of major currencies, adjusted for inflation differences. This metric is vital for understanding how the value of the USD compares on a truly global scale, distilling down to what economists refer to as ‘Purchasing Power Parity’ and the ‘Law of One Price’. Both principles posit a scenario where the price of goods should ideally equilibrate across borders, absent of trade barriers and currency valuation disparities.

Recent analyses suggest that the USD is overvalued by more than 10% according to the REER. This overvaluation carries significant implications for trade dynamics and economic competitiveness on a global scale. As the debate rages on about the future trajectory of the USD, investors and financial strategists are tasked with a critical challenge: navigating the potential ramifications of this currency rebalancing on their portfolios.

This unfolding narrative is more than a mere economic policy debate; it represents a historic juncture in the global financial system. The journey toward a recalibration of the United States’ economic standing, vis-à-vis its currency strength, is fraught with complexities and uncertainties. Compelling arguments on both sides of the aisle underscore the delicate balancing act required in steering the economy towards a more competitive and equitable future.

For enthusiasts and keen observers of macroeconomic trends, this episode serves as a riveting case study. It draws attention not only to the strategies employed by national governments to assert their stance in the global marketplace but also to the intricate mechanisms of global trade and finance. As the world keenly watches the unfolding events, the narratives around currency value, trade policies, and economic sovereignty continue to evolve, setting the stage for a new chapter in the annals of global economic history.

For those interested in delving deeper into these macroeconomic discussions and understanding the implications at a grassroot level, numerous online platforms and communities offer insightful analyses and observations. Among these, The Macro Compass stands out as a vibrant gathering space for macro investors, asset allocators, and hedge funds. This platform offers varying tiers of subscriptions tailored to meet the diverse needs and interests of its audience, ensuring that every participant finds value in their engagement with the global economic discourse.

As we navigate through these uncertain times, the conversation around the USD’s valuation and the broader economic policies of nations remains crucial. It prompts a reassessment of our understanding of currency strength, trade dynamics, and their overarching impact on global economic stability.