In the ever-evolving spectacle of global economics and technological advancements, we find ourselves at a juncture where the fusion of finance and innovation is reshaping the landscape of markets and industries. One such arena that has been a focal point of interest and speculation over the past week is the financial markets, highlighted by the resurgence of Nvidia in the pole position of market capitalizations globally, the steady ascendancy of ETFs, and the fierce competition in the race to dominate the AI sector, led purportedly by Google.

### Nvidia’s Triumphant Return to the Summit

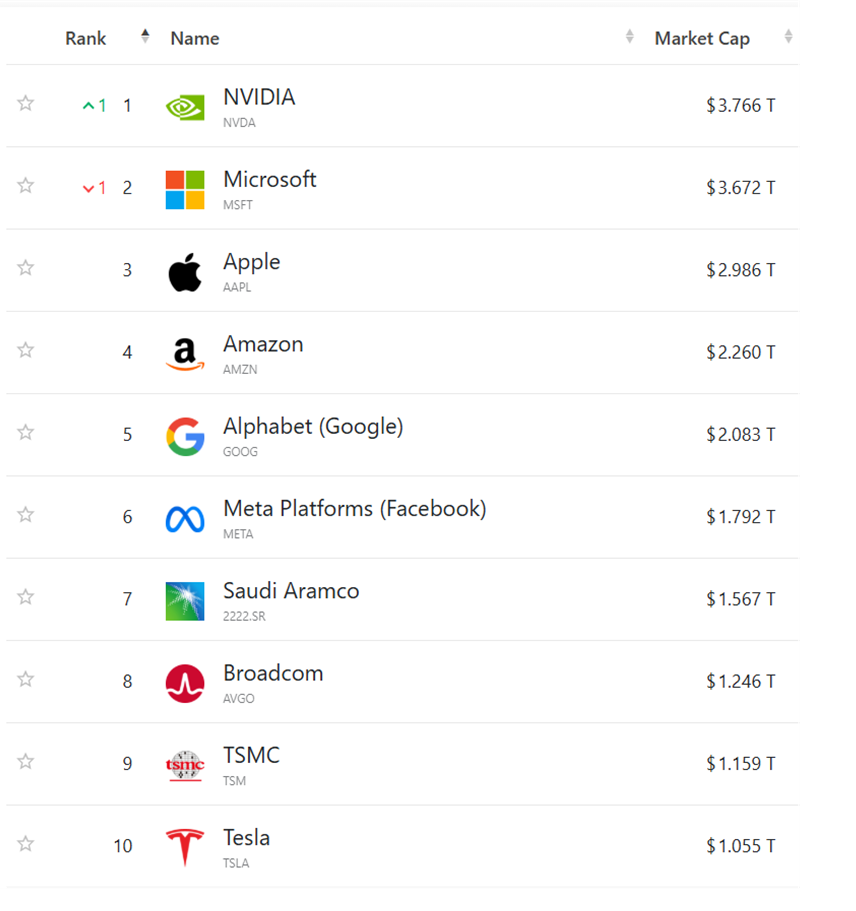

As of the latest market evaluations, Nvidia has stunningly recaptured the throne, surpassing Microsoft to become the planet’s most valuable company by market capitalization. This notable achievement underscores the predominance of American corporations in the global economic hierarchy, with 8 out of the 10 biggest enterprises, in terms of market value, being rooted in the United States.

Nvidia’s resurgence as a titan not only reflects its innovation and leadership within the semiconductor and AI sectors but also points to the broader implications of technology’s role in the contemporary economy.

### The Ascendancy of ETFs

Exchange-Traded Funds (ETFs) continue to captivate the attention of investors, drawn by their liquidity, diversity, and efficiency. Recent data indicates a remarkable milestone, with 13 ETFs now boasting assets under management exceeding the $100 billion mark. This is indicative of the growing appeal of ETFs as investment vehicles, a trend that mirrors the accumulation of wealth within a selection of ‘mega-cap’ stocks that lead their respective markets.

The concentration of such significant assets within a handful of ETFs raises intriguing questions about market dynamics, investment strategies, and the enduring appeal of these financial instruments amid changing economic landscapes.

### Google’s Alleged AI Supremacy

In the competitive world of artificial intelligence, Google reportedly stands at the forefront, according to recent speculations and market sentiments. The tech behemoth’s reputed edge is attributed to its unrivalled repository of training data, the prowess of its Tensor Processing Units (TPU), and a formidable team dedicated to research and development.

TPUs, Google’s bespoke silicon chips, are engineered specifically to boost the performance of AI workloads, enabling swifter, more efficient training, and deployment of expansive models unlike conventional computing hardware. Coupled with the comprehensive suite of services offered via Google Cloud Platform (GCP), Google is poised not only to lead but also possibly redefine the AI frontier.

### Semiconductors: The “New Oil”?

Drawing parallels from history, there’s a burgeoning discourse around semiconductors, touted as the “new oil” of the global economy. This analogy hinges on the presumption that if semiconductors ascend to a status akin to that of oil in its heyday, we might only be witnessing the commencement of an era where the importance of chips eclipses traditional energy sources in economic significance.

The notion that semiconductors could dramatically reshape economic landscapes just as oil did several decades ago is both intriguing and plausible, given the critical role they play in everything from consumer electronics to state-of-the-art AI technologies.

### A New Metric: The Porsche-to-Gold Ratio

An offbeat yet telling economic indicator is the Porsche-to-Gold ratio, tracing how the value of a Porsche 911 has evolved in comparison to gold since 1965. This metric intriguingly reveals the dynamics of luxury goods valuation against a universally recognized store of value, gold. The findings? In terms of gold, a Porsche is significantly more affordable today than it was in the 1960s, a testament to gold’s enduring purchasing power.

### Speculations on the Next Fed Chair

Looking ahead, the financial community is awash with speculation regarding the next chair of the Federal Reserve, slated for announcement in 2025. With candidates being mooted and odds being assigned to their potential appointment, the anticipation underscores the critical role of the Fed in steering the U.S. and, by extension, the global economy.

In sum, the recent developments across the financial and technological realms provide a fascinating glimpse into the forces shaping the future. From Nvidia’s market cap triumph and the ETF surge to Google’s AI ambitions, these narratives are not just stories of individual companies or sectors. They are threads in the larger tapestry of our evolving economic landscape, emblematic of an era where technology and finance are increasingly intertwined, driving us towards a future teeming with possibility and uncertainty in equal measure.