In the landscape of global finance, few currencies have played such a captivating role in recent times as the Swiss franc. As we stand on the cusp of a potentially significant development in U.S. trade policy this Wednesday, it’s crucial to revisit the events that have led the Swiss franc to its current position of strength. The tale of the Swiss franc—often regarded as a sanctuary during financial tempests—unfolds against a backdrop of international trade disputes and economic strategies, underlining the intricacies of modern-day currency warfare.

The Swiss franc, historically perceived as a bastion of stability amidst global economic fluctuations, has recently reached near zenith levels against major currencies such as the euro and the U.S. dollar. This phenomenon is not merely a consequence of fleeting market sentiments; rather, it’s deeply rooted in April’s market unrest, notably marked by the U.S.’s ‘Liberation Day’ tariffs, which upheaved asset markets. Investors, drawing lessons from this episode, increasingly view the Swiss franc as a hedge, a bulwark against unforeseen market vicissitudes.

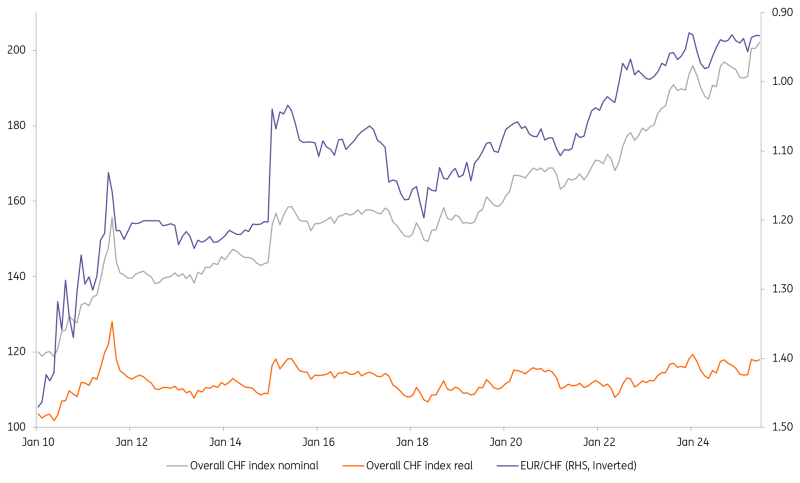

A closer examination of the Swiss franc’s valuation reveals its multifaceted strength. Various metrics, including nominal and trade-weighted indices along with inflation-adjusted (‘real’) values, paint a picture of a currency that has regained its robustness. This is in stark contrast to the 2022-2023 period when the Swiss National Bank (SNB), wary of an undervalued franc stirring inflation, had offloaded over CHF160 billion in foreign exchange reserves to buoy its currency.

However, the current economic tableau is markedly different. The Swiss franc’s resurgence places the SNB in a delicate position, grappling with near-zero inflation rates. Charlotte de Montpellier notes the significant role import prices—now made cheaper by a stronger franc—play in the Swiss inflation matrix. For a nation that predicates its economic health heavily on the exchange rate due to its ‘small and open’ economic structure, the SNB’s silence on the franc’s ascent in recent monetary policy discussions is telling. Statements hinting at the Swiss franc’s valuation or the SNB’s readiness for intervention were conspicuously missing, perhaps a testament to the current geopolitical dynamics.

Switzerland finds itself in the labyrinth of international diplomacy, striving to skirt ‘Liberation Day’ tariff escalations while safeguarding its pharmaceutical industry, a crucial export component. Amid these negotiations, any overt maneuver to devalue its currency could be frowned upon, especially under the watchful eyes of the U.S., with whom it aims to thaw trade tensions.

Analyzing the SNB’s potential courses of action provides insights into the complexity of their predicament. Historically, Switzerland has been under scrutiny from the U.S. Treasury for its currency practices, making direct intervention—a once potent tool in its arsenal—a politically sensitive option. The SNB’s quarterly disclosures of its foreign exchange activities underscore the delicateness of its position on the global stage.

Interest rate adjustments present another conundrum. While there’s speculation around the SNB reverting to negative interest rates, the booming property market and the European Central Bank’s monetary policy trajectory complicate decisions. An unconventional tweak—altering the charge on certain bank deposits—emerges as a nuanced strategy to mitigate the Swiss franc’s appreciation, reflective of the SNB’s agility in navigating through economic and political minefields.

As we peer into the future, the franc’s trajectory against the euro remains fraught with uncertainty. The intertwined fates of the SNB’s strategic choices and the broader international investment climate signal a period of sustained pressure on the EUR/CHF pair. Prospects of fiscal stimuli fuelling growth in the Eurozone, and eventual shifts in ECB’s interest rate policies, offer a glimmer of optimism for a rebalanced EUR/CHF landscape towards late 2026.

This narrative underscores the Swiss franc’s pivotal role at the juncture of international finance, economic policy, and diplomatic engagements. As market participants keenly await developments on the U.S. trade policy front, the Swiss franc’s saga continues to epitomize the interplay of economics and geopolitics, serving as a testament to the enduring allure and complexities of safe-haven currencies in uncertain times.