In the realm of financial markets and precious commodities, the tale of gold’s value presents a narrative rich in historical significance and laden with contemporary implications. Let’s embark on a journey that traces gold’s trajectory from a period when British band Ace climbed the charts with their 1975 hit, resonating through the airwaves and marking an era, to the present-day market dynamics that shape its worth.

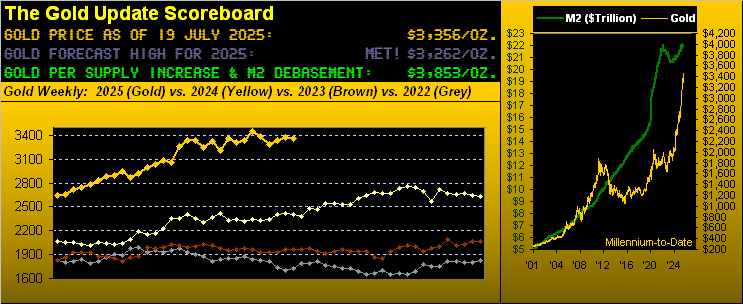

The year was 1975, a time when the world was grappling with economic shifts and musical landscapes were evolving. British band Ace released what would become a renowned pop hit, peaking at No. 3 on Billboard’s Hot 100 on a crisp April morning. Meanwhile, the financial markets bore witness to gold’s settled value at 174. Fast forward through the decades, navigating through economic upheavals, policy changes, and a myriad of global events, we find gold valuing at an astounding 3356. This represents an increase exceeding 1829% over a span of fifty years, a testament to gold’s enduring appeal as a store of value.

Contrast this with the cost of a piece of Bazooka Bubble Gum, which in 1975 could be acquired for a mere 1 cent and now sees its price bulk-marketed at 24 cents, an increase of 2300%. This humorous comparison underscores gold’s relatively sluggish pace against the surprisingly lively “bubble gum inflation.” Moreover, when examining the expansion of the United States’ “M2” money supply from April 1975’s $935 billion to the astronomical figure of $22 trillion observed today, the ballooning of monetary bases further complicates the tapestry against which gold’s value is assessed.

Yet, this analysis merely scratches the surface. Diving deeper into gold’s recent performance, particularly its weekly parabolic Short trend, reveals a fascinating stagnation. For over a year, gold seems ensnared within its cocoon, barely influenced by the external tumult and market vicissitudes. This observation leads us to ponder the wisdom of those betting against gold, historically seen as a precarious venture given gold’s propensity to defy short-sellers and reward those with patience.

Looking back over the last decade, an examination of gold’s price behavior during these parabolic Short stints paints a vivid picture. On average, the downside pursued by short sellers is met with resilience and, often, reversal, highlighting the risks inherent in such speculative strategies. Notably, the tumultuous period from 2012 to 2015 portrays a dramatic saga where short sellers found temporary vindication, only for the narrative to pivot back towards gold’s relentless ascendancy amidst a backdrop of monetary debasement.

Presently, despite an enduring Short trend rendering gold seemingly dormant, the winds of change might be upon us. The commodity’s price is teetering on a threshold, itching for a resurgence that could potentially redefine its peak values and affirm its status as a bastion against economic uncertainty.

Shifting focus to the broader spectrum, the financial landscape seems to buoy with an air of optimism ill-aligned with underlying realities. Earnings reports and stock market documentaries paint a rosy picture, yet a discerning analysis reveals cracks in the facade. The S&P 500’s valuations appear disproportionately inflated when scrutinized against earnings, suggesting a market overly reliant on speculation rather than economic fundamentals. This dissonance between perceived market rationality and the stark valuations raises alarms, hinting at potential corrections looming on the horizon.

Moreover, the current economic exuberance, as some might describe, paradoxically does not bode well for stocks should the Federal Open Market Committee steer away from rate cuts, considering the prevailing sentiment and market expectations. With the economy showing signs of vigor—at least on the surface—evidenced by a significant rebound in various economic indicators, one might argue for bullish market continuation. However, the underlying data, marred by inconsistencies and the specter of inflation alongside geopolitical tensions, suggests a more cautious approach.

As we pivot back to gold, understanding its current position requires a nuanced appreciation of market dynamics, sentiment, and technical indicators. Despite gold’s recent lack of momentum, the broader context within which it operates hints at undercurrents that could propel it from its stagnation. Whether it be economic uncertainty, inflationary pressures, or shifts in monetary policy, gold remains a crucial component of a diversified portfolio, emblematic of stability amidst chaos.

In conclusion, as the whirlwind of market speculation, economic data, and geopolitical events continues to swirl, two queries come to the fore: Are investors adequately hedged against potential market downturns? And, in an era of unparalleled economic experiments and fiscal policies, does gold not assert its relevance as a sanctuary of value? As we mull over these considerations, one is reminded of the wisdom in observing historical patterns, understanding current dynamics, and preparing for the uncertainties that lie ahead. Cheers to financial prudence and the enduring allure of gold.