In the labyrinth of global markets, few commodities exhibit the historical volatility and allure that crude oil does. Traditionally known as Black Gold, it serves not only as a cornerstone of the global energy sector but also as a barometer for gauging worldwide economic health and geopolitical stability. Over recent times, particularly since the culmination of the Israel-Iran conflict, the oil market has been navigating through a relatively calm geopolitical terrain compared to its usual tempestuous nature, resulting in a consolidation phase that has persisted for several weeks.

The cessation of the Israel-Iran War did not usher in any significant shifts in the geopolitical sphere that could have sparked a considerable rally or drop in oil prices. Moreover, despite the ongoing global trade negotiations and the imposition of tariffs, there’s been a noticeable stagnation in developments that could have potentially influenced oil markets significantly.

Nevertheless, the global trade landscape has been showing signs of resilience and adaptability. Businesses across the globe have gradually begun to assimilate the implications of tariffs into their operational strategies. This adjustment involves recalibrating supply chains in an effort to mitigate any potential spikes in costs that could arise due to these trade barriers. Despite these challenges, the prospects of global trade have been on an upward trajectory, instilling a cautiously optimistic sentiment among market participants regarding oil demand.

The valuation of crude oil heavily relies on such economic forecasts and the current sentiment, although tempered, reflects a subtle optimism that has kept oil prices approximately 6% higher than their mid-range values between $60.5 and $64 observed in May. It’s within this context that we explore the present dynamics and potential directions the oil market could take.

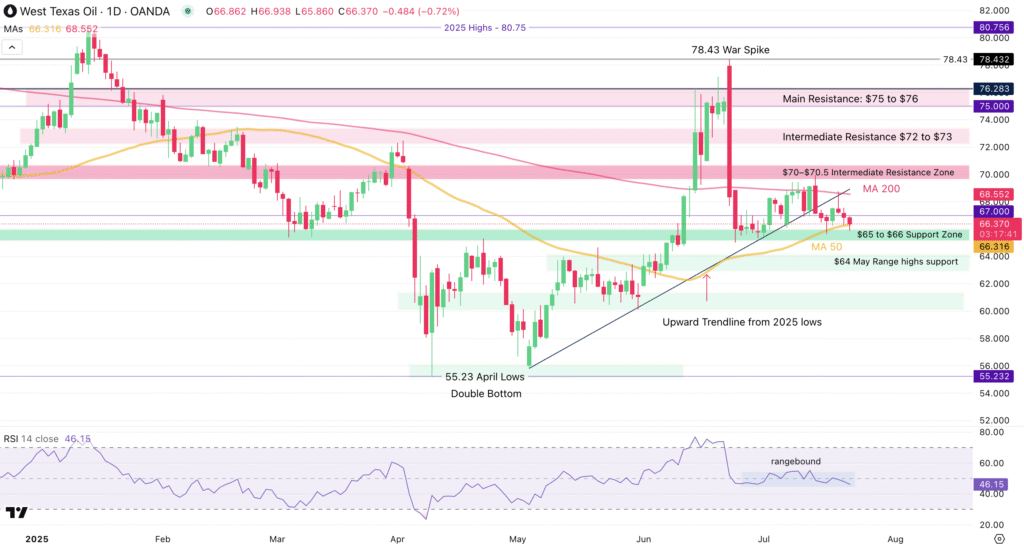

Upon a detailed examination of the US Oil Technical Update, particularly through the lens of the West Texas Intermediate (WTI) daily chart, one can discern the consolidation trend the market has been entrenched in. The chart illustrates how the market reacted to the cessation of hostilities between Israel and Iran, with oil prices reaching a high of $78.40 before retreating to a low of $65 amidst the ensuing ceasefire.

The daily Relative Strength Index (RSI) momentum is encapsulated within the neutral zone, indicating a balanced standoff between buyers and sellers. Meanwhile, the market oscillates between two critical moving averages— the 200-day moving average serving as a resistance point at approximately $68.55 and the 50-day moving average providing immediate support at around $66.31.

For traders and investors looking to navigate these waters, several key levels merit attention:

– The support zone ranging from $65 to $66 marks the lower boundary of the current trading range.

– The May high and low points at $64 and $60.5, respectively, serve as additional benchmarks.

– Resistance levels are identified at several junctures: $69.5 to $70.5, $72 to $73, and the primary resistance range of $75 to $76.

A closer scrutiny via the US Oil 1-hour (1H) chart reveals a consistently range-bound motion, underpinning the need for a more granular analysis. Despite attempts by bulls to leverage the May low trendline to rally prices, this trendline has transmuted into a resistance level, following a classic break-retest pattern observed in technical analysis.

For a downward trend to assert itself, sellers would need to decisively breach the immediate support zone and consistently close below the 50-day moving average. Concurrently, a downward tilt in the 200-period 1H moving average could potentially bolster a bearish breakout.

However, in the absence of significant catalysts that could either exacerbate or alleviate concerns related to growth projections or trade tariffs, the prevailing sentiment suggests that the market may continue to exhibit range-bound behavior. In such an environment, the bulls are tasked with staunchly defending the current support zones to prevent a further downward slide.

As is often the case in markets, sentiment can be a fickle companion. The present state of affairs in the oil market is a testament to the intricate dance between geopolitical developments, economic indicators, and the collective psyche of market participants. As recent history has shown, even amidst apparent tranquility, the markets remain vigilant, ever-ready to respond to the faintest whispers of change on the global stage.