The financial markets have embarked on a rather subdued commencement to the fresh week, continuing a downtrend witnessed over the last few days of the preceding week, culminating in a modest dip of just shy of 0.4%. This period of underwhelming performance marks a continuation of the precedent set over the past few weeks, with the precious metal’s value largely stagnating. As investor enthusiasm swells for the equity markets, propelling global benchmark indices to unprecedented heights, the allure of traditional safe-haven assets seems to be waning.

The resurgence of optimism surrounding international trade agreements, several of which have been finalised in recent weeks, is a primary catalyst fueling this shift towards riskier assets. Concurrently, the United States dollar has encountered a phase of consolidation, offering an additional impediment to the price trajectory of commodities priced in the currency, not least among them, gold.

Despite the absence of a precipitous decline in the value of gold, there is mounting evidence to suggest a forthcoming correction. Such speculation is underpinned by the metal’s inability to retest the zeniths it achieved earlier in the year over the preceding months. Nevertheless, any potential retreat might be tempered by the inflationary pressures emanating from the tariff policies and fiscal strategies implemented by President Trump.

Unfolding Developments in the Global Market

Recent developments on the international trade front have added an intriguing layer to the unfolding economic narrative. Notably, a landmark agreement has been struck between the European Union and the United States, ushering in the imposition of 15% tariffs on a broad assortment of merchandise. In a pivotal move, Brussels has committed to procuring a substantial $750 billion worth of American energy resources, alongside an additional investment pledge of $600 billion.

Subsequently, European Commission President Ursula von der Leyen confirmed the encompassing scope of the tariff, which is to be levied on the majority of EU exports – spanning sectors from automotive and semiconductor industries to pharmaceuticals. An exemption worth noting involves agricultural and pharmaceutical products, which will continue to be subject to a formidable 50% tariff, a stipulation bound to instigate discussions on both sides of the Atlantic.

In Asia, whispers of an extended trade armistice between the United States and China have been circulating, hinting at a 90-day prolongation as reported by the South China Morning Post. This is further corroborated by Reuters, which suggests imminent discussions set to take place in Sweden, marking a critical juncture in the protracted dialogue between the two economic powerhouses.

Anticipated Economic Indicators and Events

As we pivot our gaze to the forthcoming macroeconomic events, the spotlight turns towards the Federal Reserve’s meeting conclusion scheduled for Wednesday. Despite the absence of an expected rate cut – somewhat deflating given President Trump’s well-documented advocacy for easing – the financial markets are bracing for any hints regarding future policy directions emanating from the Fed’s communiqué.

This week also promises a suite of pivotal economic data releases – from unemployment figures to critical GDP numbers – poised to enrich our understanding of the economic landscape. However, the immediate calendar appears devoid of any noteworthy announcements.

Moreover, the earnings disclosures from the tech behemoths – Amazon, Apple, Meta, and Microsoft – are highly anticipated. These will not only shed light on the sector’s health but also gauge broader market sentiment.

Amid these developments, the US dollar has demonstrated resilience, bolstered by robust economic data and burgeoning inflation concerns. The expansive fiscal measures and tariff policies endorsed by President Trump are fuelling apprehensions regarding sustained inflation, potentially moderating the pace of monetary easing. The ramifications for gold, in this context, are significant, as a fortifying dollar introduces headwinds for the precious metal.

Gold’s Technical Outlook and the Broader Investment Landscape

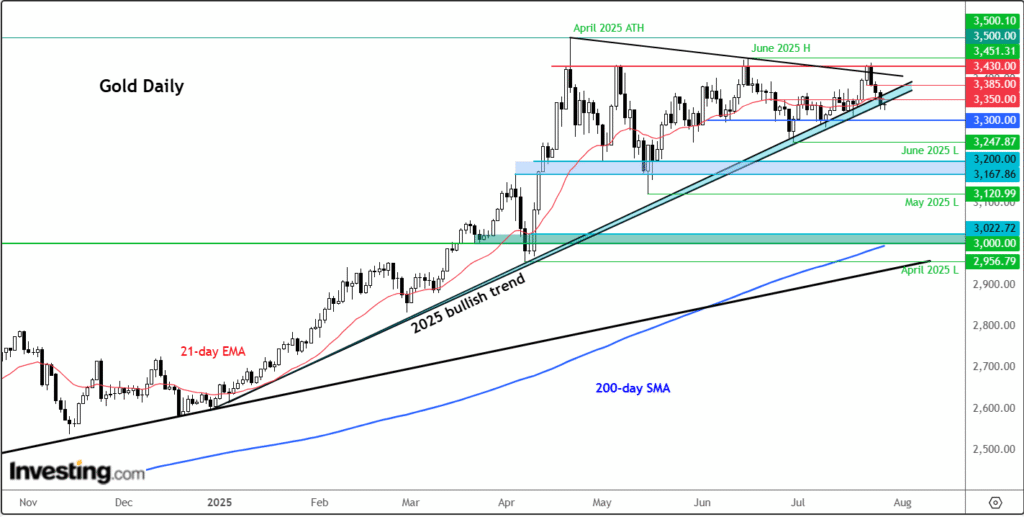

From a technical standpoint, gold’s trajectory retains an ostensibly positive outlook; however, the waning momentum is a source of unease for some investors. The precious metal is once again teetering on the edge of its 2025 bullish trend line, hovering around the $3,320-$3,330 bracket. A decisive breach of this trend line could catalyse market volatility.

Looking forward, the immediate supports lie in the $3,300 region, a threshold that has proven resilient in recent weeks. Should this support falter, the June low of $3,247 looms as the next critical juncture.

Conversely, for the bullish sentiment to recapture its momentum, resistance levels at $3,350, $3,385, and $3,430 must be convincingly surmounted, paving the way for the aspiration of attaining new peaks.

In an era marked by unpredictable market dynamics, both novice investors and seasoned traders can leverage platforms like InvestingPro to navigate the investment landscape with greater insight and confidence. Amid the current market backdrop, characterized by challenges and opportunities in equal measure, tools such as ProPicks AI, InvestingPro Fair Value, Advanced Stock Screener, and insights into the investment choices of leading billionaire investors can serve as invaluable resources.

Disclaimer: It is pivotal to acknowledge that this discourse is intended purely for informational purposes. It does not, in any guise, represent a solicitation, offer, or recommendation to invest. Investment decisions are fraught with divergent interpretations and inherent risks, leaving the ultimate discretion and associated risk squarely with the investor.

In composing this comprehensive elucidation, the intention has been to furnish the reader, irrespective of their familiarity with the ongoing discourse in the financial markets, with a thorough and insightful perspective on the prevailing economic and financial developments, thereby contributing to an informed and nuanced understanding of the complexities at play.