In the financial world, gold has historically been a beacon of stability and a hedge against inflation. However, since reaching unprecedented heights following the commemoration of Liberation Day in April 2025, the precious metal’s price has confined itself within a narrow margin of $250. This stagnation has left investors pondering the future trajectory of gold, with its value hovering around these levels despite various indicators suggesting the onset of new trends.

The erratic movements of the gold market recently, particularly in the wake of last week’s events, have reignited discussions about the precious metal’s prospects. Despite rallying along the 2025 upward trendline, gold failed to surpass its all-time high, raising questions about its underlying strength. This situation begs the enquiry whether the advocates for gold – the bulls – possess the necessary fundamental backing to propel its value to new zeniths.

One cannot ignore the impact of global events on gold’s volatility, especially in consideration of the recent upsurge during the weekly trading session. This volatility coincides with a break higher in significant financial indicators and occurs amidst the nearing conclusion of the EU-US Trade Agreement. Traditionally, gold prices have swelled with a strained global trade environment, suggesting an inverse relationship with the progress in trade negotiations. As more trade agreements materialize, casting an optimistic light on global trade, gold has paradoxically suffered, illustrating the complex dynamics at play in international economics.

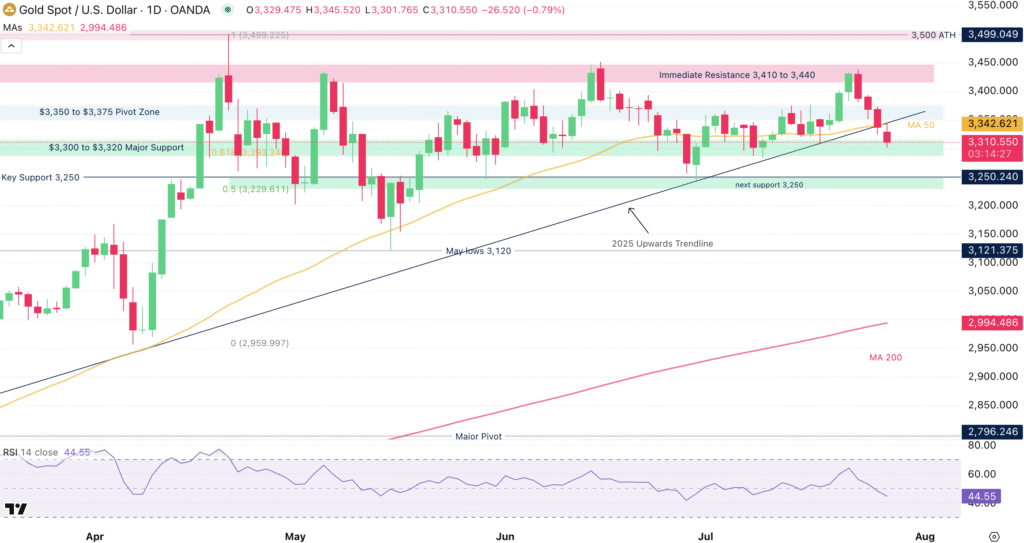

Before delving deeper into the analytical dissection, focusing on technical charts offers valuable insights. The charting landscape of gold presents a narrative of its journey towards, and subsequent retraction from, its all-time highs. A significant point highlighted is the spike to $3,439, followed by a swift retreat in response to the US-Japan Trade Agreement. This correction knocked gold off its ascending path for 2025, notably reflected in the opening prices for the week which fell short of its crucial 50-Day Moving Average, positioned at $3,342.

The failure of buyers to sustain gold’s rally above this pivotal moving average underscores the intensifying selling pressure, although the price fluctuations remain within a defined range. Presently, gold navigates through the precarious waters of the $3,300 to $3,320 support zone, with any breach potentially eyeing the $3,250 territory, a critical support threshold observed in late June.

Zooming in on the more granular four-hourly (4H) and thirty-minute (30m) charts further elucidates the battlefield for gold’s value. The 4H timeframe illustrates an immediate gravitation towards the mentioned key support, delineating the final frontier for bullish defenses against a potential $50 descent. Within the realm of the 30m chart, the skirmish between the bears and bulls intensifies, with gold currently testing the upper boundary of an emerging downward channel. This juncture signifies crucial resistance at the 30m 50-period Moving Average (MA) of $3,330, a pivotal marker for sustaining intra-day momentum and potentially spearheading a recovery.

The juxtaposition of these trends with the looming finalization of the EU-US Trade Agreement creates a compelling backdrop for forecasting gold’s short-term movements. The intricate dance between macroeconomic developments and technical indicators underscores the complexity of predicting financial markets, especially with a commodity as emotionally and economically significant as gold.

As the global financial landscape continues to evolve, the machinations within the gold market offer a fascinating glimpse into the interplay between geopolitical events, trade dynamics, and investor sentiment. With the precious metal’s value caught in a delicate balance, stakeholders eagerly await the next catalyst that could either reinforce gold’s longstanding status as a safe haven or challenge its perceived stability in the face of burgeoning economic optimism.

In summary, the journey of gold through the tumultuous waters of 2025, marked by significant geopolitical events and economic recalibrations, encapsulates the challenges of navigating the unpredictable realms of global finance. As investors and analysts alike scrutinize the unfolding narrative, gold remains a symbol of enduring allure, embodying the ceaseless quest for security amidst the vagaries of an ever-changing world.