In a significant development on Thursday, President Trump reignited concerns around global trade by announcing the imposition of new tariffs on a wide array of countries. This move signals a revival of the trade-war tactics initially articulated in April, leading to a downturn in stock markets worldwide. Despite this, all major asset classes have continued to record gains since the beginning of the year, as evidenced by performance data up to July 31, analysing a collection of ETFs.

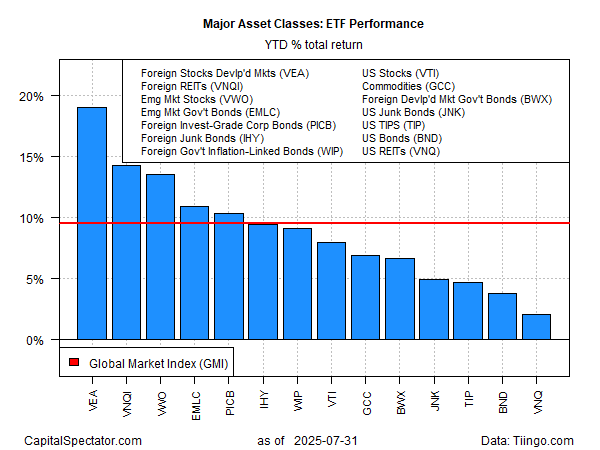

This resurgence of aggressive trade policies from the White House has reintroduced a layer of uncertainty into the financial markets. Investors now find themselves navigating through a landscape altered by unpredictable policy shifts. This uncertainty is underscored by the performance data of 2025, revealing a robust health in the global markets with gains observed across major market sectors. Notably, stocks in developed markets outside the US have surged by 19.1% this year, while US shares have seen a more modest increase of 8.0%. The Global Market Index, an unmanaged composite of all major asset classes weighted by market value, boasts a near 10% growth for the year.

One of the immediate consequences of the US’ renewed tariff approach is the differential treatment of its trading partners. Mexico, for instance, has been granted a 90-day reprieve from these tariffs, offering a window to continue negotiations. Canada, however, faces a sharp increase in tariffs, escalating from 25% to 35%. An analysis conducted by the Financial Times highlighted Brazil as the recipient of the highest US tariff at 50%, while the UK enjoys the lowest tariff imposition among America’s trading partners, at a relatively modest 10%.

These modifications in tariff policies introduce a novel element of risk to the global economic landscape, notwithstanding the resilience observed in economic activities in the months following Trump’s initial tariff announcement in the spring. Market observers and investors are closely monitoring how these adjustments in US tariff policies will influence economic expectations and data in the coming months.

Raghuram Rajan, a former governor of the Reserve Bank of India and chief economist of the International Monetary Fund, now an esteemed professor at the University of Chicago Booth School of Business, articulated the global repercussion of these policies in a conversation with Bloomberg TV, stating, “For the rest of the world, this is a serious demand shock. You will see a lot of central banks contemplating cutting as the rest of the world slows somewhat in the face of these tariffs.”

In the domestic sphere, recent inflation data for June indicates a potential uptick in pricing pressure. The Commerce Department reported a 2.6% rise in prices for June year-on-year, a slight increase from May’s annual pace of 2.4%. Core inflation, which omits the more volatile food and energy sectors, remained steady at 2.8%. Scott Helfstein, head of investment strategy at Global X, acknowledged this development, suggesting that the modest influence of tariffs is evident in the inflation data, with healthcare, housing, and utilities continuing to drive inflation.

This pivot in economic indicators has influenced market expectations around the Federal Reserve’s monetary policy, with Fed funds futures now projecting a 61% likelihood of the central bank maintaining its target interest rate at the upcoming FOMC meeting in September.

The evolution of the US tariff policy remains uncertain, with further adjustments anticipated in the coming weeks and months. Stephen Olson, Senior Visiting Fellow at ISEAS and a former US trade negotiator, shared insights into the unpredictable nature of these policies. “Don’t assume this is the end of the story,” he commented, implying that the narrative around trade policies under Trump’s administration is far from concluded. This approach, he argues, has pushed the global trade system several steps back toward a less regulated era.

Thus, as the global community grapples with the implications of the US’ trade policies, the economic landscape remains in a state of flux, with potential shifts in trade agreements and further tariff adjustments on the horizon.