In the dynamic world of foreign exchange markets, the previous week illuminated the unfolding of key risks that had been earmarked, resulting in the USD/JPY and USD/CHF pairs climbing to heights not seen for several months. This upswing comes as traders recalibrate their forecasts on Federal Reserve rate adjustments. At present, these currency pairs find themselves brushing against notable resistance levels, setting a potentially pivotal stage for their forthcoming trajectory, contingent largely on imminent economic data releases.

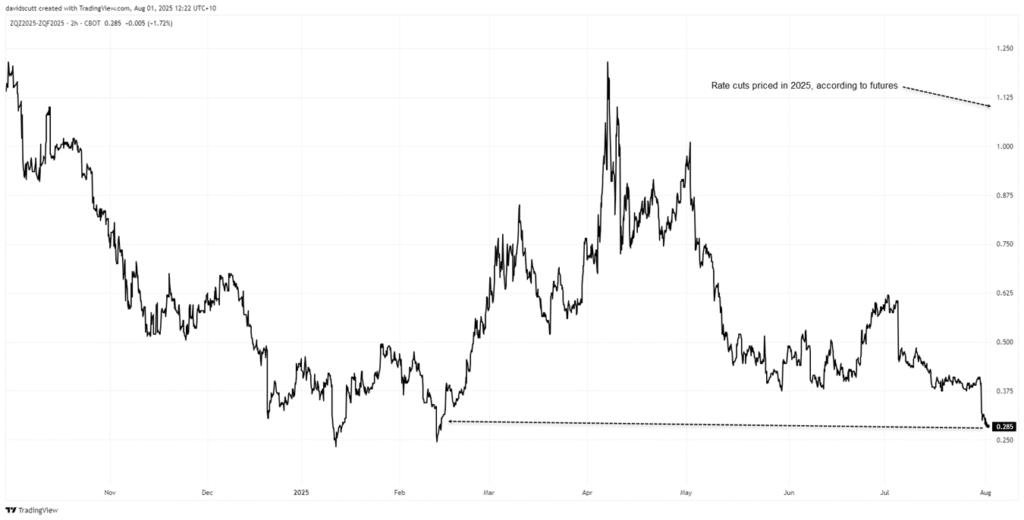

The anticipation of a rate cut by the Federal Reserve has significantly waned, dropping to a mere 28.5 basis points, a figure not observed since February. This marked shift reflects a reduced likelihood of monetary easing within the year, contrasting sharply with earlier speculation in July where market participants toyed with the possibility of up to three rate cuts before the year’s close. Now, the consensus has tapered to just a single rate cut.

This recalibration in expectations has served as a catalyst for the U.S. dollar, which has seen a robust recovery against both the Japanese yen and Swiss franc throughout July. An inspection of the correlation between these currency pairs and the 2025 rate cut projections offers insight into this dynamic. As prospects for easing diminish, both pairs have tended to appreciate, highlighting the intricate dance between monetary policy expectations and currency valuations.

Turning our gaze to the technical landscape, the USD/JPY pair has delivered a noteworthy breakout, eclipsing the 200-day moving average—a feat not achieved since February. The current positioning just shy of the 151 resistance level opens up a multitude of strategic possibilities for traders, especially with the looming release of critical U.S. economic data. A robust report could catapult the pair beyond this threshold, paving the way for potential targets at 152.40 and the February peak of 154.80. Conversely, a disappointing outcome might trigger a pullback, affording opportunities for short positions with the 200-day moving average serving as an initial target.

Similarly, the USD/CHF pair is maneuvering near the .8150 resistance. A convincing payroll report could propel it past this barrier, with .8250 and .8333 emerging as subsequent objectives. The technical indicators—RSI (14) and MACD—underscore a bullish momentum, suggesting that strategies favoring purchases on dips and breaks could prove advantageous.

The forthcoming payroll report stands as a crucial determinant for the next phase of movements for these pairs. Apart from the unemployment rate, which is forecasted to marginally rise to 4.2%, the payrolls increase and the trajectory of average hourly earnings are equally pivotal. An expected uptick in earnings to 0.3% could influence the annual rate to reaccelerate to 3.8%, shedding light on the nuanced interplay between labor market health and inflationary pressures.

In essence, the recent adjustments in Federal Reserve rate cut expectations have underscored the volatility and responsiveness of the forex market to shifts in economic indicators and policy outlooks. The technical posture of the USD/JPY and USD/CHF pairs, coupled with the anticipation of key economic data, underscores a crucial juncture for traders. As always, a balanced approach that marries technical analysis with a keen eye on macroeconomic developments will be paramount for navigating the uncertain waters ahead in the foreign exchange markets.