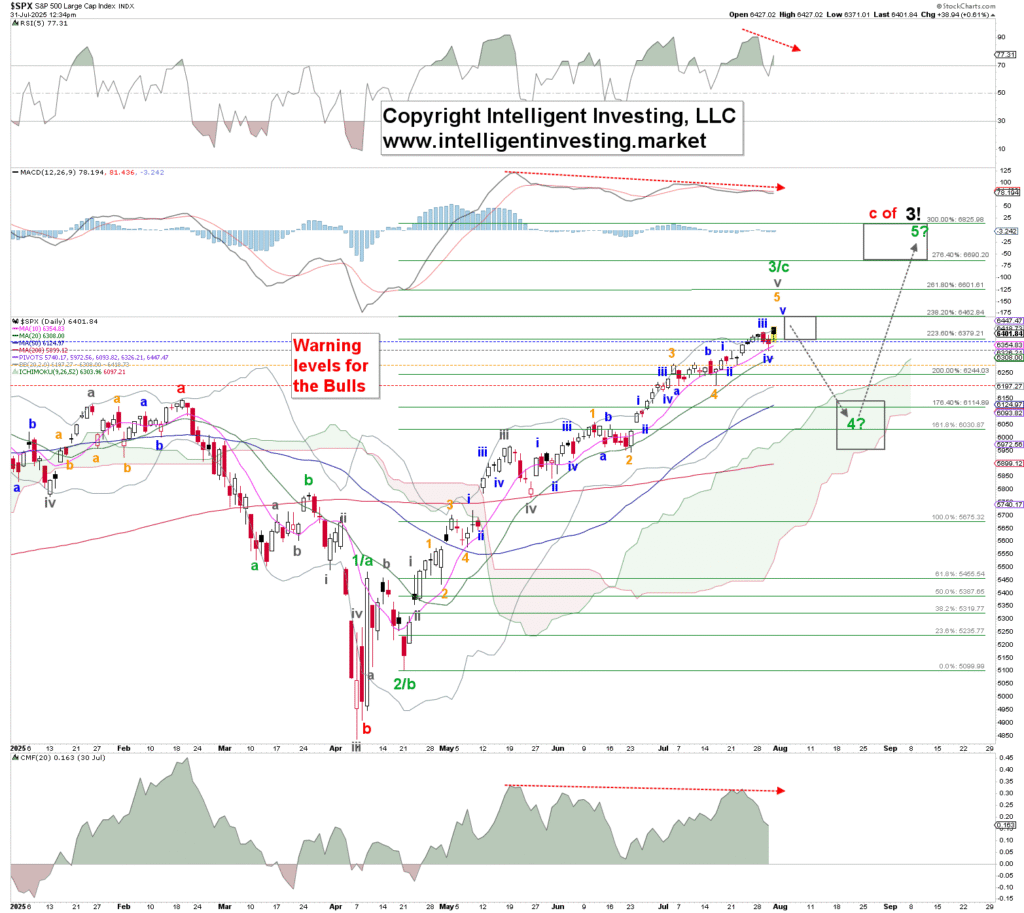

In our preceding commentary from the 11th of July, we discussed the interplay between post-election year averages and Elliott Wave (EW) theory, predicting movements within the S&P 500 index. Our analysis forecasted a series of significant price movements based around the EW principle: a peak (labeled as green Wave-3) was expected around the 16th of July, hitting an approximate value between 6380 and 6460, followed by a dip (green Wave-4) on the 21st of July to around 6025, give or take 100 units, with a preference towards the upper limit of this range. Finally, we anticipated a resurgence leading to a final high (green Wave-5) by the 2nd of August, with the index potentially reaching between 6815 and 6915.

Despite our previous analysis aligning perfectly with the June movements, the S&P 500 index defied our July expectations, opting instead for a nonstop rally. This deviation is somewhat common in financial forecasting, reminding us of the adage, “60% of the time, it works every time.” This unpredictability is part and parcel of market dynamics. Importantly, the index remained above our crucial warning levels set at 6177 and 6061, thus, we maintained a bullish stance comfortably. However, upon reaching the anticipated 6380-6460 range, the conditions suggested a likely commencement of a market pullback, although timing such shifts remains a challenging aspect of forecasting.

As the S&P 500 climbed over the subsequent three weeks, our daily advised warning levels were adjusted upwards in step with the market movements. These revised levels started with a first-tier blue warning at 6363, followed by a grey warning at 6336, an orange warning at 6281, and capped by a red final warning at 6201. These metrics are designed to flag the beginning of the pullback. To date, no such initiation has been observed.

Looking at the current wave patterns, the 6690-6820 range appears to be a feasible target for the prospective green Wave-5, an extended fifth wave. This prediction aligns with our longstanding third wave target bracket of 6738-7121. The latter range is extrapolated from the 123.6-138.2% extension of the initial wave (W-1), which spanned from March 2020 to January 2021, starting from the W-2 trough in October 2022. This scenario typifies an ending diagonal pattern, consistent with the trajectory post-March 2020, which we interpret as a significant Primary Wave-V ending diagonal.

Notably, as the stock market appeared to overlook the post-election year seasonality in July, it’s crucial to remember that such patterns serve only as averages and do not offer guarantee outcomes. Moreover, given that the index has not breached our set warning levels, it retains the possibility to escalate further, as observed over the last three weeks. This dynamic nature of the market underscores our approach of constant anticipation, monitoring, and necessary adjustments.

Presently, the index has ascended into the optimal extended green Wave-3 target zone, suggesting an imminent pullback. For this retracement to be deemed probable, a closure below $6336 is required, ideally pointing towards $6025, plus or minus 100 units, while keeping the broader picture in mind, notably that the ultimate third wave target zone is yet to be achieved.

This analysis offers an insightful glimpse into the complexities of market forecasting and the nuanced interplay of various predictive models like the Elliott Wave Principle. Such tools, while powerful, must be employed with a degree of caution and flexibility, reflecting the inherently unpredictable nature of financial markets.