In the contemporary financial landscape, amidst moments of market downturns following extensive periods of robust growth, a recurrent piece of counsel often comes to the fore:

“Exercise patience. Maintain your investments. Navigate through the storm.”

This guidance finds its underpinning in a widespread belief that markets, over an elongated timeline, predominantly exhibit an upward trajectory. However, a critical scrutiny reveals an inherent flaw within this popular narrative – the conflation of an individual’s investment portfolio with a market benchmark.

The practice of portfolio benchmarking – incessantly measuring one’s investment success against leading indices such as the S&P 500 – is a methodology fraught with potential misleading outcomes for investors in the real world. The crux of the issue lies within a fundamental misunderstanding: markets do not manifest compound returns in a linear or predictable manner.

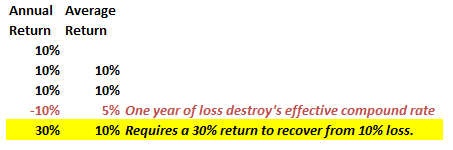

To illustrate, consider the assumption that an investment will steadily compound at a 10% rate annually over a span of five years. The arithmetic paints a discomforting picture: a mere 10% loss in any given year can halve the annual compound growth rate, necessitating a disproportionate 30% gain the following year to recoup the average desired return. This discrepancy between ‘average’ returns and ‘actual’ returns illuminates the destructive impact that losses can exert on the perceived compounding effect of an investment.

The theoretical underpinnings of this phenomenon are further evidenced by the stark contrast between the anticipated average returns and the tangible returns investors might encounter – a disparity that significantly undermines the process of financial planning over the long haul. One morbid yet realistic highlight of this scenario is that the average investor is unlikely to live long enough to witness the fruition of these so-called average returns, especially considering the century-spanning timelines over which these averages are calculated.

Diving deeper into the subject of portfolio benchmarking exposes another layer of complexity: the divergence between an investment in a diversified portfolio of stocks and the performance of a benchmark index. For elucidation, let us construct a hypothetical portfolio benchmark based on a mix of fictitious companies and juxtapose its performance with that of an individual’s $50,000 investment, diversified across similar lines. This comparative analysis reveals that the real-world challenges investors face – including stock market volatility, corporate actions like mergers and stock buybacks, and external factors like taxes and management fees – are not mirrored in the static, idealized world of benchmark indices.

Specifically, the phenomenon of stock buybacks presents a glaring example of how corporate maneuvers can artificially elevate a company’s stock price, thus skewing the performance of benchmark indices upwards – a benefit that individual investors do not enjoy similarly in their portfolios. Moreover, the underlying often ignored expectation of a substitution effect – wherein failing companies within an index are replaced with more successful ones, thereby artificially inflating the index’s performance – does not translate into any tangible advantage for the individual investor’s real-life portfolio.

As we venture further into the intricacies of portfolio management, it becomes increasingly apparent that aligning one’s investment strategy purely with the pursuit of mirroring a benchmark index is not only fraught with misconceptions but possibly detrimental to one’s financial wellbeing. Investing with an overly competitive mindset, driven by the ambition to beat the market benchmark, often sidelines the paramount objectives of capital preservation, inflation-paced growth, and realistic goal-setting based on personal financial timelines.

The narrative compellingly argues for a reevaluation of investment strategies not as a race against the ephemeral benchmarks but as a structured approach tailored to individual financial goals, risk tolerances, and time horizons. The essence of successful investing resides not in outpacing a mythical unicorn but in navigating the financial journey with informed patience and prudent strategy – prioritizing one’s unique financial health above the transient victories of beating the market averages.

Hence, in these turbulent market times, it might be worth pondering not just the conventional wisdom of staying the course but understanding the deeper nuances of what truly constitutes investment success over the long term. This comprehensive understanding can equip investors to make decisions that are not only informed by historical averages but are also attuned to the realities of their individual financial landscapes.