In the landscape of global trade and economics, the recent developments have presented a whirlwind of events, characterized by negotiations on trade deals, the imposition of tariffs, and significant shifts in data trends. This article aims to dissect the critical elements of these occurrences, providing a clearer understanding for those less acquainted with the intricate details of international trade dynamics.

### The Subtle Persistence of Tariffs

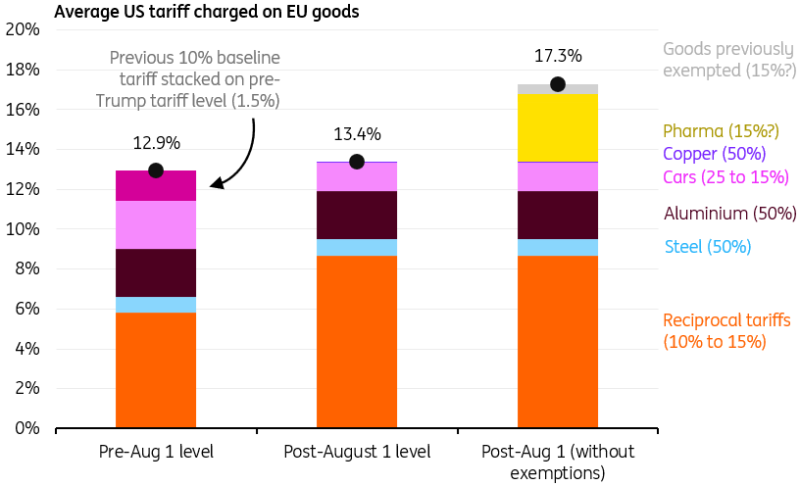

The ambiguity surrounding the alterations in tariff rates, particularly following the August 1st trade deadline, has been a subject of considerable discussion. Speculations had mounted regarding potential changes. However, upon closer examination, it appears that modifications in tariff structures, especially those pronounced by the United States administration, have been minimal at best.

For instance, the agreement with the European Union showcased a reduction in car tariffs from 25% to 15%, and a baseline tariff increase from 10% to 15%. Notably, this new baseline rate replaced the prior average tariff of approximately 1.5% that was in effect before the tenure of US President Donald Trump. Yet, when these adjustments are amalgamated, the overall average tariff rate on imports from the EU into the US showed a nominal increase from 12.9% to 13.4% – a difference that could arguably be seen as negligible.

Industries outside of the automotive sector, such as pharmaceuticals, were also earmarked for a 15% tariff, along with other sectors previously exempt from reciprocal tariffs. This inclusion suggests a potential for a more significant impact on the average tariff rate against the EU, although the specifics surrounding these adjustments remain uncertain.

Amid these developments, questions linger regarding the implementation timeline of these pharmaceutical tariffs, the possibility of quarterly reviews by the US administration, and the enforcement of energy purchase and investment promises made by Europe among others. These unresolved issues cast doubt on the actual alleviation of uncertainty for businesses and consumers, initially thought to be a key benefit of the agreement for Europe.

### Reevaluating the US Job Market

The revelation of unexpectedly weak job data has precipitated a recalibration of perspectives regarding the robustness of the US job market. The anticipation of a Federal Reserve rate cut in September, now regarded as highly probable by markets, underscores the fragility of the job landscape – contradicting earlier assertions by Fed Chair Jerome Powell about the market’s resilience.

Significant downward revisions for May and June’s job data have illuminated a stark reality, potentially indicating net job losses for these months once the data undergoes further adjustment to align with tax records. Such developments challenge the utility of payroll data as a reliable economic indicator in the current context, as suggested by Powell.

### Inflation and Tariffs

The narrative of US inflation has increasingly intertwined with tariff policies. Recent data, specifically the Personal Consumption Expenditures (PCE) Deflator, indicates a notable uptick in goods inflation. This rise aligns with predictions that tariffs would exert an inflationary lag effect, raising concerns about the potential exacerbation of inflation over the summer months.

### European Central Bank’s Stance

Conversely, the European Central Bank (ECB) finds itself in a position where a September rate cut appears less imminent. The trade deal’s ramifications, coupled with a weakened Euro in response to it, have somewhat diminished immediate pressures for further policy easing by the ECB. Nonetheless, the ongoing monitoring of growth, inflation, and unemployment rates will be crucial in shaping the ECB’s future decisions.

### Global Perspective: Developed and Emerging Markets

Looking forward, attention shifts to how individual Federal Reserve officials will respond to the latest job data revelations, with implications for potential rate adjustments. Similarly, in Canada, tariff impacts on US-Canada trade pose significant concerns, making upcoming job data highly anticipated.

In Europe, the UK’s job market challenges may prompt the Bank of England to consider rate adjustments, navigating through a complex economic landscape marked by inflationary pressures. Meanwhile, Central and Eastern Europe, and countries like Hungary and the Czech Republic, are navigating through their economic recovery phases, pondering over rate decisions and economic indicators such as industrial production and retail sales.

In summary, the unfolding economic narratives across the globe present a complex interplay of policies, trade agreements, and market reactions. These developments underscore the interconnectedness of the global economy, where decisions within one nation can ripple across to others, influencing policies, market sentiments, and economic outlooks. As these stories continue to evolve, the world watches keenly, awaiting the next turns in this ongoing economic saga.