In the dynamic world of cryptocurrency, the recent five-week period of gains came to a halt last week, as the market experienced a decline exceeding 5%. This downturn was even more pronounced among alternative cryptocurrencies (altcoins), which on average fell by about 8%. However, this week has brought signs of resilience in the crypto space, hinting that the recent pullback may be short-lived. Despite this tentative recovery, cryptocurrencies have yet to overcome critical resistance levels that would signify the start of a bullish trend.

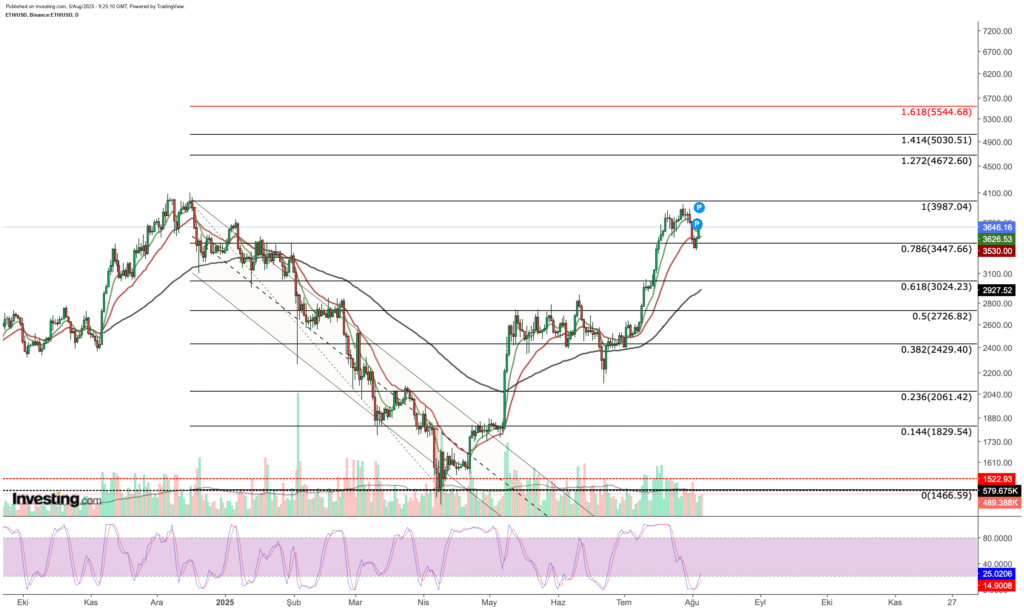

Ethereum, a leading digital currency known for its versatile blockchain technology, encountered resistance as it attempted to surpass the $3,900 valuation mark last week, ultimately retreating to near $3,400. With the commencement of August, a renewed interest from investors at this lower valuation spurred a recovery, albeit a cautious one.

One notable development has been the increased engagement from large-scale investors. According to data from analytics firm Santiment, there has been a notable increase in the number of wallets holding at least 10,000 Ethereum. This surge in institutional interest, coupled with robust demand for Ethereum-based investment products, underscores the ongoing confidence in Ethereum’s long-term potential. However, the persistent challenge of breaking above the $3,900 resistance level reflects broader economic concerns, including uncertainties in the US economy and global trade tensions, which continue to temper investor enthusiasm.

At present, Ethereum appears to be consolidating within a range between $3,450 and $3,980, with $3,700 emerging as a pivotal resistance point. Achieving a daily close above this level could pave the way for another attempt to breach the main resistance. However, the current buying momentum appears insufficient for such a breakthrough. Ethereum’s trajectory in the short to medium term appears contingent on sustained institutional investment, yet it remains highly susceptible to macroeconomic influences.

Solana, another prominent player in the crypto arena, has also faced challenges recently. After failing to maintain its position above the $200 mark in late July, Solana entered a more pronounced correction phase, falling below the critical support level of $183 to find a new support zone between $160 and $165.

This week, there’s a cautious effort to reclaim the $165 level, though confirmation of a reversal remains pending. A viable recovery strategy for Solana involves breaking out of the current downtrend and retesting the $183 resistance. Overcoming these hurdles could potentially propel Solana towards the $230 mark, pending a decisive daily close above specific thresholds. The path ahead for Solana hangs in the balance, with its ability to surmount these challenges being crucial for reversing the recent downturn.

Litecoin, in contrast, has shown remarkable resilience, swiftly concluding its corrective phase that bottomed out at $105 in early August. This rebound has positioned Litecoin more favorably compared to broader market trends.

The recent surge in Litecoin’s valuation necessitates monitoring key support levels, especially the $125 mark, as any profit-taking actions could result in a retraction to the $115-$125 support zone. Maintaining above this range would be essential for Litecoin’s continued upward momentum, potentially targeting the $155 valuation. However, the resistance encountered earlier in the year within the $130-$135 range remains a significant barrier. A successful weekly close above this threshold could cement a more sustained upward trend for Litecoin.

In conclusion, while the crypto market has shown signs of recovery from its recent pullback, critical resistance levels remain unbroken, leaving the future trajectory uncertain. The resilience of leading cryptocurrencies like Ethereum, Solana, and Litecoin in the face of economic headwinds will be telling of the market’s potential to reclaim its upward momentum. As always, participation in the cryptocurrency market carries inherent risks, and investors are advised to conduct thorough research and consider a multitude of perspectives before making investment decisions.