Exploring the Vast Expanse of the Financial Cosmos: A Journey Through Gold Mining’s Influence

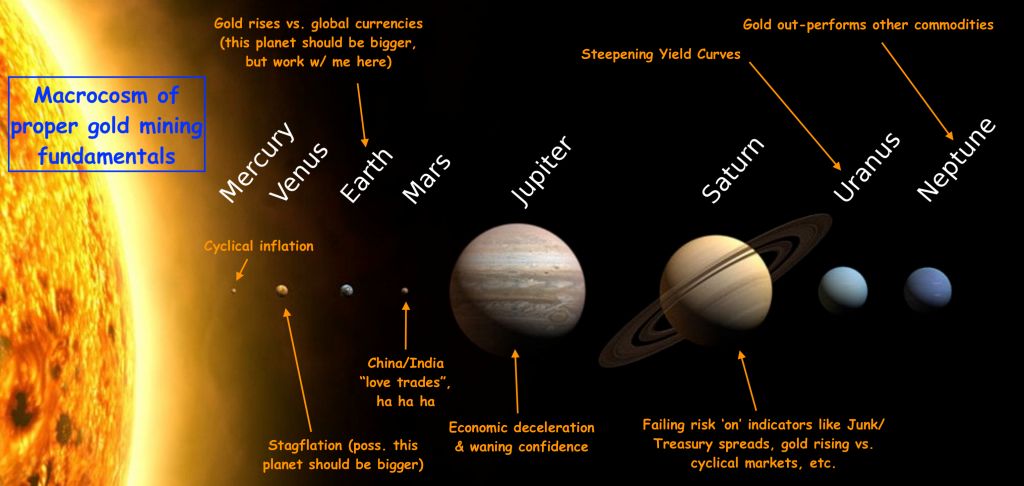

In the boundless realm of finance, where markets and investments ebb and flow with the unpredictability of a stormy sea, there exists a concept so vast and intricate that it mirrors the grandeur of the cosmos itself. This concept, which I have chosen to term the “Macrocosm,” serves as a metaphorical planetary system which seeks to simplify and represent the myriad factors influencing the gold mining sector and its foundational role within the broader macroeconomic landscape. The larger a planet within this celestial analogy, the greater its positive relevance to the underpinnings of gold mining and its macro fundamentals.

The birth of the Macrocosm visualisation was inspired by a moment of curiosity, when the power of artificial intelligence through a WordPress feature was harnessed to conjure an image based on the singular term “Macrocosm.” The result was astonishingly reflective of the tumultuous journey ahead for the macro markets, reminiscent of a chaotic view one might imagine in the intricacies of trade policies being devised. It counterbalanced the serene order of my devised solar system, presenting a stark visual metaphor for the unpredictable nature of financial markets.

Embarking further into our celestial journey, the narrative arc of gold mining’s recent history unfolds much like a cosmos in motion. The descent into the abyss of the 2008 financial crash, followed by the bear market onset in 2012, was not happenstance but a path charted by cyclical inflationary forces under the watchful gaze of policymakers. Bernanke’s tenure, in particular, highlighted the tenuous balance between macroeconomic control and the natural cycles of boom and bust that define our financial universe.

Our exploration takes us through the dark void of the Gold Bugs Index (HUI), which faced a harrowing descent in 2015, concluding a bearish phase that began in 2012. This period can be likened to a supernova event, where the very forces that birthed the previous bull market—cyclical inflation working in harmony with an economic upcycle—turned villainous, compressing margins as the cost of mining soared in comparison to the value of gold itself.

Yet, from the depths of despair, the sector witnessed a rebirth as the market bottomed out in December 2015, igniting a stellar rally in the first half of 2016. This rally, though short-lived, served as a harbinger of the sector’s unyielding spirit, akin to the awe-inspiring resilience found within the heart of a collapsing star.

The celestial dance of the gold mining sector, punctuated by its alternating bull and bear phases, offers a poignant reflection of the broader macroeconomic forces at play. The COVID-19 pandemic’s crash and the subsequent inflationary pressures exerted by federal and governmental responses provided a backdrop against which gold’s intrinsic value was tested. Amid these tireless waves of cyclical and counter-cyclical forces, gold and the gold mining sector embarked on their latest phase, seeking renewal as they rose from the bear market’s shadow.

Within this cosmic tableau, gold’s price trajectory serves as a powerful testament to the enduring allure and stability it offers against the backdrop of fiscal expansionism and uncertainty. The journey through the “Cup” pattern in the gold price monthly chart reveals a tale not of bubbles bursting, but of foundations being firmly laid for a new chapter in the macro cosmos.

As we navigate the intricate web of factors influencing gold stocks, from Federal rate cuts to market contractions, the HUI Gold Bugs Index’s resurgence acts as a beacon of hope, signalling potential breakthroughs against the backdrop of a shifting economic landscape. The evolving dynamics between gold, stocks, and currencies underscore a unique investment thesis, poised to lever the tumult and transformations occurring within the vast financial cosmos.

As we stand on the precipice of 2025, reflecting on the nine-year journey since the 2016 bottom, the current unfolding chapter in the gold mining narrative is one of meticulous management and keen anticipation. Amidst the cacophony and clutter of global events, strategic investing within the gold mining sector emerges as a form of celestial navigation, guiding us through uncharted territories with the promise of unearthing new worlds of opportunity.

This cosmic journey through the Macrocosm not only serves as a metaphorical exploration of the intricate dynamics shaping the gold mining industry but also offers a broader commentary on the cyclical nature of economies and the existential quest to find stability amidst the inherent chaos of our universe. As we continue to chart the course of this celestial passage, the enduring saga of gold mining remains a testament to human resilience, ambition, and the relentless pursuit of prosperity against the vast, unyielding canvas of the cosmos.