Dividend-paying stocks have long been revered by investors for their ability to provide a steady income stream, a quality that holds significant appeal in times of market fluctuation. These stocks are typically issued by well-established companies with robust financial health. It’s a logical conclusion that only entities with profitable operations have the capacity to distribute dividends. Moreover, such businesses frequently enjoy a loyal shareholder base, contributing to their resilience during economic challenges.

The current financial climate, marked by the fallout from earnings season surprises and the added layer of complexity due to geopolitical tensions provoked by the tariffs implemented by the former U.S. President Donald Trump, signals a potentially opportune moment to pivot towards dividend-paying stocks. These assets promise not only stability but also an attractive income in a period laden with uncertainties.

This piece aims to delve into the enduring nature of dividend stocks and undertakes a venture using the Investing.com screener to uncover high-yield dividend stocks that promise safety alongside the potential for notable returns amidst today’s tentative market backdrop.

Essential Criteria for Selecting Dividend Stocks

Investors mulling over the acquisition of dividend stocks should weigh several key factors to discern the most lucrative opportunities. The dividend yield, calculated as the annual dividend payment divided by the stock’s current price, stands out as a critical metric. It offers insight into the return on investment the dividend presents.

Equally important is the portion of profits a corporation directs towards dividends. A near-total allocation of profits to dividend payments could signal limited scope for an increase in future dividends. Moreover, such a practice leaves a company with minimal reserves for expansion or reinvestment, potentially stifling growth prospects.

The dividend growth rate across a span of 3 to 5 years or the continuity of dividend payments over time can also serve as indicators of a company’s commitment to maintaining dividend distributions. Additionally, evaluating a company’s overall financial health and valuation is imperative to ensure that one does not end up investing in stocks that are overpriced.

Strategies for Identifying Prime Dividend Stocks

With these considerations in mind, we set our sights on the Investing.com screener to pinpoint exemplary dividend stocks within the U.S. stock market, focusing specifically on the S&P 500 index. We sought after stocks that epitomize a combination of desirable qualities:

- A dividend yield of more than 4%.

- A history of dividend payments spanning over 5 years.

- A payout ratio of less than 75%.

- An upside potential of more than 10%, based on InvestingPro Fair Value.

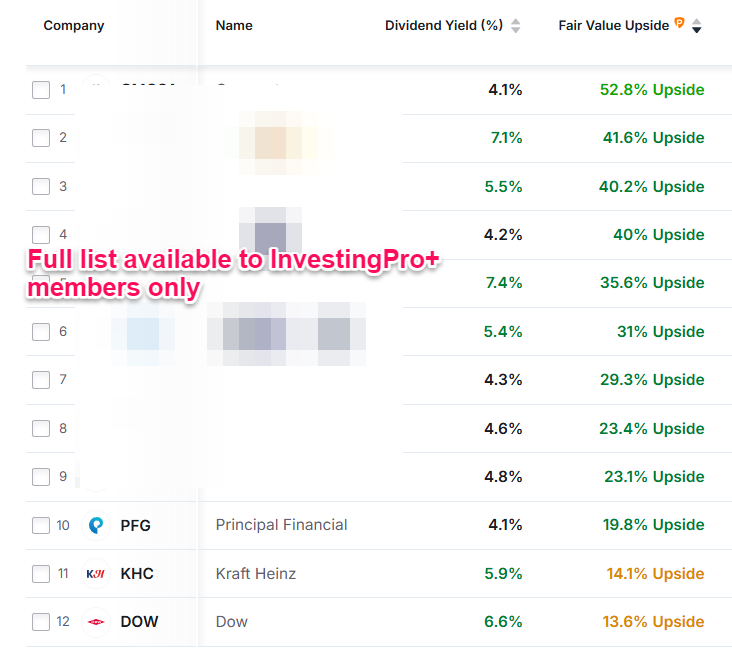

This rigorous search culminated in the discovery of 12 standout stocks. These options not only span a diverse range of sectors, but they also boast dividend yields of 4.1% to 7.4%, with their upside potential gauged at +13.6% to +52.8% according to Fair Value. This selection serves as an excellent foundation for investors eager to assemble a dividend stock portfolio centered around the most prominent names in the U.S. stock market.

For those wishing to expand their search beyond the confines of the S&P 500, Investing.com offers various specialized predefined screens. These tools allow for the application of multiple search parameters simultaneously, which can be adjusted and personalized as needed. The platform features over 20 predefined screens designed to cater to a broad spectrum of investor preferences, though it should be noted that certain screens are exclusive to InvestingPro subscribers with the Pro+ plan.

The Value of InvestingPro in Informed Decision-Making

This exploration represents but a fragment of the multitude of features available through InvestingPro. The platform is engineered to assist investors in navigating any market environment with confidence, providing access to:

- AI-driven stock market strategies, re-evaluated monthly.

- A decade’s worth of historical financial data for thousands of international stocks.

- Databases detailing investor, billionaire, and hedge fund positions.

- A plethora of additional tools instrumental in helping countless investors outshine the market daily.

Subscribing to InvestingPro unveils a path to intelligent investing, simplified through the convenience of having the most effective tools readily accessible. Whether you’re experienced or new to the world of investing, the array of resources offered by InvestingPro is designed to demystify the process, ensuring that every investment decision is informed and strategic.