In the intricate world of cryptocurrency trading, Ethereum has recently attracted a significant amount of attention from investors and traders alike, thanks to its noteworthy performance and potential for future gains. Our analysis, three weeks prior, when Ethereum was trading at approximately $3400, leaned heavily on the Elliott Wave (EW) Principle — a method that uses investor psychology-driven wave patterns to predict market trends. Our projections anticipated a series of price movements, which, as events unfolded, have closely mirrored Ethereum’s actual price trajectory, underscoring the utility of the EW Principle in forecasting market shifts.

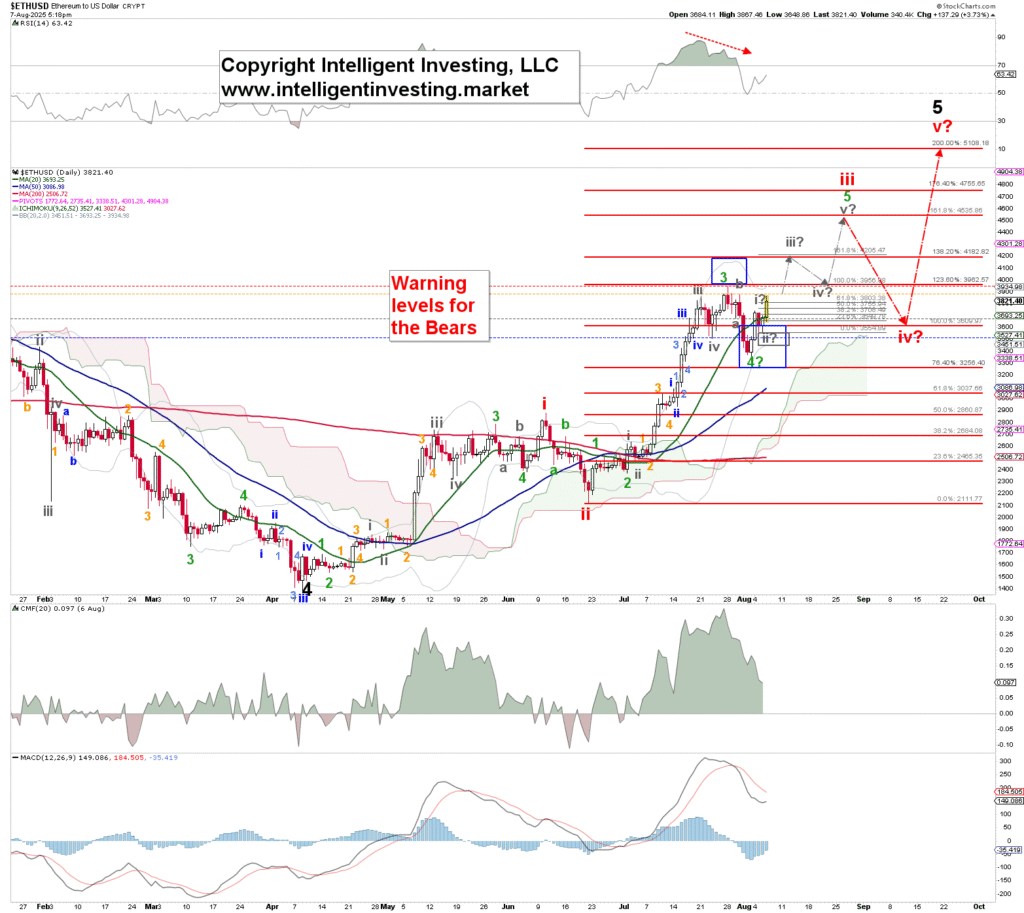

We had posited that Ethereum would reach a short-term pinnacle as it approached the red 100% Fibonacci extension, around the $3600 mark. This peak was expected to represent the climax of the gray W-iii wave, a common juncture for the third of a third of a third wave in EW parlance. Following this, we anticipated a correction phase for gray W-iv, which would likely find support near the 76.4% Fibonacci level, around $3250, before embarking on a rally towards the gray W-v wave, targeting the 123.6-138.2% Fibonacci extensions ($3955-4175). Importantly, we believed that a more pronounced correction phase would only materialize post the culmination of the red W-iii wave, potentially peaking at the 161.8% Fibonacci level, approximately at $4525.

This forecast has been largely borne out by subsequent events. Ethereum reached a high of $3859 on July 21, followed by a retracement to $3510 on July 24. Subsequently, it mounted a rally to $3941 on July 28, and, as of the latest data, is trading around $3675. The completion of the gray W-iii, iv, v waves, remarkably close to our projected targets, serves to validate the EW Principle as a robust forecasting tool for traders and investors, with our premium newsletter subscribers reaping particular benefit from these insights.

The EW analysis posits that Ethereum’s recent low at $3356 might signal the end of the green W-4 wave, setting the stage for the subsequent series of movements encapsulated in the gray W-i and ii waves (as illustrated). The subsequent trough near $3546 on Tuesday nearly meets our ideal W-ii target zone of $3450-$3555, with Ethereum’s price breaking above the previous day’s high of $3737, suggesting that the gray W-iii of the green W-5 is now in progress. While the confirmation point is pegged above $3878, this indicates a promising outlook for the bullish scenario, albeit with caution advised as the final wave (W-5) confirmation is pending.

A deeper analysis reveals that the red W-v wave’s ideal target, at the red 200% Fibonacci extension — roughly $5100 — falls short of the more ambitious breakout/symmetry target of about $6140. This suggests the possibility of an extended fifth wave, a phenomenon not uncommon in the volatile realm of cryptocurrencies. Further, extrapolation through both log-based and linear-scaled Fibonacci extensions provides a confluence of targets in the vicinity of $6200, underlining a strong consensus on Ethereum’s potential upside.

The journey of Ethereum, from its inception to its current stature, is emblematic of the broader evolution of cryptocurrencies from niche digital assets to mainstream investment vehicles. Ethereum’s innovative smart contract feature has not only set it apart from its predecessor, Bitcoin, but also paved the way for an entire ecosystem of decentralized applications (DApps). As we move forward, the interplay between technological advancements, regulatory landscapes, and investor sentiment will likely dictate the trajectory of Ethereum and the cryptocurrency market at large.

Our analysis, grounded in the Elliott Wave Principle, sheds light on the intricate patterns underpinning market movements and offers a lens through which to view the potential future direction of Ethereum’s price. Whether you’re a seasoned trader, a casual investor, or simply a keen observer of the digital currency space, understanding these dynamics can provide valuable insights into the complex, yet fascinating world of cryptocurrencies.