In recent times, the cryptocurrency world has seen an uptick, driven by strategic political manoeuvres in the United States, marking a potentially transformative period for digital assets. At the forefront of these developments is the Trump administration’s initiative to integrate cryptocurrencies into 401(k) retirement pension plans. This move is complemented by the nomination of Stephen Miran, a well-known advocate for cryptocurrencies, to the Federal Reserve Board of Governors.

The nomination of Stephen Miran and the proactive stance towards incorporating cryptocurrencies into pension schemes signal a potential softening of monetary policy in the United States. Such shifts are eagerly welcomed by the cryptocurrency sector, given their potential to redefine the economic landscape. Miran’s backing hints at a faster move towards more accommodating monetary policies, particularly beneficial for cryptocurrencies like Bitcoin, traditionally seen as safeguards against inflation.

Moreover, the inclusion of digital assets in the 401(k) pension plans could significantly affect the cryptocurrency market due to the US pension system’s vast financial resources. This integration would not only spike demand but also enhance the credibility of cryptocurrencies by cementing their role within institutional frameworks.

Historically, the launch of Exchange-Traded Funds (ETFs) has provided a considerable boost to Bitcoin and similar integrations could further intertwine cryptocurrencies with traditional financial systems. This would likely contribute to reduced volatility and a more stable pricing environment for digital assets.

Despite the optimism, the upward trajectory of cryptocurrencies like Bitcoin still encounters challenges. Data indicating diminished network activities suggests that recent rallies may have been driven by short liquidations rather than sustained engagement. Achieving and maintaining momentum beyond the immediate resistance levels might necessitate a resurgence in network activity and trading volumes.

However, these advancements have offered a buffer against a deeper market correction, and Bitcoin, for now, enjoys a positive short-term momentum. Its resilience will hinge on continued demand from both retail and institutional investors, amplified by regulatory developments.

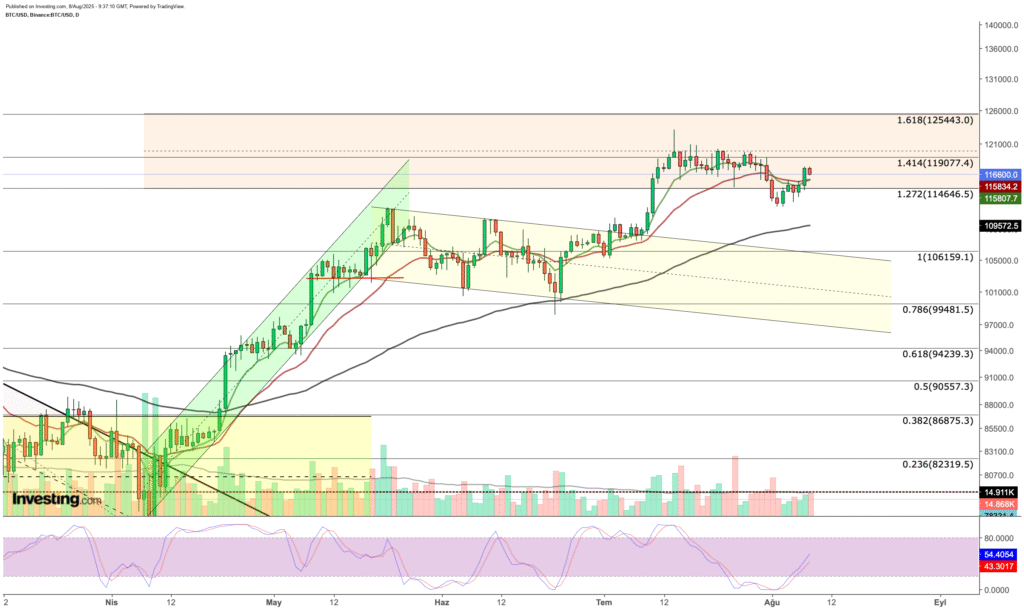

From a technical analysis standpoint, recent events have facilitated Bitcoin’s recovery from a downward trend, positioning it against a pivotal resistance zone. If Bitcoin sustains a close above this threshold, it could set the stage for a potential climb towards higher resistance levels, with market indicators backing this optimistic outlook.

Yet, the journey ahead is not devoid of obstacles. A failure to breach significant resistance levels could trigger a sell-off, emphasizing the importance of strategic positioning by investors in the forthcoming weeks.

For those looking to delve deeper into the intricacies of market analysis, InvestingPro offers an array of tools designed to refine investment strategies. From AI-driven stock picks to comprehensive financial health scores, these resources cater to the needs of both seasoned investors and those new to the trading landscape, aiming to enhance decision-making processes and investment outcomes.

In sum, the landscape of cryptocurrency and broader financial markets is at a potential turning point, influenced by policy shifts and technological advancements. As these sectors continue to evolve, the dialogue between traditional and digital finance grows richer, holding the promise of an integrated financial future. However, it is crucial for investors to approach these opportunities with a blend of optimism and caution, aware of the inherent risks and the dynamic nature of the markets.

Disclaimer: This article aims to provide information and insight into recent market developments. It is not intended as an endorsement of specific investment strategies or as a solicitation to engage in trading activities. Cryptocurrency investments carry high risks, and decisions should be made with thorough consideration and awareness of the market dynamics. This publication does not offer investment advice or services.