In the universe of investments, the thrilling rush often associated with the first sip of morning coffee was mirrored by the performance of Dutch Bros Inc, a notable player in the coffee industry traded under the ticker symbol NYSE:BROS. Investors experienced a remarkable surge in excitement as shares of the company soared upwards of 20% during mid-day trading. This exhilarating climb occurred in the wake of the company announcing a set of robust earnings after the market closed on the 6th of August.

Dutch Bros, based in Oregon, USA, has established itself as a vibrant and fast-growing coffee chain known for its unique blend of coffee and an energetic customer service ethos. The company’s recent earnings report revealed figures that not only surpassed Wall Street predictions but also painted a picture of a company in the throes of vigorous expansion. With revenue hitting $415.81 million, Dutch Bros significantly outperformed analysts’ expectations, which hovered around the $403.24 million mark. This figure represented a notable increase of 27.9% compared to the same period in the previous year. Similarly, the earnings per share (EPS) stood at 26 cents, eclipsing projections by a striking 44%, and demonstrating a year-over-year increase of 36.8%.

In light of these encouraging results, Dutch Bros took the opportunity to revise its financial outlook for the full year upwards. The company now anticipates its revenue to fall between $1.59 billion to $1.60 billion, with adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) expected to reach between $285 million to $290 million. This upward revision is a testament to Dutch Bros’ confidence in its operational strategy and growth trajectory.

Before the release of this impressive earnings report, Dutch Bros shares had already appreciated by around 20% in 2025, reflecting the market’s optimism towards the company’s ambitious expansion plans and robust financial health. However, it’s noteworthy that the stock had experienced a decline of over 10% in the month leading up to the earnings announcement. This downturn was partly influenced by a mixed earnings report from Starbucks Corp, a leading figure in the coffee industry, which consequently affected the broader retail sector, including mid- and small-cap stocks like Dutch Bros.

The comparison between Dutch Bros and Starbucks is intriguing yet not entirely straightforward. While some may consider Dutch Bros to have a “challenger brand” status in the face of the colossus that is Starbucks, such a simplification overlooks the unique market positioning and business model of Dutch Bros. It’s beneficial to draw parallels from the past, such as Avis’s strategic positioning against industry leader Hertz, to understand how challenger brands can carve out their own success stories.

Dutch Bros differentiates itself through its focus on an earlier stage of growth, affording it flexibility and a distinctive appeal that Starbucks, with its massive global footprint, may not possess. This distinction is exemplified by Dutch Bros’ ambitious expansion strategy, which saw the company opening 31 new locations within the quarter and entering its 19th state. The company also reiterated its commitment to continue this pace of growth, with plans to unveil 160 new locations in 2025 and a long-term vision of operating over 2,000 locations by 2029.

Moreover, against a backdrop of a 3% same-store sales decline reported by Starbucks, Dutch Bros presented a contrasting narrative of success with its 6.1% growth in same-store sales during the same period. This achievement is partly attributed to Dutch Bros’ strategic focus on capturing a younger demographic, leveraging its drive-thru-only business model to appeal to this group’s preferences and habits.

Given the significant momentum Dutch Bros exhibited in 2025, questions naturally arise regarding the sustainability of this growth trajectory. Two indicators stand out as reasons for optimism. Firstly, the remarkable year-over-year free cash flow (FCF) growth, moving from a $32 million cash burn to reporting $46 million in FCF, underscores a narrative of profitable growth and operational efficiency. Secondly, the positive outlook from analysts adds further credence to the bullish sentiment surrounding Dutch Bros. Such endorsements are reflected in the consensus price target of $77.82 for BROS stock, suggesting a potential upside of 13%.

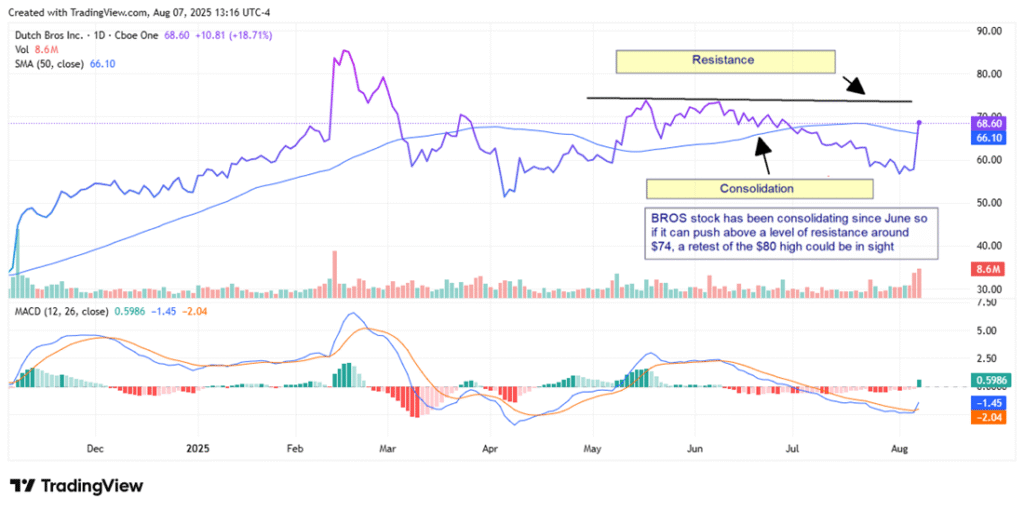

The investor enthusiasm following the earnings report has catalyzed a technical breakout for Dutch Bros stock, which now trades above its 50-day simple moving average (SMA)—a key indicator of bullish momentum. This move is further bolstered by a bullish crossover in the moving average convergence/divergence (MACD) indicator. With the 50-day line now acting as a support level, technical analysts might predict potential resistance around the $73-$75 range. However, the stock’s consolidation since June and the subsequent breakout could signal a retest of its $80 high, marking a potentially lucrative opportunity for investors.

In essence, Dutch Bros’ recent performance is not just a testament to its current financial robustness but also signals the broader potential of challenger brands in established markets. As Dutch Bros continues to navigate its growth journey, the blend of ambitious expansion, strategic market positioning, and operational efficiency it has demonstrated could constitute a compelling case study on the dynamism of modern retail brands and their ability to captivate both consumers and investors alike.