In the latest financial quarter, with a significant portion of companies having divulged their fiscal results, the landscape of the stock market offers a fascinating insight into the current economic underpinnings and future trajectories. An overwhelming 80% of companies listed on the S&P 500 Index have surpassed their earnings expectations, heralding what could potentially be the most impressive outperformance since the third quarter of 2021. This achievement sets a robust tone, particularly for technology, real estate, and communication sectors, each witnessing over 90% of their constituents eclipsing forecasts. Such figures not only reveal the resilience of these industries but also underscore two prominent trends: the enduring power of US consumer spending and an escalated commitment towards advancing artificial intelligence (AI) infrastructure among the behemoths of the tech world.

This narrative of economic resilience and optimistic projection into AI advancements is echoed by a chorus of leading executives. Richard D. Fairbank, the CEO of Capital One, juxtaposes the often gloomy portrayal of the world in the news with the robust health signal sent by consumer behaviors, illustrating a “picture of strength.” Similarly, Charlie Scharf, at the helm of Wells Fargo, acknowledges the solidity in consumer and business sectors albeit cushioned with a cautionary note on the potential risks that uncertainty brings to future outcomes. This sentiment of cautious optimism is mirrored across the board, with notable voices like Christophe Le Caillec, CFO of American Express, celebrating the “remarkable resilience” evident across their customer base.

Further reinforcing the narrative, industry leaders from Delta and MasterCard have highlighted a stable travel environment and healthy consumer spending, respectively, attributing these trends to the solid fundamentals of the US economy. However, this optimistic outlook isn’t devoid of distinctions across economic strata, as pointed out by Ewout Steenbergen, CFO of Booking, who notes a divergent behavior pattern between the upper echelons and the more budget-conscious segments of the US consumer market.

Amidst these observations, the impact of tariffs, a pivotal component of the broader economic discussion, has been approached with a practical lens by Andy Jassy, CEO of Amazon. He notes the resilience in demand and price stability within the first half of the year, a testament to the adaptable nature of large corporations in navigating regulatory landscapes.

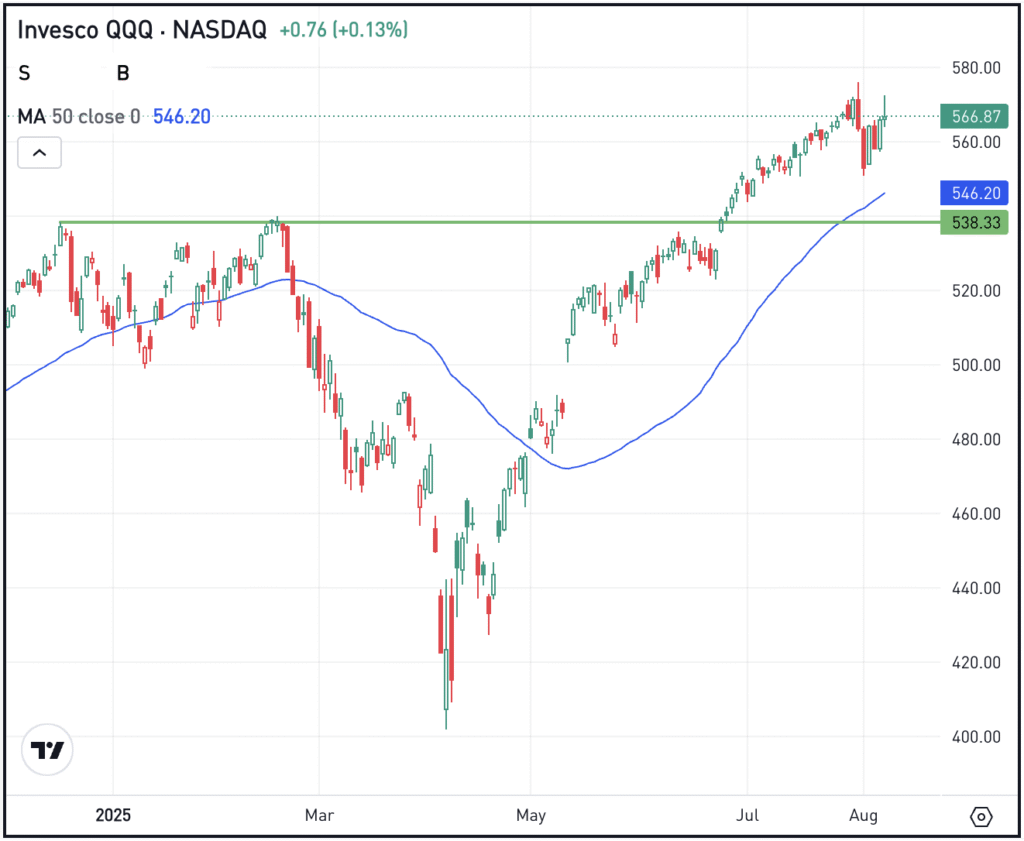

Turning the focus to the stock market, an interesting development is observable through the lens of the Invesco QQQ Trust, which tracks the NASDAQ-100 Index. This ETF, despite recent market volatilities, remains a hair’s breadth away from its recent peak, showcasing the enduring appeal and robust performance of the tech sector. The stability and growth potential of tech stocks, symbolized through companies like Nvidia, Apple, and Palantir, are crucial indicators for investors gauging the market’s health and anticipating future trends.

However, the stock market, ever dynamic, intersperses its growth narratives with cautionary tales. Eli Lilly, despite outshining in earnings and revenue, faced a downturn in investor sentiment owing to less-than-stellar results in a late-stage trial for an anticipated weight loss drug. Similarly, Ethereum’s price trajectory illustrates the volatility and speculative energy within the cryptocurrency sector, a narrative that adds layers to the complex fabric of modern investment strategies.

In wrapping up, the financial landscape, as painted through this quarter’s earnings reports and executive insights, underscores a blend of optimism tempered with caution. The resilience of the consumer base, coupled with strategic investments in burgeoning technologies, sets a promising stage. Yet, the inherent uncertainties of market dynamics and external pressures such as regulatory changes or global economic shifts advise a prudent approach. As the landscape evolves, so too will the strategies and outlooks of investors, executives, and market analysts, all navigating the intricate dance of risk and reward.

Disclaimer: This overview offers insights based on current market conditions and executive statements. It serves educational purposes and should not be construed as financial advice. Market volatility and individual circumstances mean that considerations and strategies should be tailored to specific goals and risk appetites. Past performance is not indicative of future results, and investments can result in losses exceeding initial outlays.