In the wake of the publication of our initial article, a number of correspondences were received voicing a sense of incompletion among our readership. They expressed a desire for further guidance on how investors might have repositioned their portfolios from high beta and momentum-driven stocks to avoid significant financial downturn during the collapse of the dot-com bubble. While our previous article highlighted the resilience of low beta stocks during the market downturn, it refrained from delving into specifics.

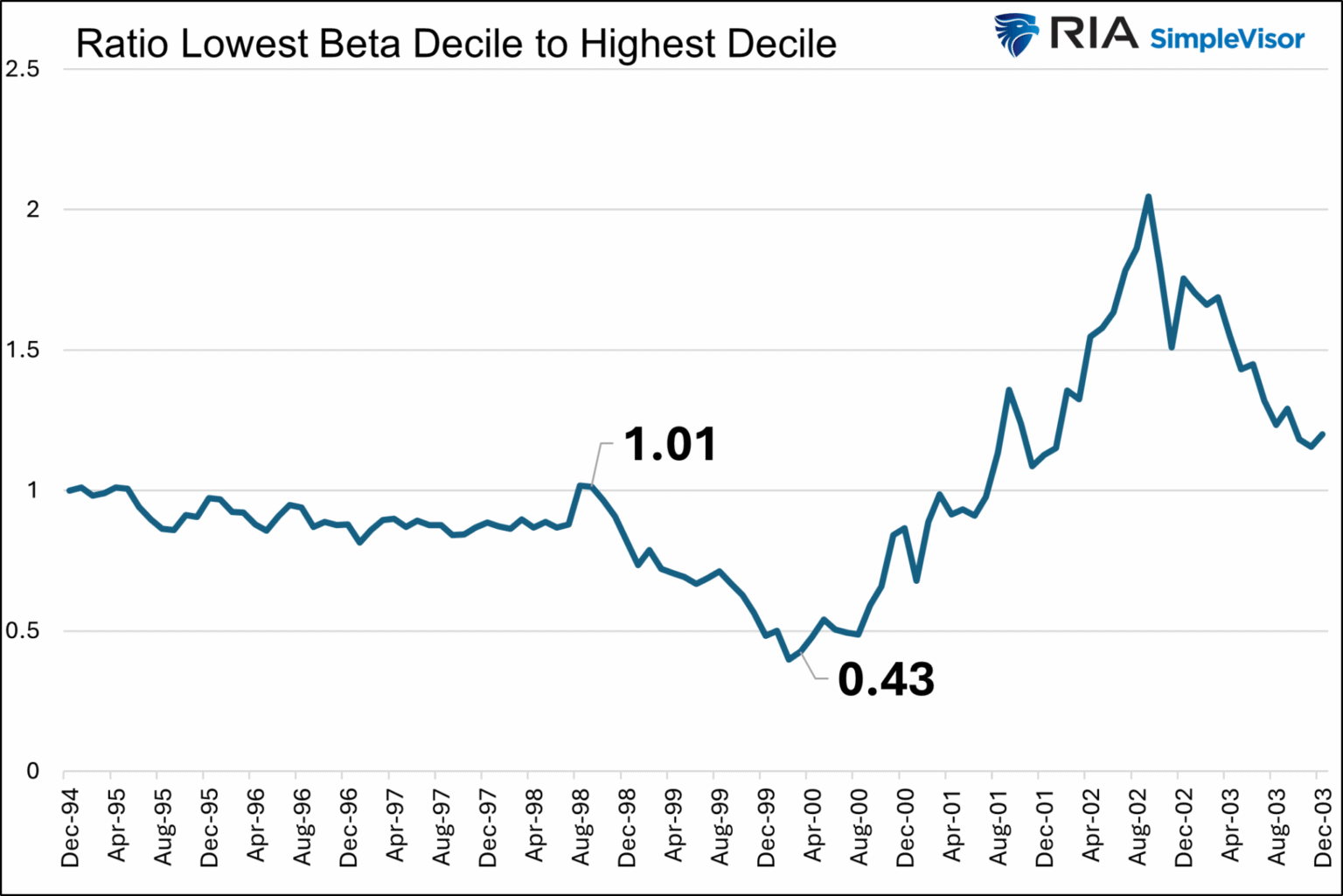

To address this, we examine in greater detail the strategic shift from high beta to low beta stocks that took place towards the tail end of the dot-com era around the year 2000. This move is evidenced to have been remarkably prescient by data presented in a reflective analysis. One graphical representation from our earlier discussion illustrates that such a realignment of investments would have been astute. Another graph provides a broader perspective, showing that despite low beta stocks maintaining an average flat performance during the 1998-2000 boom, they achieved a notable return of +35% across the full boom-bust cycle spanning 1998-2003. In stark contrast, stocks in the highest beta decile, which surged by 111% during the boom, only secured a modest 2% return over the composite period.

Drawing an analogy, managing an investment portfolio can be likened to coaching a sports team. A coach must continually evaluate the play, deciding on which players to field and reserve, with an ability to adjust the team lineup as the game unfolds.

Leveraging this mindset, we should aim to navigate current market conditions with foresight towards future opportunities. This leads us to explore beyond the realm of high and low-beta stocks, dissecting the performance of various stock factors through the dotcom era. Utilizing monthly decile data from Kenneth French of Dartmouth, we’ve discerned notable performances across different stock categorizations during the 1995-2003 market cycle.

Growth Versus Value:

In unravelling the dynamics between growth and value stocks, employing the traditional price-to-book value ratio sheds light on their distinct attributes. Our findings illustrate a comparative performance between growth and value stocks leading up to the 1998-2000 boom, albeit with a notable shift favouring growth stocks during the boom itself. Interestingly, the zenith of value stocks considerably outshone the lower deciles in this period.

It’s also critically important to ascertain the enduring performance of growth versus value stocks throughout different market cycles. After a deep dive into these categories, evidences suggest that notwithstanding the underperformance during the tech bubble, adherents of value investing surpassed their growth counterparts across the duration of the cycle. However, the distinction in returns among various deciles indicated that a profound preference for deep value, rather than value alone, pervaded investor sentiment during this timeframe.

Market Capitalization Insights:

Further delving into the era using market capitalization revealed a differential performance. Initial stages showcased a pronounced preference for large-cap stocks, with the largest deciles by market cap dramatically outpacing smaller-cap stocks prior to the bubble. This trend inverted during the bubble’s expansion, spotlighting the ascendancy of the smallest deciles through increased performance, a trend that persisted even in the aftermath of the market’s peak and into recovery.

Profitability Considerations:

The period also underscored an intriguing narrative around profitability. The least profitable stocks, particularly during the bubble, seemed to captivate investors’ attentions with their prospective earnings potential despite their present lack of profits. This inclination reversed post-bubble, with higher profitability stocks regaining favor.

Summarizing the insights from the dot-com era provides a lens through which we may scrutinize current market behaviors and potential future outcomes. The prevailing inclinations towards growth, large market cap, and high profitability stocks may echo the prelude to past speculative bubbles. However, if the market landscape were to shift towards a bubble akin to that of the late 1990s, it’s plausible that smaller, low-beta, value-focused stocks with higher profitability could emerge as the stalwarts of tomorrow’s market.

As we stand at the cusp of potential market shifts, these historical reflections underscore the importance of vigilance and strategic adaptability. Identifying and aligning with stock factors that hold promise through speculative fervor and subsequent corrections could be pivotal in sustaining and growing wealth amidst volatility. In essence, the lessons from the dot-com era serve not only as reminiscences of past cycles but as beacons guiding future investment strategies.