In the rapidly evolving world of finance, this week promises to bring several crucial developments that market watchers should eye keenly. Highlighted within this complex tableau are the anticipated updates on U.S. inflation data and retail sales, alongside the unfolding narrative of Trump-imposed tariffs, each likely to significantly impact market sentiment and trading strategies in the days ahead.

One of the standout narratives in the current financial epoch revolves around Cisco, a titan in the realms of networking and security. With an impressive momentum that has been buoyed by the accelerated adoption of AI and cloud technologies, the company stands on the cusp of its fiscal fourth-quarter report, anticipated to reflect a promising upside opportunity. Analysts, buoyed by positive outlooks and Cisco’s robust performance in previous quarters, foresee a significant earning potential, anticipating adjusted earnings per share to rise to $0.98, a noteworthy increase from $0.87 in the prior year, alongside a projected revenue uptick to $14.6 billion, a 7.4% year-over-year increase. This optimism is rooted in the company’s strategic pivot towards subscription-based models and significant investments in AI and networking solutions.

On the contrary, Deere & Company, known for its heavyweight presence in the agricultural machinery sector, appears to be navigating a turbulence zone. Challenges such as sector-wide structural headwinds, the spectre of cost inflation, and attenuated demand present a cocktail of risk, particularly as the company gears up for its fiscal third-quarter earnings reveal. Analysts, tempering their expectations, project a fall in profits to $4.58 per share from the year-ago figure of $6.29, alongside a decline in revenue forecasted at $10.3 billion, marking a 9.1% decrease. This anticipated underperformance is further compounded by apprehensions surrounding U.S. trade tariff implications, which may exacerbate cost pressures and disrupt supply chains, potentially squeezing margins tighter.

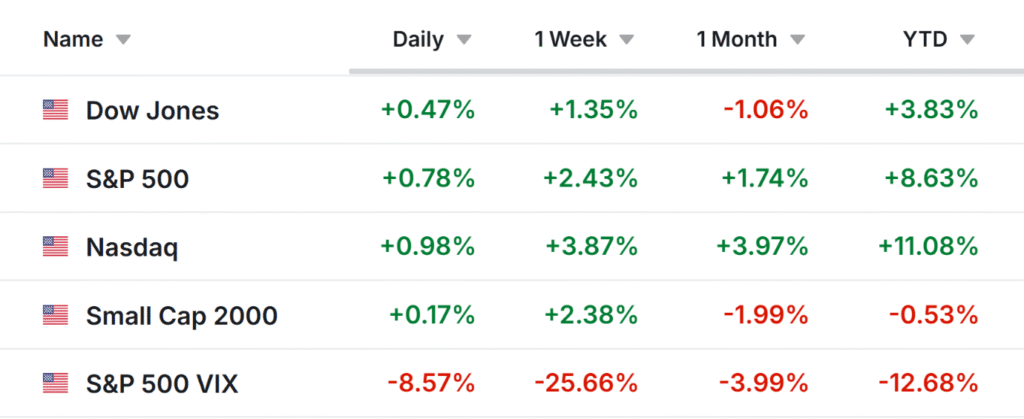

Amid this maelstrom of market dynamics and corporate prognostications, the broader Wall Street canvas reflects a tapestry of cautious optimism. The closure of the preceding week saw major indexes like the Nasdaq charting new territories with record highs, buoyed by investor optimism around potential interest rate cuts; a sentiment that might undergo revisions as fresh economic data and corporate earnings unfurl in the week ahead.

Looking beyond the immediate, the architectural underpinnings of market movements – from inflationary pressures gauged by U.S consumer price data to the insights gleaned from retail sales and manufacturing reports – will provide crucial waypoints for navigating the economic landscape. Additionally, with an earnings season in full swing, various high-profile entities from diverse industry verticals are poised to disclose their fiscal health, potentially swaying market directions.

The focal point, however, transcends the singularities of buying recommendations for stalwarts like Cisco or cautionary advisories against investments in firms like Deere. The essence lies in leveraging sophisticated analytical tools and platforms, such as InvestingPro, which amalgamates AI-driven insights and holistic financial health assessments, enabling investors and traders to charter a course through an often turbid financial sea with greater assurance and strategic acumen.

As we stand on the cusp of another week fraught with potential pivot points for the global financial markets, the narrative weaves through the interstices of economic data releases, corporate earnings forecasts, and the overarching geopolitical dynamics influenced by trade policies. Each factor, in its singularity and collective interplay, holds the potential to script the next chapter of market movements, underscoring the importance of informed, strategic decision-making in the pursuit of financial resilience and growth.

In this continuum of financial discourse and market strategizing, one’s arsenal should be fortified with not just timely information but the analytical depth to discern the ephemeral from the enduring trends. Platforms and services like those offered by InvestingPro represent beacons for navigating these complex waters, allowing both neophyte investors and seasoned market veterans to glean actionable insights, ensuring that their investment journey, while fraught with inevitable risks, is charted with a compass of knowledge and strategic foresight.