In a dramatic turn of events that reverberated across the automotive industry and beyond, the United States’ burgeoning electric vehicle (EV) sector encountered an unexpected obstacle. On a day earmarked for celebration, the 4th of July 2025, the US government made a decision that could potentially reshape the future of transportation within the country. This decision came in the form of the promulgation of the “One Big Beautiful Bill,” an act that effectively heralded the cessation of federal EV tax credits—a cornerstone measure aimed at fostering the adoption of electric vehicles. What was once a distant expiration date set for 2032 was suddenly advanced by seven years, bringing an abrupt end to the subsidy programme by the 30th of September, 2025.

The inception of these tax credits under the auspices of the Inflation Reduction Act (IRA) of 2022 was a key policy move designed to catalyze a transition towards cleaner transportation. Depending on the category, the incentives ranged from $7,500 for new electric vehicles, $4,000 for used, and up to $40,000 for commercial electric vehicles. These fiscal stimuli were not merely financial incentives but were also instrumental in sparking industrial investment, encouraging consumer uptake, and spurring the development of a supportive supply chain ecosystem.

The rationale behind the sudden retraction, as put forth by the administration, centred around fiscal conservatism, projecting savings of approximately $170 billion over the ensuing decade. However, this sudden policy shift raised immediate concerns regarding the broader implications for emissions reduction efforts, the nurturing of domestic EV manufacturing capabilities, and the United States’ positioning in the global clean technology arena. Such drastic measures risk unsettling an industry that thrives on predictability for planning production schedules and investment strategies. It runs the risk of dampening enthusiasm among automakers and suppliers for ramping up EV production capacities, potentially relinquishing technological leadership and market share to international competitors.

Beyond the immediate fallout, the revocation of the federal EV tax credits signifies a more profound reversal of a cohesive strategy tailored since 2022 to accelerate electric vehicle adoption. The consequences are far-reaching, spanning the vapourization of consumer tax credits alongside the cessation of commercial and leasing subsidies. Moreover, the cessation of infrastructure investment initiatives, notably the National Electric Vehicle Infrastructure (NEVI) program initially backed with $5 billion for the development of fast-charging stations, introduces additional layers of uncertainty.

The revocation not only affects the consumer market but also has ramifications for regulatory protections aimed at emission reductions. The rollback extends to the cessation of California’s Clean Air Act waivers, a move that further complicates the regulatory landscape surrounding emissions and fuel economy standards.

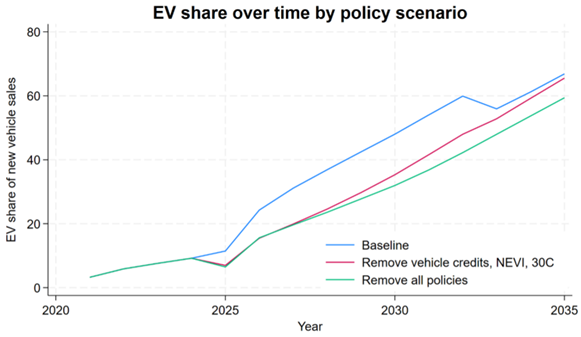

This policy about-face represents one of the most significant shifts in US EV policy over more than a decade. It not only disrupts the provision of incentives and infrastructure investment but also the regulatory frameworks that have been pivotal in advancing vehicle electrification.

In light of the imminent cessation of federal EV subsidies, a short-term surge in EV purchases has been noted, with dealers reporting sizeable inventories and decreasing prices to encourage sales. However, this flurry of activity disguises the undercurrent of potential risks that may crystallize in the medium to long term. With the subsidies set to dissipate, price-sensitive consumers might defer EV purchases, potentially denting the mainstream adoption of electric vehicles.

Market reactions to these developments have been mixed. Companies deeply entrenched in the EV ecosystem, like Tesla, witnessed variations in stock performance, reflecting the nuanced and sector-specific impacts of the policy reversal. The abrupt withdrawal of support has prompted speculation on the future trajectory of EV adoption rates and manufacturing momentum—a critical juncture that could determine the pace at which the US transitions to cleaner transportation alternatives.

As the dust settles on this pivotal policy pivot, questions linger about the United States’ ability to maintain its competitive edge in the rapidly evolving global EV landscape. The strategic moves of international players, particularly China and Europe, whose aggressive EV adoption policies have set new benchmarks, underscore the challenges ahead for the US. The policy retreat not only jeopardizes domestic manufacturing ambitions but also dampens the momentum towards realizing a lower carbon future, underscoring a critical juncture in America’s clean transportation journey. Whether this constitutes a temporary setback or a more enduring obstacle to the United States’ EV aspirations remains to be seen—an uncertainty that shadows the American electric revolution at a moment of profound transformation.